Active Trading and Options Surge in Popularity

Stocks are being held for record-short periods of time as investors chase quick gains and market swings over long-term investment performance. The increased short-term focus of investors has led to surges in active trading strategies and short-term options.

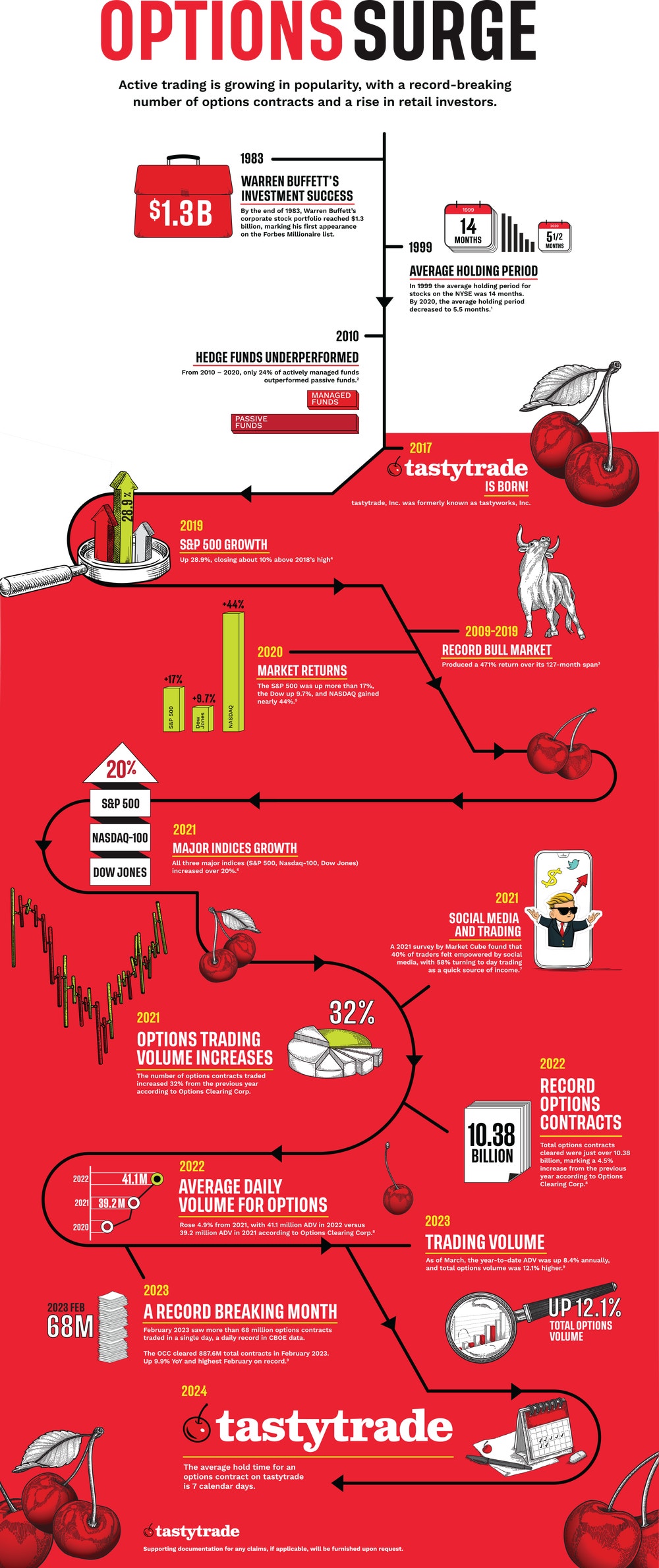

The average holding period of stock on the New York Stock Exchange (NYSE) has declined drastically since the golden age of trading (1890 up to World War I). At the end of 1999, the average holding period was 14 months, compared to 5.5 months in 2020.1

It's generally understood that stocks can produce better returns over long periods of time. Buying and holding investments is a strategy deployed by investors interested in long-term returns, regardless of short-term fluctuations. The success of buy-and-hold is a proven strategy of investing giants such as Warren Buffet, Jack Bogle and Peter Lynch. Investors looked to Warren Buffet for inspiration when his corporate stock portfolio reached $1.3 billion at the end of 1983, and he subsequently made the Forbes millionaire list for the first time. Buffet’s guiding principle was to buy stocks at affordable prices and hold them patiently. His company Berkshire Hathaway (BRK.A) had $948.45 billion in assets as of December 2022, according to the latest financial report.

Over time, investors moved to placing their money into index tracking Exchange Traded Funds (ETFs), such as the SPDR S&P 500 (SPY), for years or decades. The data is on their side. From 2010 to 2020, only 24% of actively managed funds outperformed passive funds.2 But the holding period of ’forever’ has changed, with the average holding period hitting record lows as investors surf for quick gains.

Growing Attraction to Short-Term Returns

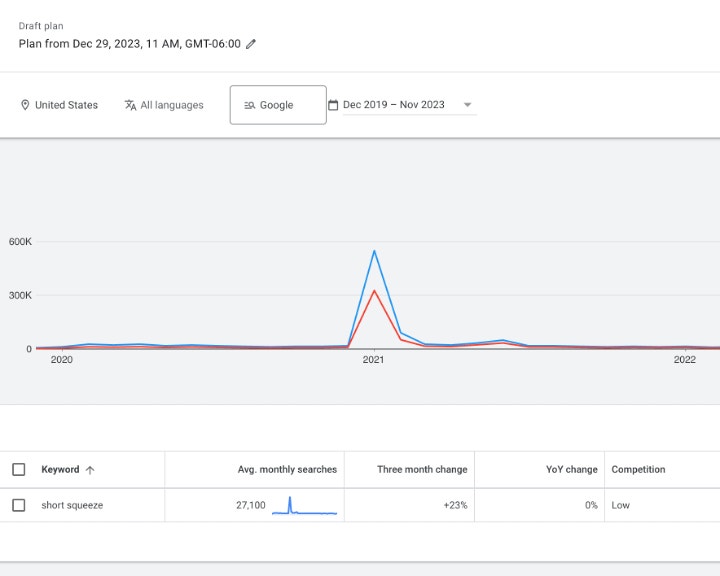

In 2021, we saw an influx of people turning to the stock market for entertainment and profits. Many of these new traders, fueled by meme stock trading made popular by the Reddit page “Wall Street Bets”, turned to short-term trading strategies. Enticed by extraordinary but risky trades that resulted in unusual gains shared on Reddit by its users, this new cohort of traders utilized options that targeted unlikely price movements. Just like some of the meme stocks that soared, the search volume for the trading term “short squeeze” soared just as much. A short squeeze refers to a big player being “squeezed” out of a bearish position, forcing them to cover (buy) short shares, which can result in immense upside pressure in a stock’s price.

The interest in short-term investing is up for a few different reasons. Traders are attracted by the possibility of big gains in short periods of time. From 2009 to 2019, the market was in the longest bull run in American history, topping the nearly 10-year streak in the 1990s. According to the Leuthold Group, the boom started in March 2009 and generated a 471% return over its 127-month run. The years 2009 to 2019 marked the best-performing run since World War II.3

Stock prices and earnings skyrocketed during that time. Tech stocks soared in 2019, with Apple and Microsoft contributing 15% to the S&P 500’s rise in value. For perspective, the S&P was up 28.9%, closing about 10% above 2018’s high.4

In 2020, the S&P 500 was up more than 17%, the Dow up 9.7%, and the tech-heavy NASDAQ gained nearly 44%.5

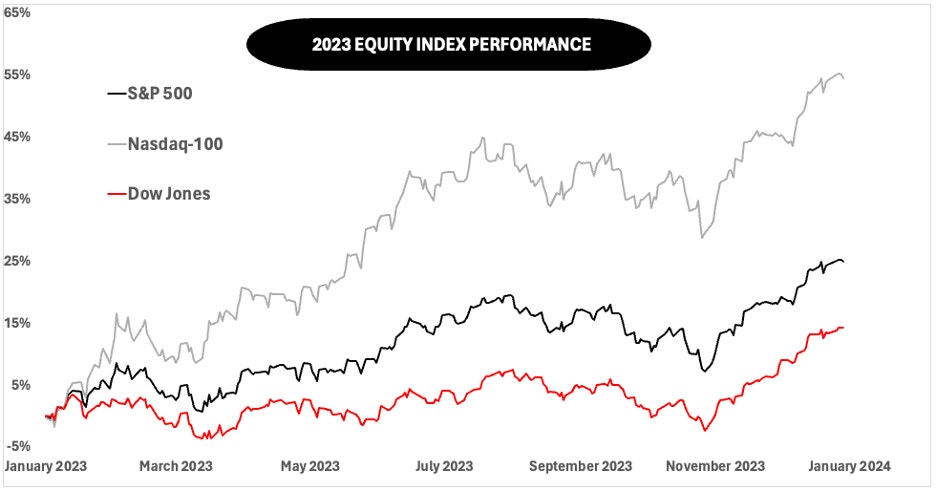

By the end of 2021, the three major Indices (S&P 500, Nasdaq-100, and Dow Jones) all increased over 20%.6

In addition, in 2021, a new breed of retail traders entered the market utilizing investor education resources and social media to break away from the traditional strategy of buy-and-hold. Aside from stocks, cryptocurrency and non-fungible tokens (NFTs) all became major market players and dominated the interests of media, the public, and retail traders. The unprecedented rise in the market allowed for many to capitalize on fluctuations in stock prices.

Along with social media, the rise of brokerage apps naturally with smart phone use made trading more accessible likely helped fuel the rise of short-term trading strategies. The topics of “stocks”, ” “trading”, and “passive income” have exploded on YouTube, Instagram, and TikTok. Research company, Market Cube, found in a 2021 survey that 40% of traders felt empowered by social media. 58% of respondents turned to short-term investing, most notably day trading, to find a quick source of income.7

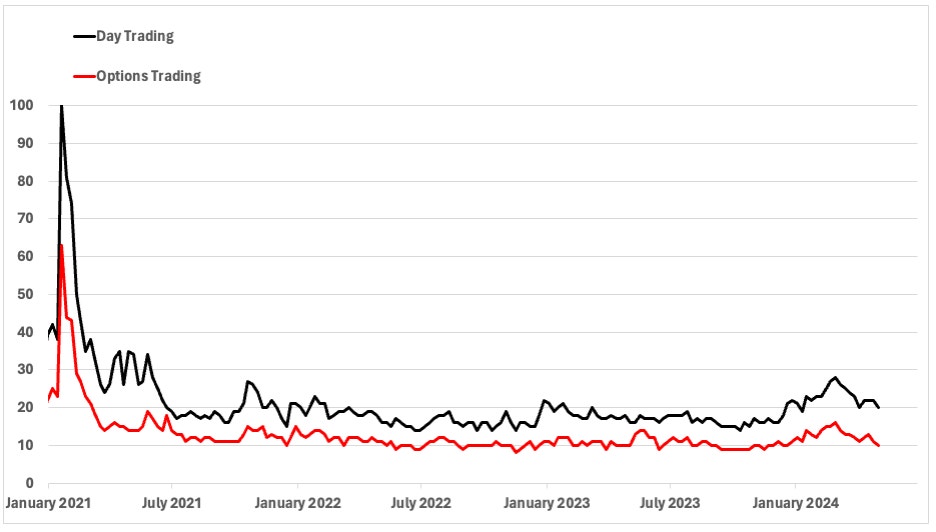

This growing attraction is also very clear when we study Google Trends from 2021. The phrases ‘day trading’ and ‘options trading’ became trending buzzwords. During January and February of 2021, ’options trading’ was highly searched in the U.S., as seen on the image below.

Record Number of Options Contracts Being Traded

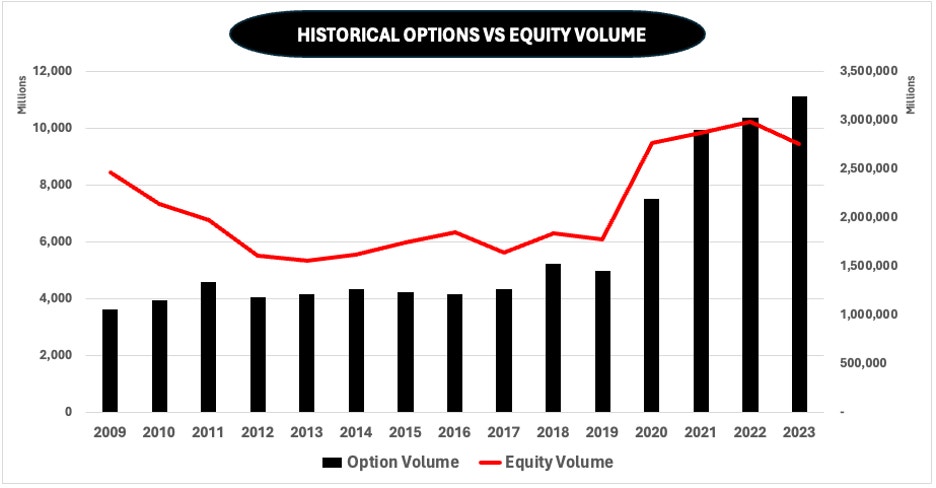

Retail traders continued to favor options in 2022, extending the trend from 2021 when the number of options contracts traded increased 32% from the year prior. According to the Options Clearing Corp, 10.32 billion options contracts were cleared in 2022, a 4.6% increase from the year before.

Perhaps even more impressive is that the average daily volume (ADV) for options contracts rose 5.0% from 2021, with 41.1 million ADV in 2022 versus 39.2 ADV in 2021.8

Compared to equity volumes, we see in the chart above that options volumes have continued to rise. From 2005 to 2015, equity volume surpassed options volume. By 2016, we saw a reversal, with options volumes increasing and equity volumes leveling off. In 2022, options volume hit a fresh record high, continuing that trend. It should be noted that while interest in options has increased, the number of options contracts opened has not overtaken the total number of shares traded.

In 2022 options volume was up year-over-year and the pace of growth continued to increase going into 2023, with December seeing total options volume increasing by 2.4% from a year ago. That compared to a 2.7% decline in total options volume from November over the same period. 8

With interest rates expected to fall by the second half of 2024, we may see another blockbuster year for options trading. Only time will tell but as of May, the year-to-date average daily volume (ADV) is up over 2.96 million contracts compared to 2023, close to a 6.7% increase.9

So, Why is Options Trading So Popular

Traders who are new to options trading typically find it interesting that it’s less capital intensive than trading stocks and that there are ways to control their risk and potentially optimize the probability of profit. Options also offer holders the right to buy or sell an underlying asset at a certain price within a specific timeframe.

As robust derivative securities, options allow traders to expand their ability to potentially generate returns far beyond traditional long and short-term investing strategies. Options can be used to generate returns even when a trader expects no movement in an underlying asset.

Not only can you enter the market with a smaller capital there’s also multiple ways in which you can profit and control risk.

In addition:

- Options enable traders to be much more flexible with strategies, regardless of whether they're bullish, bearish, or neutral

- Investors have a broad scope in terms of the underlying assets they can trade (stocks, ETFs, and broad-based indices)

- It’s not one size fits all. Explore based on an individual’s investment objectives, financial circumstances, and risk tolerance

- Opportunity to speculate against certain levels of stock movement rather than simple direction itself

- Options data is readily available on many online trading platforms, making it easy to gain further insights by using historical information

Is Long-Term Investing a Thing of the Past?

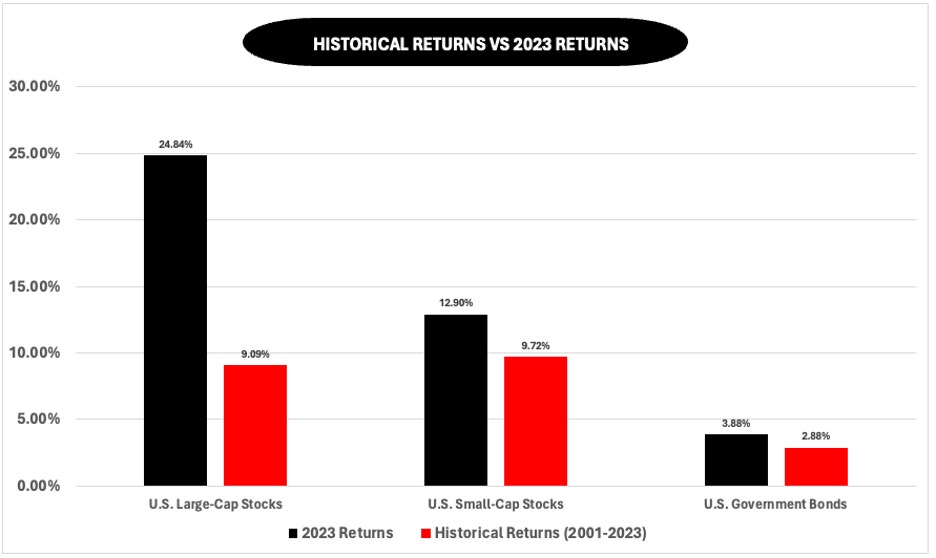

2022 marked a reversal from the bull run of 2009 to 2019, the ups-and-downs of 2020, and the remarkable highs of 2021. The benchmark S&P 500 Index is up over 9% through April, and the market still looks to the central bank for a rate cut timetable, while economic inflation data still comes in higher than expected.

As the markets seek information from the Fed, declining liquidity, lingering inflation, and slowing economic growth persists. By looking at the options on the U.S Large-Cap Stock index (SPX) as of May 2024, we can see that a +/- 9.5% move is priced in by the end of 2024. Given that we have historically seen a 10% return in this index, this goes to show the level of uncertainty that is being priced in with less than a full year to go.

The potential for an economic recession and the bear market that would likely accompany it, may turn investors away from long-term investing. Holding and trading stocks for shorter durations can provide investors with more immediate cash flows and trading options may help investors manage the risks of the current volatility.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.

1 Chatterjee, Saikat, and Thyagaraju Adinarayan. “Buy, Sell, Repeat! No Room for 'Hold' in Whipsawing Markets.” Reuters, Thomson Reuters, Aug. 3, 2020

2 Johnson, Ben. “Busting the Myth That Active Funds Do Better in Bear Markets.” Morningstar, Inc., Aug. 27, 2020

3 Li, Yun. “This Is Now the Best Bull Market Ever.” CNBC, CNBC, Nov. 14, 2019

4 Lewis, Al. “The Stock Market Boomed in 2019. Here's How It Happened.” CNBC, Dec. 31, 2019

5 “2020 Returns.” DQYDJ, Dec. 31, 2020

6 “US Equity Indices.” YCharts.

7 Locke, Taylor. “Day Trading Grew in Popularity during the Pandemic-Here's Why People Do It.” CNBC, CNBC, June 28, 2021.

8 “OCC Clears Record-Setting 10.38 Billion Total Contracts in 2022” The Options Clearing Corporation, Jan. 4, 2023

9 Based on historical volume statistics found on the Options Clearing Corporation website

10 Ahmed, Saqib Iqbal. “Analysis: U.S. Retail Traders Pile Back into Options as Meme-Stock Mania Flares.” Reuters, Thomson Reuters, Aug. 18, 2022.