What Are Indices and How Does Index Trading Work?

A financial index measures the performance of a specific group of assets, most commonly stocks. They serve as a benchmark for tracking the performance of a certain market segment. Indices—sometimes also referred to as an index—offer traders valuable insights into market trends or economic conditions.

What is an Index?

An index provides a standardized way to track the performance of a group of stocks, often within certain market sectors. Examples include the S&P 500 and the Dow Jones Industrial Average, both popular benchmarks used to gauge U.S. market performance. Investors commonly use indices to gain broad exposure to the market. They also serve as tools for strategy development, as traders often compare their personal performance against these benchmarks.

How Are Indices Calculated?

Indices are calculated in different ways, which impacts how much each asset within it contributes to the overall value. The two most popular calculations are value weighting and price weighting. Let’s dive into each to see how they work and why they matter.

Market Value-Weighted Indices

Market cap weighting or market value weighting bases the weight of each asset in the index on its total market capitalization, commonly referred to as market cap. In this type of index, companies with a larger market capitalization have a larger influence on the index price.

The following formula is used in a market capitalization index:

- Determine the Market Capitalization for Each Company: Multiply the share price of each company by the total number of shares it has.

- Calculate Each Company's Weight in the Index: Divide the market capitalization of each company by the total market capitalization of all the companies in the index.

- Compute the Index Value: Multiply each company's weight by a base index value (a starting reference value). Add up all these individual values to get the final index value.

For instance, companies with a large market capitalization such as Apple or Amazon, will have a bigger impact on the price of the index compared to smaller companies. Because larger companies are more reflective of the economy, this type of index offers a more realistic snapshot of the market regarding changes in the economy, monetary policy, fiscal policy and so on. That said, the index can also be skewed when the performance between a few large companies conflicts with the performance of many smaller companies. It is important to understand the weighting of the index you’re trading for this reason.

Price-Weighted Indices

Conversely, a price-weighted index assigns weight to each stock based only on the price of each individual share without consideration of the market capitalization of that share. This means that a stock with a higher share price contributes more to the index’s value even if the company has a small market capitalization.

The advantage of a price-weighted index is the simplicity in its calculation, as many investors find it easier to interpret and compare historical performances. Alternatively, high-priced stocks can at times distort the price of the index.

The following formula is used in a price-weighted index:

- Sum the Stock Prices: Add together the current stock prices of all the companies included in the index.

- Use the Divisor: Divide the total sum of the stock prices by a predefined divisor. This divisor is adjusted as necessary to account for changes like stock splits or the addition/removal of stocks in the index to maintain consistency.

- Calculate the Index Value: The result of the division gives you the value of the price-weighted index.

Equal-Weighted Indices

In an equal-weighted index, the same importance is given to every stock regardless of its price or size. This method gives a more balanced view of the performance of each stock within the index, with small and large companies of any price impacting the price of the index the same. The following formula is used in an equal-weighted index:

- Calculate the Return for Each Stock: Determine the percentage change in price for each stock in the index over a specific period (e.g., from the start of the period to the end).

- Assign Equal Weighting to Each Stock: Since each stock is equally weighted, each stock's return will have the same impact on the index, irrespective of its market capitalization or stock price.

- Compute the Average Return: Add up all the individual stock returns (as percentages) and then divide by the total number of stocks. This gives you the average return for the period.

- Determine the Index Value: Apply the average return to the index's starting value to calculate the new index value.

What Affects the Stock Market Index Prices?

Numerous factors can influence the price of stocks and the indices that hold them. However, because they are baskets of stocks, they are typically less susceptible to the price risks that impact equities.

- Economic News: Central bank reports and economic reports can influence prices

- Company Financial Results: Corporate earnings results can influence prices, especially in market-capitalization weighted stocks where large companies hold more influence

- Company Announcements: Leadership changes, mergers, and specific company news can shift prices

- Index Composition Changes: Companies being added or removed from the index can affect the index price

What is Stock Market Index Trading and How Does It Work?

Indices trading requires speculation on the price movements of equities based on their reaction to market sentiment, economic factors, monetary policy and other macro-themed events. Whereas trading individual stocks requires a more micro-focused lens that looks at company-specific news and earnings events. Market indices do not offer the ability to buy the index outright, so these products can be traded via derivative securities such as options and futures. With that said, there are plenty of adjacent ETFs that traders and investors can buy or short outright.

Benefits of Trading Indices

- Diverse Selection: Gives you access to various markets

- Flexibility: Options for different trading strategies

- Cash settlements: Options on indices are cash settled, allowing more flexibility in trading options on them without early assignment and exercise risks. Cash-settled indices do not have shares associated with them.

- Portfolio Diversification: Reduces individual stock risk

Most Popular Indices

The most popular indices track equities and volatility markets. Here are some notable indices for traders:

- S&P 500: Tracks 500 leading U.S. companies (e.g., Apple, Microsoft)

- Dow Jones Industrial Average: Includes 30 large U.S. firms (e.g., Walmart, 3M)

- NASDAQ 100: Features U.S. tech giants (e.g., Adobe, Alphabet)

- VIX: Measures S&P 500 implied volatility expectations

Types of Index Sectors

Indices can track different segments, including equities, bonds, commodities, and real estate. They provide broad market perspectives essential for analyzing and investing. These offer exposure to a broad basket of instruments within each type of asset class.

Equity Indices

Equity indices assess stock market segments:

- Global Indices: Tracks stocks across the world

- Regional Indices: These focus on specific areas like Europe or Asia

- National Indices: Specific to individual countries

Bond Indices

Bond indices reflect bond market or Treasury market performance, considering aspects like accrued interest and price changes, covering government, corporate, or high-yield bonds.

Commodity Indices

Commodity indices track raw material prices, including economic insights specific to that asset class and sectors like energy and metals.

Real Estate Investment Trust (REIT) Indices

REITs track real estate holdings and are valuable for tracking home buying and apartment leasing trends. They can also track sub-sectors within real estate, such as commercial holdings.

Exchange-Traded Funds (ETFs)

ETFs are among the most popular ways for investors to gain access to the price movement of indices, with American-style options and shares available. They offer diverse exposure across various classes of assets. Many ETFs that track asset classes are highly liquid, cost effective and simple to trade.

Equity Index ETFs

- SPDR S&P 500 ETF Trust (SPY): Tracks the performance of the S&P 500 index, providing exposure to large-cap U.S. stocks

- iShares MSCI EAFE ETF (EFA): Focuses on equities from developed markets outside of the U.S. and Canada, such as Europe, Australasia, and the Far East

Bond ETFs

- iShares Core U.S. Aggregate Bond ETF (AGG): Tracks the performance of the U.S. investment-grade bond market, including government, corporate, and mortgage-backed securities

- iShares 20+ Year Treasury Bond ETF (TLT): Focuses on U.S. Treasury bonds with maturities of 20 years or more

Commodity ETFs

- SPDR Gold Shares (GLD): Offers exposure to gold, tracking the price performance of the precious metal

- United States Oil Fund (USO): Provides exposure to the price movement of West Texas Intermediate (WTI) crude oil

REIT (Real Estate Investment Trust) ETFs

- iShares U.S. Real Estate ETF (IYR): Focuses on U.S. real estate companies and REITs

How to Trade or Invest in Indices

- Understand indices and trading mechanics.

- Open a tastytrade trading account.

- Choose your trading strategy.

- Initiate your first index trade.

Ready to Diversify Your Portfolio?

How to Gain Exposure to Indices With an ETF

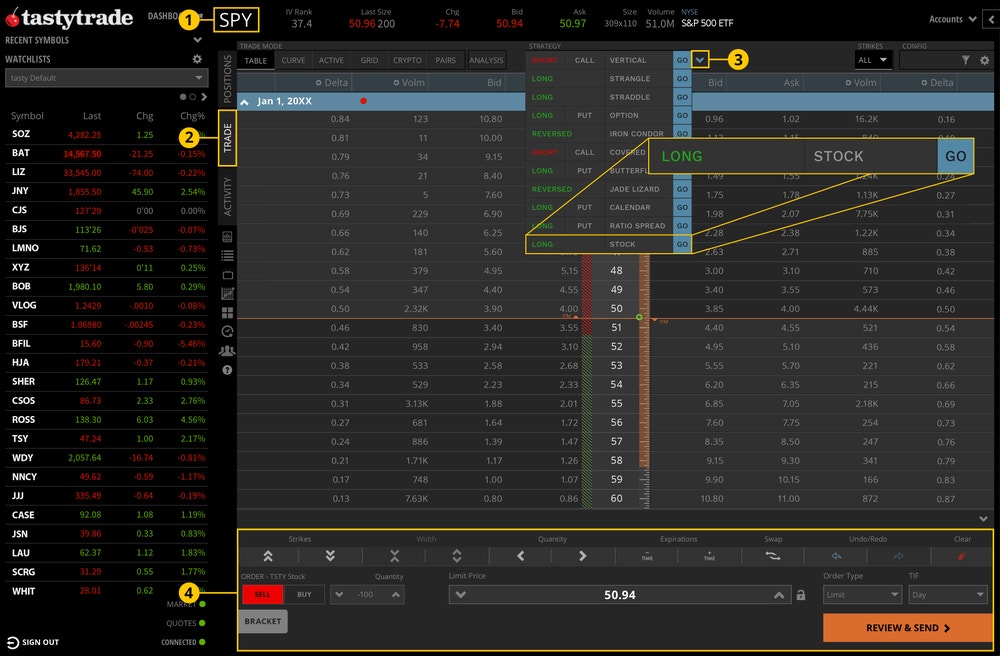

- Locate the ticker-symbol search box along the top of the platform and enter your ticker symbol. E.g., SPY to trade the S&P 500 index.

- Navigate to the Trade tab.

- Click on the strategy dropdown symbol and click “long” next to “stock.”

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

FAQs

A stock market index is an instrument that measures the value of a basket of stocks in a specific sector, rather than a single listed stock.

There are hundreds of indices, each representing different markets or sectors. Before trading, understand how an index is constructed and the weightings of each product within the index.

Index trading involves speculating on the price movements of market indices. Traders can become long or short an index to express a market opinion.

Yes, with strategic approaches and market understanding, profits are possible from index trading. However, like with all trading, there are risks associated with index trading. Understanding how an index is constructed, and the weights of each product within an index can give you an idea of how an index may perform as the prices of products within the index move.

Investors should obtain a copy of the investment company’s prospectus, which contains important information about the investment company, related risks, and expenses. Carefully read the prospectus before investing in an ETF.

This content, including the use of actual symbols, any visual display or other reference to product, type of investment, strategy, or service offered, is for demonstrative and informational purposes only. It is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.