Margin Accounts vs Cash Accounts: What’s the Difference?

Contents

When it comes to brokerage accounts, there are two main account types:

The main difference between the two account types is access to leverage. Leverage allows investors to borrow cash and collateralize eligible positions to hold positions and establish new positions. Certain products like futures and strategies like long or short multi-leg options spreads require a margin account. You, as an investor or trader, should be aware of which account type to open.

In this section, we will cover the main differences between cash and margin accounts so you're not spinning your wheels trying to figure out what type of account to open, and so you have a good understanding of the strategies and products that are tradeable in each account type.

Cash Accounts

A cash account is one of the most basic brokerage accounts one can open. There is no account minimum to open or maintain a cash account at tastytrade, nor are there any account maintenance or inactivity fees. Cash accounts only allow investors to establish positions with the cash they have available in their accounts, meaning it prevents investors from borrowing money (access to leverage). The products and the scope of trading strategies are limited.

Cash accounts can be optimal for investors looking to purchase stock, establish long single-leg options positions, or purchase cryptocurrencies. Any short options position established in a cash account must be fully covered. You might have heard of cash-secured put or covered call strategies. These positions are often traded in cash accounts as they are fully covered positions by cash or stock holdings. What do we mean by that?

For example, selling a $100-strike put option to open in a cash account will require $10,000 of funds (100 shares x $100) without considering the credit received from selling the put option. When selling call options, a cash account must have at least 100 shares (round-lot) of stock per call option sold.

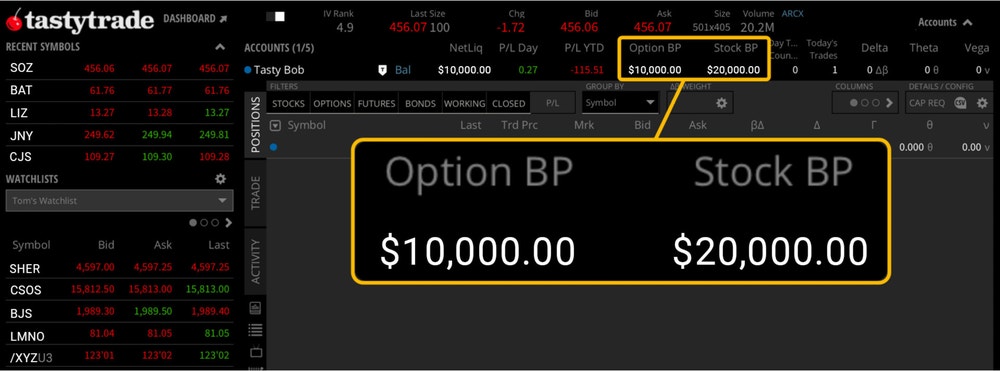

As a result of not having any access to leverage, investors at tastytrade will notice the available funds in their option buying power and stock buying power on the trading platform will be the same, denoting that investors do not have access to leverage.

While having a cash account can offer investors peace of mind by preventing investors from establishing positions with borrowed money, investors may find the strategies allowed restrictive when ready to trade other strategies, such as multi-leg option spreads or futures trading. That is why investors need to consider not only their risk tolerance and trading objectives but also what products or strategies to trade when considering the type of account to open, as some account types are more restrictive than others.

At tastytrade, we do not have account minimums for US/domestic and international cash accounts. Allowed strategies in a cash account include:

- Buy Stock

- Buy Options

- Sell Covered Calls

- Sell Cash Secured Puts

- Cryptocurrencies

Please visit the tastytrade Help Center to view a complete list of countries tastytrade currently supports. Cryptocurrency trading is unavailable for customers residing in certain states and countries. Please visit the tastytrade Help Center for current restrictions.

Trading in a Cash Account

When trading in a cash account investors and traders need to be aware of good faith violations. This occurs when you use unsettled funds to purchase another security and sell it before the funds have settled from the first or previous sale.

For example, your account holds $10,000 in ABC stock. You sold ABC stock to purchase DFG stock then sold DFG stock the same day before the funds from selling ABC stock have settled. This transaction will be marked as a good faith violation and when you get 5 good faith violations in a 12-month rolling period, your account will be set to closing-only. The settlement takes 2 business days after the trade date. However, the settlement period is subject to change.

Some investors and traders consider this as a downside of trading in a cash account as you would have to wait for your funds to settle unlike in a margin account.

Margin Accounts

Investors intending to trade any naked or uncovered options, multi-leg options spread strategies, such as a vertical or iron condor, must have a margin account. Additionally, futures and options on futures trading also require a margin account. The main characteristic that sets a margin account apart from a cash account is the ability to borrow money and borrow against marginable positions, such as long stock positions to establish and maintain other positions.

Additionally, margin accounts allow investors more capital efficiency than their cash account counterparts as you do not have to put up the entire cost of the trade but satisfy the margin requirement for the security you are holding.

Trading Levels

tastytrade offers three trading levels for margin account holders, from the most flexible trading level to the most restrictive trading level:

- The Works

- Basic

- Limited

Please visit the tastytrade Help Center to learn more about our trading levels, including an exhaustive list of permissible strategies and asset classes allowed in each trading level.

Margin Privileges

Margin privileges give investors the ability to borrow money and collateralize equity positions to establish other positions. While there is no minimum to open or maintain a margin account at tastytrade, accountholders that want access to margin privileges must start the day and maintain an account of $2,000 or more and meet margin requirements for any positions they hold in their margin account.

When an account is eligible for margin privileges, the account's stock buying power will be twice the option buying power, indicating that the account can buy shares on margin. It's important to note that equity options, futures, and options on futures are non-marginable, which means investors cannot borrow cash to establish positions.

Why are margin accounts necessary for defined-risk credit options trades?

A common question asked by new investors that want to trade any defined-risk credit options strategies such as vertical credit spreads or iron condors is, "Why is a margin account required if my account has enough to satisfy the max loss of a defined risk credit spread?" The short answer is that options are leveraged products and there is always early assignment risk whenever involving a short equity options contract, even in a credit spread. This is why the only short option strategy allowed in a cash account is a cash-secured put.

Day Trading in a Margin Account

In a margin account, investors planning to day trade securities, such as stocks and equity options, must know pattern day trading rules which bind all margin accounts industry-wide and are not a rule exclusive to tastytrade margin accounts. Investors who place more than three-day trades in a rolling five-business-day period will be flagged as a pattern day trader (PDT).

PDT-flagged accounts must maintain an account equity value of $25,000 or more. If an account's net liquidation value falls below $25,000 at the start of the day, you will receive an equity maintenance (EM) call. Please note that day trading can be extremely risky and is not suitable for all investors. You should be very familiar with the market if you are considering this strategy. As with any strategy you should have a full understanding of the risks involved.

PDT rules do not apply to futures, options on futures, and cryptocurrencies. Futures and cryptocurrency positions are transacted and held in separate accounts within your margin account and are subject to cash sweeps to and from your securities account. Cash sweeps to futures and cryptocurrency accounts can potentially trigger an EM call for falling below $25,000 for your PDT-flagged securities account. Please visit the tastytrade Help Center to learn about the separation of accounts, pattern day trading rules, and for a short video on day trading and EM calls.

What is a Portfolio Margin Account?

A portfolio margin (PM) account applies a risk-based margin methodology called Theoretical Intermarket Margining System (TIMS) when determining buying power requirements for securities such as stocks, equity options, and cash-settled index options instead of a rules-based methodology that binds Regulation-T (Reg-T) margin accounts. As a result, investors with a PM account will have access to ~6.7:1 leverage as opposed to the standard 2:1 leverage in a standard Reg-T margin account. It is important to note that the extended buying power relief afforded to PM accountholders does not apply to futures or cryptocurrency positions.

Want to learn more about PM accounts? Please visit our portfolio margin page.

Margin Guide

Are you looking for a deep dive into the ins and outs of margin accounts, including how they differ from a cash account? Whether you're brand new to trading or just want to learn more about how margin accounts work, check out the tastytrade Margin Guide, where we break down the following topics:

- How margin works

- Brief introduction to Regulation-T (Reg-T)

- Margin account funding requirements

- Account equity related margin calls

- Day trading related margin calls

- Additional risks to consider

Trading in a margin account is not suitable for all investors. Investors must understand the risks of trading securities on margin before investing in a margin account. Please visit our disclosures page to review our Margin Disclosure Statement.

A portfolio margin account is not suitable for all investors. Trading in a portfolio margin account can substantially increase leverage. However, such increased leverage can significantly increase the risk of loss.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.