Long Call Option Trading Strategy: Learn the Basics

Contents

Long Call Summary

- Purchasing a call option is a bullish strategy. Each standard equity call option purchased gives you the right, not the obligation, to buy 100 shares of the underlying asset at a set strike price on or before the expiration date.

- The value of a call option can appreciate as the price of the underlying asset increases and approaches and breaches the long call's strike price.

- Out-of-the-money (OTM) calls are usually cheaper than in-the-money (ITM) calls, which have intrinsic and extrinsic value, making them more expensive. Extrinsic value decays over time and may cause the option to lose value, especially if the underlying asset doesn't move towards the strike price.

Long Call Option

Purchasing a call option gives you the right, not the obligation, to buy 100 shares of the underlying asset at the strike price on or before the expiration date. The call option value will appreciate as the price of the stock or ETF rises and approaches your strike price. Therefore, it is a bullish strategy. Conversely, the value of a call option will depreciate when the price of the underlying it tracks drops or remains constant due to time decay.

Buying calls can be a less capital-intensive way to gain long exposure to the shares without buying shares outright. However, long options suffer from time decay, and the value may decrease each day the underlying does not move toward the strike price. As a result, the underlying must rise at a greater velocity towards the call options' strike price to make up for lost value.

Out-of-the-money (OTM) calls are usually cheaper than in-the-money (ITM) calls. That is because the value of an OTM call is entirely made up of extrinsic value. ITM calls will have intrinsic and extrinsic value, resulting in a higher cost per contract. Over time, the extrinsic value of all options decays to $0 as expiration approaches. Meanwhile, ITM calls will retain their intrinsic value at expiration, and any extrinsic value will decay down to $0 near or at expiration.

The ideal scenario of a long ITM call option is to have the underlying rise as much as possible so it gains intrinsic value and is worth more at expiration than what the trader purchased the call option for upfront. This is the same scenario for OTM call options since OTM call options need to move ITM at expiration to have any value. Before expiration, OTM and ITM call options can gain a combination of extrinsic and intrinsic value if the stock moves swiftly to the upside.

Long call options that expire ITM by $0.01 or more will be auto-exercised. Investors only holding a long call will result in 100 long shares* per contract purchased at the call option's strike price. Investors holding the corresponding short shares will cover or buy shares at the call option's strike price. It's important to note that investors who want to avoid the long call contract from auto-exercising for expiring ITM may sell the contract before the market closes on the expiration day. Any long call options that expire OTM will expire worthless, resulting in a maximum loss for the investor. The following section covers more about potential profit and loss of a long call.

* Only accounts with sufficient account equity may hold and maintain the long stock position. Any account holding a long call subject to expiration risk may be closed out by the tastytrade risk team. Please visit the tastytrade Help Center to learn more about expiration risk.

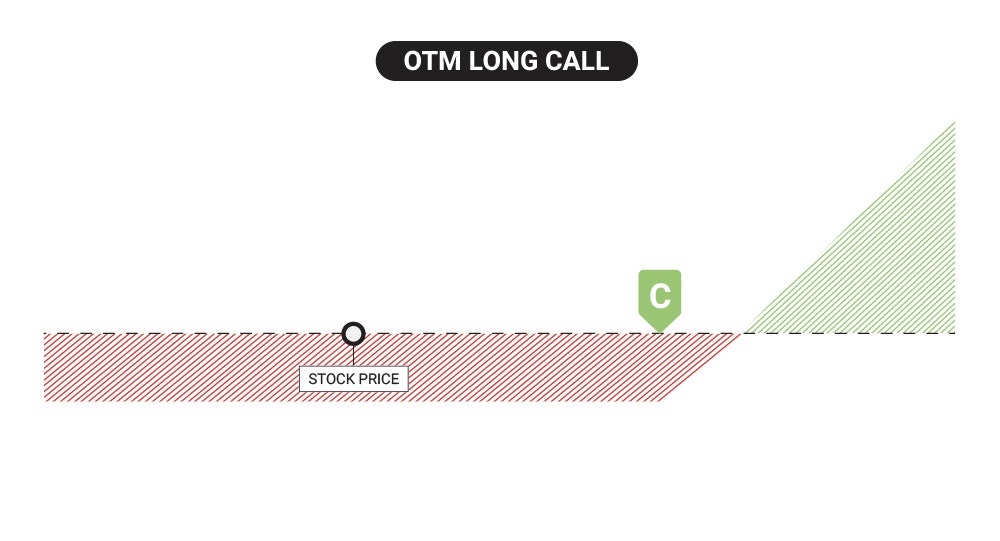

Profit & Loss Diagram of a Long OTM Call

A long OTM call is profitable if the current option value exceeds the purchase price of the option. This can occur if the underlying surpasses the strike price by more than the debit paid for the long call, or if the OTM call moves closer to the underlying asset price after a quick rally. Calls can theoretically have unlimited profit, as there is no cap on how high a stock price can go, as indicated in green.

Losses on the call options can occur if the underlying does not surpass the breakeven point, as illustrated where the red and green zones converge on the x-axis. The breakeven point can be calculated by taking the purchase price of the option and adding it to the call strike, as the option must have more intrinsic value than the call’s purchase price to be profitable at expiration.

The maximum loss on a long call is the debit paid for the option, which the flattened red loss zone of the diagram illustrates.

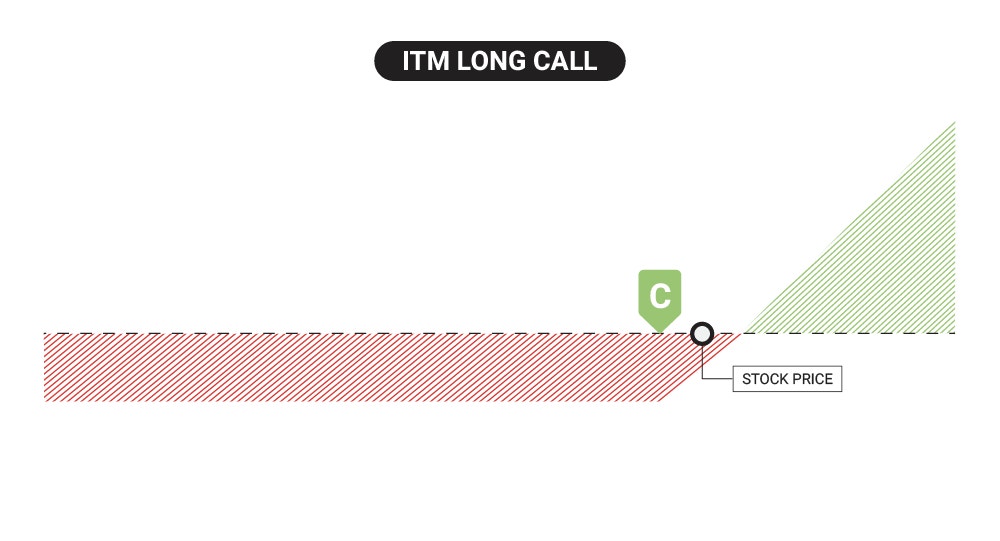

Profit & Loss Diagram of a Long ITM Call

A unique characteristic of ITM options is that the price of the option’s intrinsic value will move 1:1 with the underlying. Although purchasing an ITM option has intrinsic value, it does not necessarily mean it will be profitable after the order is executed.

Like buying an OTM call, the purchase price of an ITM call must increase for it to be profitable, and that means the stock price must move further above the call strike for it to be profitable, as illustrated where the red and green zones converge on the x-axis.

The maximum loss on a long call is the debit paid for the option, which the flattened red area of the diagram illustrates.

Example of a Long OTM Call Option

XYZ currently trading @ $45

- Buy to Open +1 XYZ 50-strike call @ $4 debit

Cost: $4 debit ($400 total, ($4 x 100 shares))

Time Decay Affect | Works against the option’s value |

Max Profit | Theoretically unlimited |

Max Loss | Debit paid per contract ($400) |

Breakeven Price (at expiration) | Strike price + debit paid ($54) |

Account Type Required | Cash, Margin, and IRA |

Example of a Long ITM Call Option

XYZ currently trading @ $45

- Buy to Open +1 XYZ 40-strike call @ $7 debit ($5 intrinsic value + $2 extrinsic value)

Cost: $7 debit ($700 total)

Time Decay Affect | Works against the option’s value |

Max Profit | Theoretically unlimited |

Max Loss | Debit paid per contract ($700) |

Breakeven Price (at expiration) | Strike price + debit paid ($47) |

Account Type Required | Cash, Margin, and IRA |

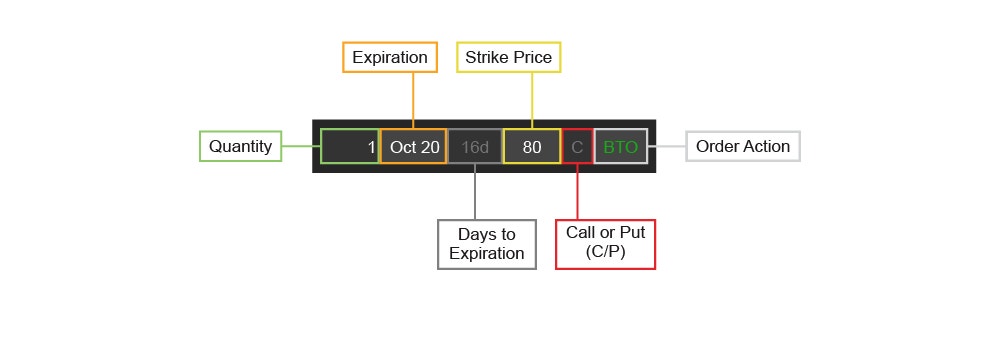

How to Buy a Long Call

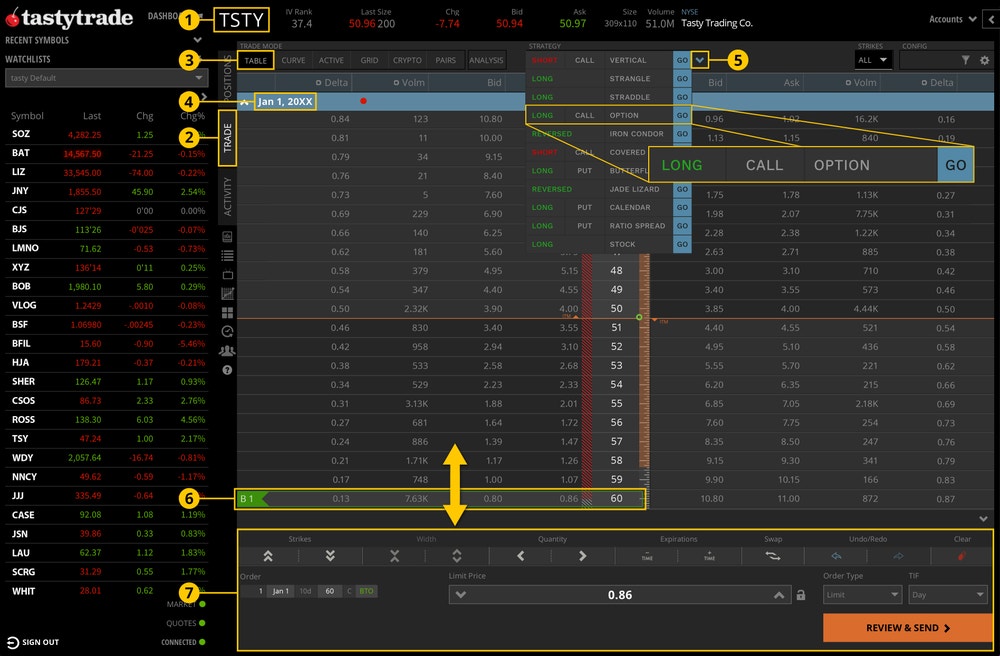

Using the Strategy Menu

- Enter a symbol.

- Click on the Trade tab.

- Go to the Table mode.

- Click on an Expiration Date to expand.

- Click the Strategy Menu. Locate the Option strategy and (from left to right) click each column to display Long, Call, and Go.

- The long strike order will display a green bar in the expanded expiration. Drag the long strike up or down to select the strike.

- Go to the order ticket to determine quantity, price, time-in-force (TIF), etc. before clicking Review and Send. Review the order thoroughly including commissions and fees, then send the order.

Building it Manually

- Enter a symbol.

- Click on the Trade tab.

- Go to the Table mode.

- Click on an Expiration Date to expand.

- Click the Ask price of the call you want to buy. The long strike order will display a green bar in the expanded expiration, and you can drag the long strike up or down to adjust the strike.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking Review and Send. Review the order thoroughly including commissions and fees, then send the order.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.