How to Trade Options: A Beginner's Guide

What Are Options?

Options are derivative contracts that give you the right to buy or sell an underlying asset at a fixed price before or at the contract’s expiration date. The time until expiration can be as short as the day you buy or sell it, known as zero days until expiration (0DTE), or as long as a year or more.

These derivative contracts are conditional because the right to open the stock position is typically only exercised when certain conditions are met. When the contract owner exercises the right to buy or sell the underlying security, the counterparty is obligated to provide 100 long or short shares of the specific security per options contract.

There are two basic types of options: the call option and the put option. A call gives you the right, but not the obligation, to buy a specific asset at a certain price within a limited amount of time as specified by the contract. A straightforward way to remember this type of option is that the owner can “call” for the sale of the underlying asset.

The put option is similar to the call option except that the owner has the right, but not the obligation, to sell a specific asset at a certain price and within a certain time. You can remember that a put option gives you the right to “put” the underlying asset to somebody. We will talk more about calls and puts and how they are used to construct trading strategies in later sections.

Why Do People Trade Options?

Trading options can offer several strategic differences when compared to trading stock:

- Leveraging exposure to increase potential return but also risk

- Hedging to potentially offset risk in your portfolio on a short- or long-term basis

- Non-linear exposure to trade ranges instead of static direction

- Extensive flexibility to suit different objectives

How to Trade Options in 6 Steps:

As a beginner in options trading, you can kickstart your journey by following the ‘How to trade options’ steps below.

1. Understand the Basics of Options Trading

Understanding the basics of options trading and its risks is a steppingstone to advancing your market awareness, and this may help you manage your portfolio risk better.

So, what are options, anyway?

Each options strategy can be boiled down to the four foundational option contract exposures:

- Long calls – Options purchased to speculate on bullish price movement

- Long puts – Options purchased to speculate on bearish price movement

- Short calls – Options sold to speculate against bullish price movement

- Short puts – Options sold to speculate against bearish price movement

Every options contract has a value based on market conditions and the time associated with the contract itself, but all options contracts are made up of two types of value:

- Intrinsic value – Real value to the option holder at expiration that is linear with the stock price relative to the options strike price. Options that have intrinsic value are said to be in-the-money (ITM). This applies to calls below the stock price and puts above the stock price.

- Extrinsic value – Premium value associated with an option based on implied volatility and time value that goes to $0 by the expiration of the options contract. Most options have some extrinsic value if they are far from expiration, but options closest to the stock price tend to have the most extrinsic value.

With a solid foundation of knowledge, you will quickly realize that even the most complex strategies can be broken down into these main concepts.

Remember, options contracts are conditional in nature. They allow you to speculate on the price of an underlying security—whether it will rise, drop, or stay the same.

There are several strategies that can be utilized in options trading that profit from bullish moves in the underlying, bearish moves in the underlying, or no movement at all. Options strategies can be flexible to fit various account sizes, risk tolerances, and periods of high and low volatility, among other factors.

Call and Put Options

You can choose between a call or put option, be long or short, or use a combination of any option type as part of your strategy.

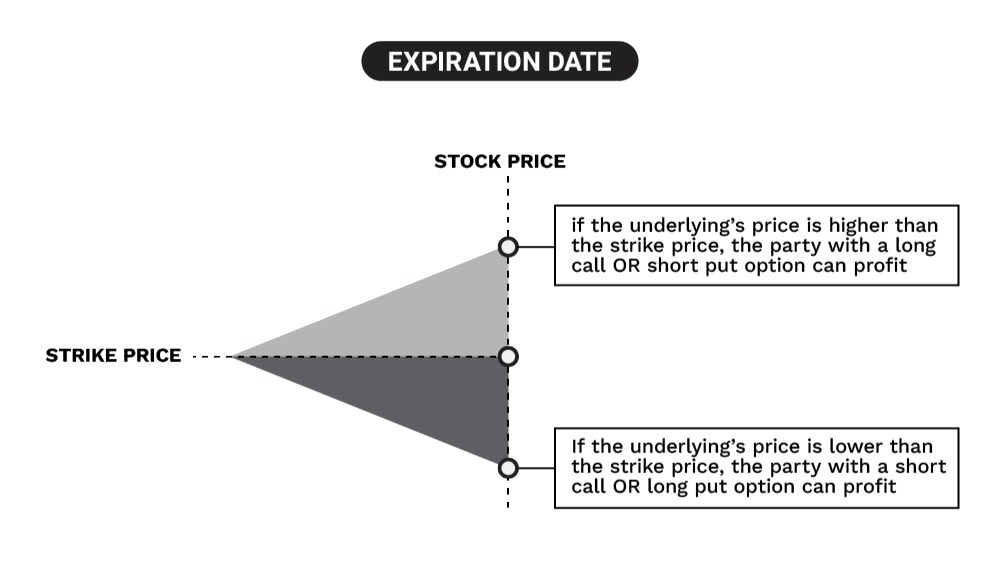

In relation to the underlying instrument, here is what long and short call and put options transition to when these options expire ITM and convert to stock:

Options You Own | Options You Are Short | |

|---|---|---|

Bullish (you want the underlying price to increase) | Long call option (right to buy 100 shares at your strike price if ITM at expiration) | Short put option (obligation to buy 100 shares at your strike price if ITM at expiration) |

Bearish (you want the underlying price to decrease) | Long put option (right to sell, or short, 100 shares at your strike price if ITM at expiration) | Short call option (obligation to sell, or short, 100 shares at your strike price if ITM at expiration) |

Options You Own | |

|---|---|

Bullish (you want the underlying price to increase) | Long call option (right to buy 100 shares at your strike price if ITM at expiration) |

Bearish (you want the underlying price to decrease) | Long put option (right to sell, or short, 100 shares at your strike price if ITM at expiration) |

Options You Are Short | |

|---|---|

Bullish (you want the underlying price to increase) | Short put option (obligation to buy 100 shares at your strike price if ITM at expiration) |

Bearish (you want the underlying price to decrease) | Short call option (obligation to sell, or short, 100 shares at your strike price if ITM at expiration) |

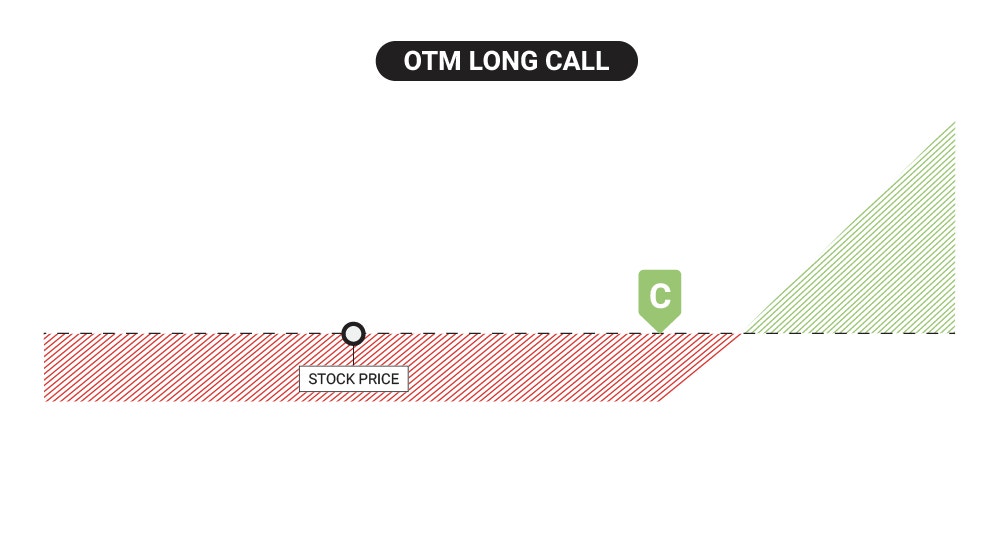

Concisely, long options are defined risk, directional trades – you need the stock to move in your favor, or the extrinsic value of that option will decay over time and the option will lose value. Each day the underlying does not move in the option owner’s favor, the more the underlying needs to move in favor of the option owner to offset the option’s extrinsic value decay.

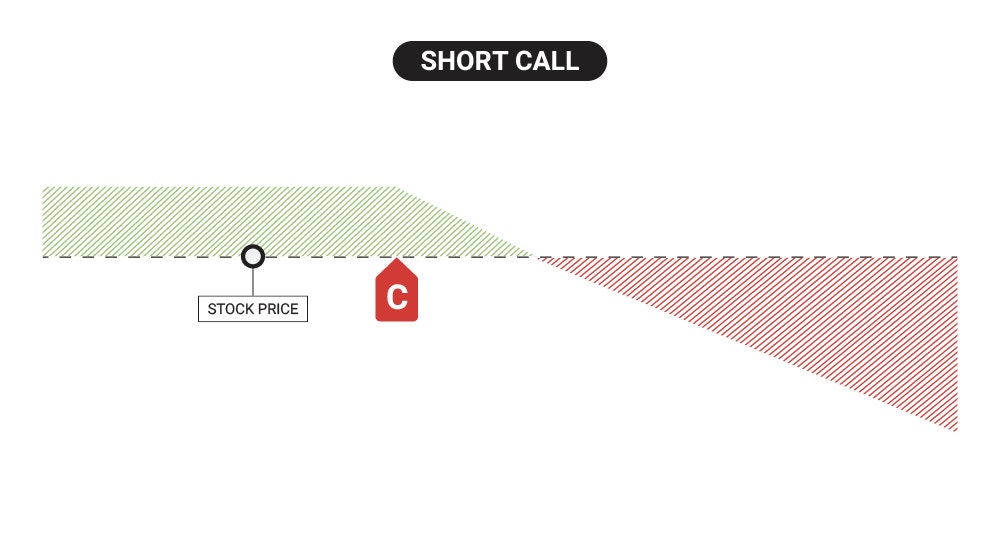

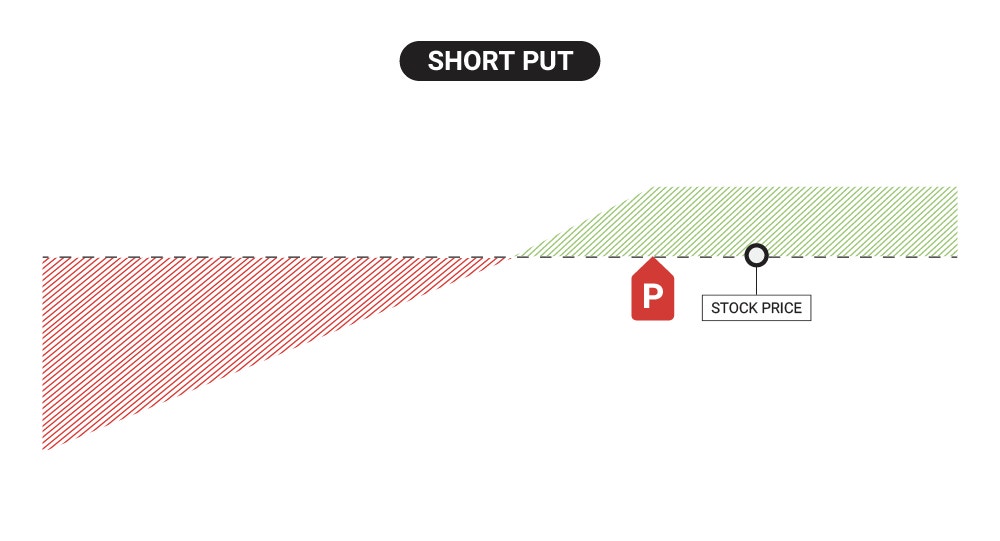

Short options are more neutral trades because you are betting against the stock price movement. If the strike remains out-of-the-money (OTM) at expiration, the trader can realize max profit by keeping the credit initially received from selling the option. Short options trades are undefined risk in nature, meaning the risk depends on where the stock price is in relation to the strike price – Short puts have risk of the stock going to $0, and short calls do not have a risk-cap as there is no limit to how high a stock price can go.

Traders can also deploy multi-leg strategies for more complexity. Regardless of the trader’s intention, understanding these four basic option types is crucial, as many options strategies may be comprised of calls and puts that are long or short.

Options Strike Price and Expiration Date

Strike prices and expiration dates are crucial aspects of options contracts, as these are two main factors of an option’s price and implication for the option holder in terms of risk. An options strike price and expiration date determine when and where your option can be converted to 100 shares of long or short stock depending on the option type.

An option’s strike price is the price at which you choose to potentially enter a stock position when an option is ITM and converts to 100 shares of long or short stock. Options have a higher chance of being exercised when they are in the money, i.e., have intrinsic value. Most options are American style options that can be exercised at any time, but some options are European style and those can only be exercised at expiration. Call and put options have different ITM implications depending on where the stock price is, so it is important to understand how this plays a role in your strategies:

Strike Price is Above the Market Price | Strike Price is Below the Market Price | |

|---|---|---|

Call Options | Out-of- the-money (OTM) | In-the-money (ITM) |

Put Options | In-the-money (ITM) | Out-of-the-money (OTM) |

Strike Price is Above the Market Price | |

|---|---|

Call Options | Out-of- the-money (OTM) |

Put Options | In-the-money (ITM) |

Strike Price is Below the Market Price | |

|---|---|

Call Options | In-the-money (ITM) |

Put Options | Out-of-the-money (OTM) |

Options that have a strike price close to the stock price also have more extrinsic value, as there is more uncertainty whether the strike will expire ITM or OTM. Options that are far OTM or deep ITM have less extrinsic value as there is more certainty that the option will remain OTM or ITM.

The expiration date is the last day on which the contract holder can exercise their right to exercise the option or trade the option to close or adjust the position. Just like strike price proximity, expirations play a role in an option’s extrinsic value as well – the more time associated with an options contract, the more extrinsic value there will be, and vice versa. If an option expires ITM, the contract is converted into 100 long or short shares of the underlying depending on the option type.

Equity and ETF (Exchange Traded Funds) options at expiration:

- tastytrade exercises any long options that are at least $0.01 ITM and remain ITM through expiration, as stock prices can move after the options market closes and push ITM options back OTM in after-hours trading.

- Long options that are not at least $0.01 ITM and remain OTM expire worthless.

- Most short options are exercised automatically if they are ITM at expiration.

- There is a chance of OTM short options being exercised if they are close to the stock price and move ITM after the market closes.

While options are typically offered monthly, with the expiration date on the third Friday of the month, highly active products like SPY or SPX even offer daily expiration dates for maximum flexibility. Many underlyings also offer a wide selection of expiration dates spanning over a year, commonly referred to as “LEAPS.”

Options Assignment vs Exercise in American Style Options

Assignment refers to when a short option converts to its resulting position.

- For a short ITM call, this is 100 shares of short stock.

- For a short ITM put, this is 100 shares of long stock.

You are obligated to the long option holder’s exercise decision when you are short.

Exercise refers to when a long option converts to its resulting position.

- For a long ITM call, this is 100 shares of long stock.

- For a long ITM put, this is 100 shares of short stock.

When you are long, you have a right to exercise the option and convert it to shares, or not. The decision to exercise long options rests with the long option holder, which they can do any time up until expiration day. At expiration, long options auto-exercise when they expire ITM by $0.01 or more.

Think of riding in a car when considering the differences between long or short options contracts. When you are short an option, you are at the mercy of what the long holder decides, like being the passenger in a car. When you are long an option, you are the driver in this example.

Intrinsic and Extrinsic Value of Options

Intrinsic value, combined with extrinsic value gives you the total option’s premium. But these two key parts of options prices differ in what they represent.

- Intrinsic value refers to the real value of an options contract at expiration – it is the difference between the underlying’s market price and the strike price, and it only applies to ITM options.

- Extrinsic value is the difference between the total option premium and the intrinsic value if it exists - it is the combination of time value and implied volatility value. The more time there is to expiration, and/or the higher implied volatility is, the more extrinsic value the option will hold. Options near the stock price have more extrinsic value than ITM or OTM options, generally speaking. Extrinsic value applies to OTM, ITM and ATM options that have time left until expiration.

Intrinsic value can never be negative. So, if a long call strike price is higher than the underlying’s price, or the stock price is higher than the strike price in a long put, there is no intrinsic value. Instead, the option only has extrinsic value and is said to be out-of-the-money (OTM). This can change though, as markets move frequently throughout the day. You can always solve for extrinsic or intrinsic value just by looking at the stock price, and where your ITM or OTM strike price is in relation to that as shown above. Intrinsic value is a linear value and can always be found by taking the difference between the stock price and the ITM strike price.

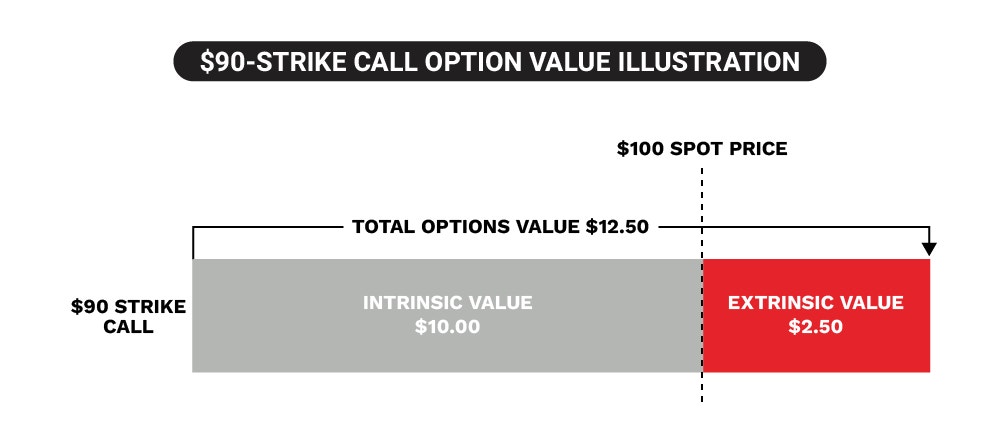

For example, a $90 strike call on a $100 stock price has $10 of intrinsic value.

If the total option value is $12.50, that means there is $2.50 of extrinsic value in the option’s price:

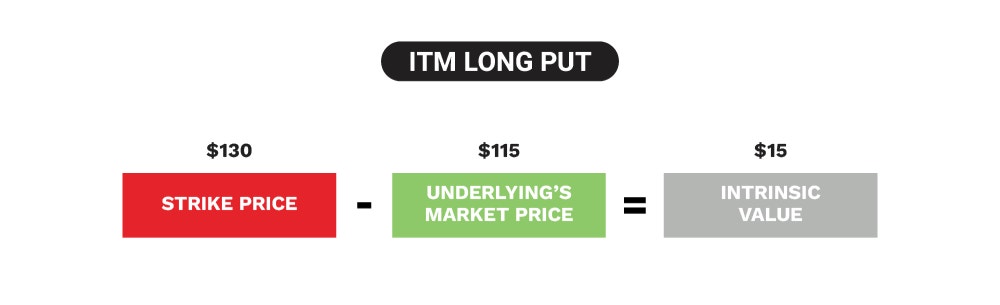

If we are looking at put option contracts, we can find the intrinsic value by subtracting the ITM put contract strike price from the stock price. For example, if we have a put strike at $130 and XYZ is trading at $115, there is $15 of intrinsic value in the put option:

Leverage in Options Trading

Leverage has a significant impact on your option trades. Trading options using leverage means you get increased exposure to the stock price with less capital – putting forth only a percentage of the full stock trade value upfront when comparing an option to 100 shares of outright stock. With leverage, you could get a magnified return on capital – on the other hand, potential losses are also amplified since buying an option that expires OTM results in 100% loss of the initial investment. Compared to buying and selling shares of a stock outright, options offer significant leverage.

2. Create an Options Trading Account

Open a trading account with tastytrade to kick off your options trading journey.

- Trade on your desktop, from your browser, or on your mobile device.

- Explore the markets and advance your expertise using our in-app content in Research and News tabs.

- Boost your risk management flexibility and learn how to manage your own money.

3. Develop a Trading Plan

Planning your trading strategy thoroughly before jumping into options trading helps you stay focused on your goals to reach your objectives, and it is vital in your trading journey. It is also a way in which you can manage your risk effectively.

Some of the many factors that you need to consider when setting up your trading plan include:

- Methods of managing risk, like using the bracket order system to enter stop-loss and profit target resting orders

- How to choose assets, trading style and strategies that fit your trading plan

- Implied volatility and what might influence it—binary events, supply and demand, macroeconomic events, and more

- Understanding trading psychology and how it might affect your decision-making process

Defined and Undefined Risk in Options Trading

Grasping the difference between defined and undefined risk enables you to better understand the relative risk and reward as well as the buying power requirement.

Defined risk refers to strategies where the maximum amount you could lose is limited and known before you place a trade. Strategies with defined risk include long calls, long puts, and typical multi-leg options strategies like vertical, calendar and diagonal spreads.

An undefined risk strategy, which applies to a short put and a short call, is when the maximum possible loss is unknown or undefined upon order entry. Specifically, short call options have undefined risk since there is no cap on how high a stock price can go. Short put options are limited in intrinsic value risk as a stock cannot go below $0.

It is important to note that to trade any undefined risk or any long or short multi-leg defined risk strategy requires a margin account.

Keeping Risk Small in Options Trading

Options trading carries risks and is not suitable for all investors. Staying small could be an effective way to manage your risk, especially when you are still an options trading beginner. You can do this in several ways, such as:

- Utilizing smaller trade sizes to lower risk

- Allocating capital for options trading as a small percentage of account size to put context around risk

- Limiting your number of trades to spread risk through time

- Choosing defined risk strategies to understand max potential loss scenario upon trade entry

- Having a trading plan with exit or management strategies when trades go against you

- Being mindful of volatility, i.e., fast-moving markets to understand the market condition you are trading

4. Identify a Trading Opportunity

One of the reasons traders choose options trading over stock trading is flexibility. Some traders start trading underlyings or sectors that they are familiar with, or trade popular ETFs (Exchange Traded Funds) to ensure options markets are liquid across all expirations and exposure is broad across sectors.

Whatever you choose, tastytrade empowers you with tools that can help boost your market awareness.

They include:

- Follow Feed—see what other traders are doing in the markets

- In-platform video feed—watch tastylive trading content live

- Preset market watchlists that update regularly, or you can build your own

- Watchlist sort and filter capabilities

5. Choose to Buy or Sell Options

Once you have chosen an underlying asset, you can proceed to other specifics, such as the type of position you would like to take, like whether you are long or short the option or strategy of your choice.

Being long an option means you pay for the option up front, and your max loss is the debit paid for that option. Profit potential depends on what you can sell the option for later – to profit with a long option, you need to sell it for a higher price later. If you sell the option for a lower price than what you paid to enter the contract, that will result in a loss.

Being short an option means you collect the option premium up front. If the option expires worthless and OTM, you keep the option premium collected up front as profit. If the option has some sort of value prior to or at expiration, you can buy it back (or cover it) for less than what you collected to realize a profit. If you buy it back for more than what you collected up front, that will result in a realized loss.

Call vs Put Options

Call and put options are different, but a closer look reveals parallels in their long and short variations when it comes to directional assumption.

So, when do traders use long and short call and put options?

- Long calls or short puts: If you think the underlying’s price will rise

- Short calls or short puts: If you think that the underlying price will remain neutral, or your strike will remain OTM

- Long puts or short calls: If you think the underlying’s price will drop

Pick a Timeframe

When opening an options trade, picking a timeframe—selecting the expiration date—is one of the important decisions you will need to make.

Long-term options are more expensive, but in theory they should hold onto extrinsic value more easily with so much time left to expiration.

Short-term options are less expensive and more volatile, as their time is limited which accelerates extrinsic value decay.

Both options have the same intrinsic value potential if they move ITM.

Options are typically offered on a monthly basis, but you can also opt for contracts with different timeframes, e.g., 7-day and 45-day cycles.

Pick a Strike Price

The range of available strike prices is found in an options chain, along with other relevant information like the delta of the strike price, probability of being ITM, and more.

When deciding on a strike price, you can choose where you take on intrinsic value if the stock moves past your strike and ITM.

You can also consider liquidity—high trading volume, open interest, and tight spreads between the bid and ask prices—which makes it easier for you to enter and exit positions, with less risk of slippage.

Outside of that, long options traders typically select strike prices that they think will go ITM by expiration.

Short options traders typically select strike prices that they think will remain OTM by expiration.

6. Monitor and Close Your Options Position

Once you have opened an options position, it is essential that you track the performance of the underlying to see if your options position is profitable or not. Managing your options positions is critical for both profit taking and risk management for loss.

Remember, if you buy an options contract and it expires OTM, you will lose 100% of the debit paid up front. If you sell the options contract to open and it expires OTM, you’ll realize 100% max profit equivalent to the credit received upfront.

You have one of three choices when your option is ITM:

- Close the position to capture potential profits on long options, or limit potential losses on short options.

- Roll the position out in time to collect more extrinsic value premium on short options positions if you think that the option will move OTM in the next cycle.

- Let the option expire and take delivery of 100 shares of the underlying if you have enough account equity and a suitable account type – long or short shares of a stock are determined by the option type you hold, and some underlyings are cash settled where there is no stock transfer, so it’s important to understand the inner workings of the product you’re trading. Remember, if you hold a short option contract, you are obligated to take the resulting shares of the contract if the counterparty exercises the option.

tastytrade provides several tools and functionalities that help you manage your positions effectively. These include:

- Customizable portfolio metrics and columns to monitor

- Liquidity indicators

- Email communications for upcoming expirations, dividends, etc. on your existing positions.

- Badges to denote ITM options and expiring ITM options

- Customizable option chain metrics

- Analysis feature to hypothesize positions at different days to expiration, stock prices, and implied volatility changes

- Bracket Orders to set stop-loss and profit target resting orders

- Charting features

Options Trading Examples

Options trading examples bring concepts to life – they can help boost your market awareness and enhance your understanding of options concepts overall. Let’s have a look at a call option example as well as a put example, with the shares of Company XYZ as the underlying asset.

It is also worthwhile to note when setting up an options trade and referring to an options chain, the quote listed is of a single unit. Since standard options are in control of 100 shares of stock, the listed quote of an option is of a unit of stock. That means when you view an options quote on an options chain you must multiply the listed quote by 100. For example, a call purchased for $1 translates to $100 in real dollar terms, as illustrated below.

Long Call Option (Bullish)

Suppose XYZ is at $49 and the call contract we are looking to purchase has a $50 strike, and we are buying the option for $2, or $200 dollars: if the stock price rises to $60 at expiration, the contract holder will have the right to buy 100 shares of the stock at $50. Since the contract is $10 below the new stock price, this option will have $10 of intrinsic value, or $1000 in real dollar terms since it is $10 ITM.

One options contract represents 100 shares of a stock, so at expiration the call option would be worth $1,000. Excluding commissions and fees, the call buyer would have a net profit of $800, since their call is now worth $1,000 at expiration and they paid $200 for it. They can choose to sell the call to realize the profit and close the position, or if they have enough account equity to purchase the stock, they can exercise their right to buy the 100 shares at $50 (with a breakeven of $52, since they purchased the call contract for $2).

The P/L would be the same at expiration, but if the option is exercised, they now have 100 shares of risk in the stock and they can realize any additional gains if the stock continues to climb, or losses if the stock drops.

With long call options, the max loss of the debit paid is realized if the contract expires OTM, and losses prior to expiration can be realized if the stock price does not rise quick enough, or at all. Be mindful that options trades can have volatile P/L prior to expiration. Learn how to offset an assignment by exercising a long option.

Short Call Option Example (Bearish)

Let’s revisit the call example above, where Company XYZ is now trading at $49 and we are looking at the $50 strike call, except this time we are giving a short call example, where we sell the contract for $2, or $200 in real dollar terms.

Excluding commissions and fees, if the stock climbed to $60, the trader would lose $800 if they closed the trade, since the option would be worth $1,000. But they would be able to offset some of that cost with the $200 premium they collected upfront for taking the short call risk.

Assuming the trader has enough account equity and suitable account type, they could also let the short call expire ITM and take assignment of 100 short shares of stock if they wanted to short the stock from that price level. Short call investors should be aware that there is no limit to how high a stock can go, so in theory there’s unlimited risk.

On the contrary, if the stock price closes below $50 at expiration, the short call seller would realize a max profit by keeping the initial credit received of $200. They could let the option expire worthless or buy back the short call to realize the profit and remove any potential assignment risk.

With short premium trades, investors are speculating against the movement of a stock price, where long premium trades are speculating for the movement of a stock price.

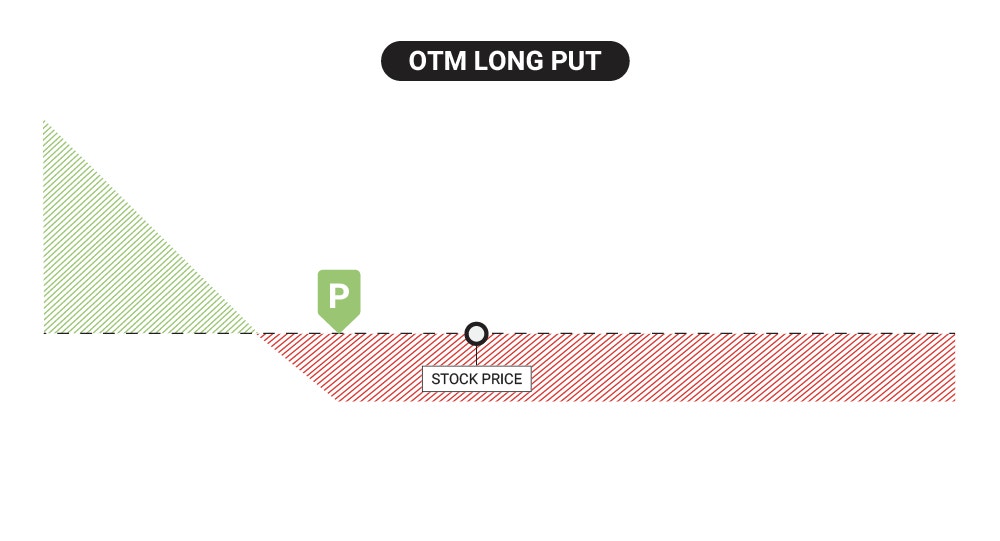

Long Put Option Example (Bearish)

In the case of long options, we want the stock price to go down so that our put contract increases in value, ideally by gaining more intrinsic value than what was paid for the option. Remember, a put contract allows us to sell or short 100 shares of stock at the strike price, which means if it is ITM then you can sell the stock at a premium relative to the market price with the long put option.

If XYZ is trading at $50 per share, an investor might buy a $45 strike put option to speculate on the stock price going down below $45. Let’s say they pay $1, or $100 real dollars, for this put option, with 30 days to expiration.

If at expiration, the stock is at $30 at expiration, the put contract would be worth $15, or $1,500 in real dollar terms. Excluding commissions and fees, the net profit would be $1,400 if the contract were closed, since the investor paid $100 for this contract upfront.

Alternatively, they could exercise the contract to establish a short share position at a basis of $44 ($45 strike less $1 paid for the contract). This would transition the trade into a stock position, and they would realize profit or loss going forward as the stock moved up and down.

Remember though, if the stock closes above $45 at expiration, the investor would have lost the whole investment of $100 paid upfront. This means the stock could have come down a little bit, say to $47 at expiration, but not enough for the put option to gain intrinsic value at expiration, so the contract would still be worthless.

Short Put Option Example (Bullish)

Now, imagine selling a put contract’s strike at $50 for $2, or $200 real dollars, when XYZ stock is at $55—by expiration, the stock drops to $51. In this case, excluding commissions and fees, the short put seller would realize max profit of $200, since the stock price did not drop below $50 by expiration, and the option expires worthless.

This is an example of how short option traders can be profitable even if they are slightly directionally wrong (short puts are neutral-bullish trades). With short options, traders are simply speculating against the stock price breaching the strike price through expiration. With OTM options contracts like this one, traders have some wiggle room before the strike moves ITM.

If the short option seller’s intention here was to acquire shares at a lower basis than the price it was trading at when the short put was originally established, the investor would achieve that if it dropped to $45 for example. They would own the shares at $48 ($50 strike less the $2 premium upfront), which is lower than buying the shares at the original price of $55 per share when establishing the short put.

Remember though, short put options can increase in value when the stock price drops. If the trader wishes to get out of the contract prior to expiration, or if they change their mind about acquiring shares, they can realize losses on the closing transaction if it costs more to buy back the short put than the $2 they received when opening the trade. Max loss with a short put contract is the strike price multiplied by 100, less the credit received for selling the put.

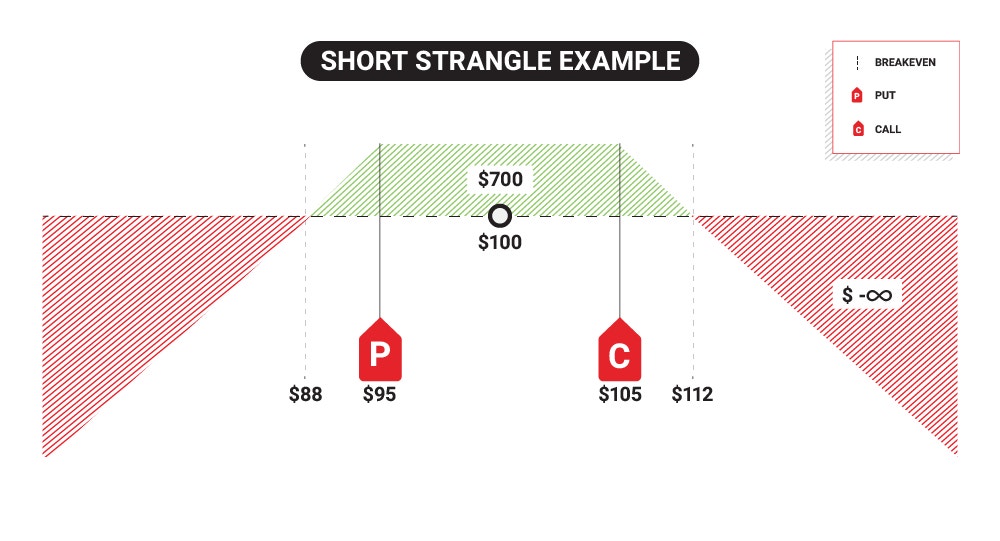

Profiting from a Neutral Directional Assumption

One of the differentiating factors of options trading is that you can profit from underlying prices that stay within a specified range, not only those that experience large upward and downward movements.

Take a short strangle, for example, which is simply the combination of a short OTM put and a short OTM call at the same time. If Company XYZ’s stock is trading at $100, a trader might sell a 95 put and a 105 call at the same time, and in the same expiration cycle.

Excluding commissions and fees, if the trader collects $3.50 from each option, the total max profit would be $7, or $700 real dollars, if both options expire worthless. The stock may ebb and flow and each option may show gains or losses at any time, but at expiration if both options are OTM, they will expire worthless, and the trader would keep the credit received as max profit.

If the stock moved to $120, and the options trade was closed at expiration for $15, the trader would realize a loss of $800. They would have $15 of intrinsic value in the short call that moved ITM, and the short put would be worthless, but they collected $700 total up front for taking the risk in the contracts which offsets intrinsic value risk to a degree in the contracts.

The breakeven prices to the downside and upside are $88 and $112 respectively, since the trader would be able to offset $700 of intrinsic value to the upside or downside with the $700 in extrinsic value premium they collect up front.

Unlike a short put or short call by themselves, a strangle combines short options on both sides to create a truly directionally neutral trade. With this comes the trade-off that you have risk on both sides, and any wild move in either direction can be problematic for a strangle.

Still, to realize max profit on a short strangle the stock needs to stay between the two short strikes through expiration. Unlike just selling a put, or just selling a call, a strangle has intrinsic value risk on both sides. Short put options have the risk of the stock going to zero, and short call options have unlimited risk as there is no cap to how high a stock price can rise.

This can create a lower probability range compared to a short put or a short call alone, so traders must understand the implications of taking risk on both sides of a market before deploying a more complex strategy like this undefined risk strangle.

FAQs

To open your first options trade, follow these steps:

- Log in to your tastytrade account.

- Do your research and create a trading plan.

- Browse the options market and the asset you want to trade.

- Decide whether you will go long, short, or neutral.

- Decide between an undefined or defined risk trade.

- Open your position, have a plan for risk management, and monitor the market.

Options work by having a contractual agreement between two parties, a buyer and a seller (in a call or put option), with opposite assumptions of how the market will move. What one party makes in profits, the other side loses, and vice versa.

You can use options to obtain long or short shares of stock at desired strike prices, trade multi-leg options strategies, or speculate on the price of the options themselves.

Stock options work by having two parties agree on exchanging 100 shares of long or short stock per contract depending on the option type, at a predetermined price (strike price) by a specific date (expiration).

While the contract buyer has a right, but not an obligation, to exercise the option, the contract seller is obligated to make the exchange if the counterparty exercises their option (assignment). What one party makes in profits the other sees in losses, and vice versa.

Using a margin account means that no minimum account balance applies. However, you need to have funds in your account that cover margin requirement of an options contract to start trading. But, if you are aiming to qualify for margin privileges, you must have a minimum of $2,000 in your account.

Options and stocks have similarities in the sense that if you own an options contract, you control the theoretical equivalent of 100 shares of stock without having ownership of stock.

The key difference is that with options, you control 100 shares of stock as a derivative contract for a limited amount of time, which means the cost to do so can be significantly less than buying or shorting 100 shares outright in the market.

This means more leverage and potential return on capital for profitability, but also a higher probability of losing the max loss of the cost of the option, and general volatility of profit or loss from trade entry to the option’s expiration.

Whether trading options is better than outright stocks trading is a question that depends on many factors, like risk tolerance and trading objectives and you as a trader.

Before choosing between options and stock trading, taking a deep dive into the differences between the two and what they mean for you can be quite useful.

Some of the key differences are:

Trading Options

- You can choose what price you take on bullish or bearish intrinsic value risk.

- Directional exposure is dynamic, and it can be manipulated by strike and expiration choices.

- Higher than 50/50 probability trades are possible with options. For example, short OTM options strategies that expire worthless can start far away from the current underlying price, which means room for the market to move before the strike moves ITM.

- Once you have purchased or sold an option, the extrinsic or intrinsic value worth will be determined by your contract’s expiration date and where the strike price is relative to the stock price.

- Greater flexibility with trade entry and management—strike price, expiration, Greek exposures, and strategies.

Trading Stocks

- You typically buy or sell around its market price.

- Directional exposure is static.

- You only profit if the market moves in your favor, which is typically 50/50 in the short term.

- There is no time period linked to closing a trade you enter, and your profit or loss is directly correlated with where you bought or shorted the underlying to enter to the trade.

- Less flexibility with the static nature of whether you are long or short the stock, and whether the stock is up or down from when you entered the trade.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.