How to Trade and Invest in Gold

Traders and investors frequently trade gold in financial markets. People have used gold for thousands of years in commerce and trade. Today, traders utilize it to speculate on the market and hedge against volatility. Investors also use gold to diversify their portfolios and hedge against inflation risk. Understanding how to trade gold is essential for a trader. Gold typically rises during times of rising inflation and economic uncertainty. Due to its popularity, there are various ways to trade it, whether through the futures market, gold-related stocks, exchange-traded funds, or options on futures. Grasping how to trade gold enables traders to fully take advantage of the metal’s potential.

How to Trade and Invest in Gold

1. Understand What Gold Trading and Investing Are

Gold trading involves buying or selling gold, usually for speculative or hedging purposes. Physical trading of gold is rare since there are numerous products that allow traders to gain exposure to gold prices, such as the futures market, exchange-traded funds (ETFs), gold stocks, and options on gold ETFs and futures.

Investors buy gold to diversify their portfolio, since gold is usually uncorrelated with stocks and other financial assets. Gold’s appeal is especially attractive during times of economic uncertainty or when investors expect inflation to increase. The metal has offered a time-tested asset that is both liquid and easy to access through various product offerings.

What Drives the Price of Gold?

Various factors determine the price of gold, such as the economy, central bank policy, fiscal policy, the rate of inflation and market sentiment, to name a few.

One of the biggest factors is central bank policy, specifically that of the U.S. Federal Reserve since gold trading is primarily priced in U.S. dollars. The rate set by the Fed has an outsized influence on its price since gold is a non-interest-bearing asset.

When the Federal Reserve is expected to lower interest rates, gold prices typically rise. This is because the rate of return on safe-haven assets such as Treasuries is expected to drop with interest rates. Alternatively, if the Fed is expected to raise rates, it could hurt gold prices.

2. Open a Trading Account

Open, manage, and close gold positions with a tastytrade brokerage account. In addition to gold futures, gold ETFs, and gold stocks, you can trade over 8,000 US-listed stocks with no commissions on an award-winning platform.1

Ready to Trade?

3. Select How to Trade or Invest in Gold

Whether you’re an investor looking to buy and hold gold for the long term, or a trader looking to speculate on short-term movements, there are a variety of products to gain gold exposure. From futures to options on futures, tastytrade covers all the bases.

Gold Futures

Gold futures offer a liquid vehicle to speculate on the price of gold. tastytrade offers two gold futures products:

- CME Gold Futures (ticker symbol /GC): Represent 100 troy ounces of gold C

- ME Micro Gold Futures (ticker symbol /MGC): Represent 10 troy ounces of gold

These contracts trade nearly 24 hours a day, 5 days a week, and are both physically deliverable.

Gold ETFs

Gold exchange-traded funds, or ETFs, are vehicles that are designed to track the price of gold. There are also ETFs that track the performance of gold miners. Two notable examples are the SPDR Gold Shares ETF, ticker symbol GLD, and the VanEck Gold Miners ETF, ticker symbol GDX. Gold ETFs allow you to gain broad exposure to the price of gold or miners compared to stocks.

Gold Stocks

There are numerous companies that are involved in the exploration, mining, refining, and selling of gold. These stocks give you exposure to the gold market but can also be susceptible to broader market sentiment in the stock market. Most gold stocks you’ll find are typically involved in the exploration and mining of gold. Some notable examples include Agnico Eagle Mines, ticker symbol AEM, and Newmont Corporation, ticker symbol NEM.

Gold Options on Futures

Options on gold futures give traders a way to participate in gold prices with a defined risk approach. CME gold futures offer an array of weekly and monthly options, allowing traders to take various approaches to speculating on gold prices. Traders use options to create risk-defined positions and help fine tune their trading strategies.

4. Open Your First Gold Position

Opening your first gold position starts with selecting what product you want to trade. This depends on your account type, trading strategy, and risk tolerance. Futures and options on futures will appeal to a speculative trader who is seeking profits. Alternatively, gold stocks can cater to those who want to gain exposure to gold to diversify their portfolio. Once you’ve familiarized yourself with each gold product, you’ll be able to make an informed decision that best suits your trading style.

5. Monitor and Manage Your Trades

Once you’ve opened your first position, it’s important to monitor your trade as you would with any other product. The tastytrade platform offers the technology and tools to easily monitor and manage your trades, which include real-time data, an intuitive interface, and customizable alerts.

Gold Trading Examples

There are various instruments to trade gold, with each giving unique advantages based on your trading strategy. It’s important to pick the product that best aligns with your trading strategy and risk tolerance. Gold futures provide direct exposure to gold prices and are usually employed by traders speculating on price movements. Stocks and ETFs also give you exposure to gold prices, although they can be less direct than futures, as the individual risks faced by each company are unique. Regardless of which product you select, tastytrade offers intuitive tools and technology that can help you enter and manage your trades.

Gold Futures Trading Example

The outcome of trading a gold futures contract depends on whether you go long or short. If a trader enters a long position on a futures contract, they will benefit if the price subsequently increases. Alternatively, a short position on a futures contract benefits when the price drops.

You can open and close your futures position during any time when the market is open. There are no pattern day trading (PDT) rules for gold futures since they are not classified as securities.

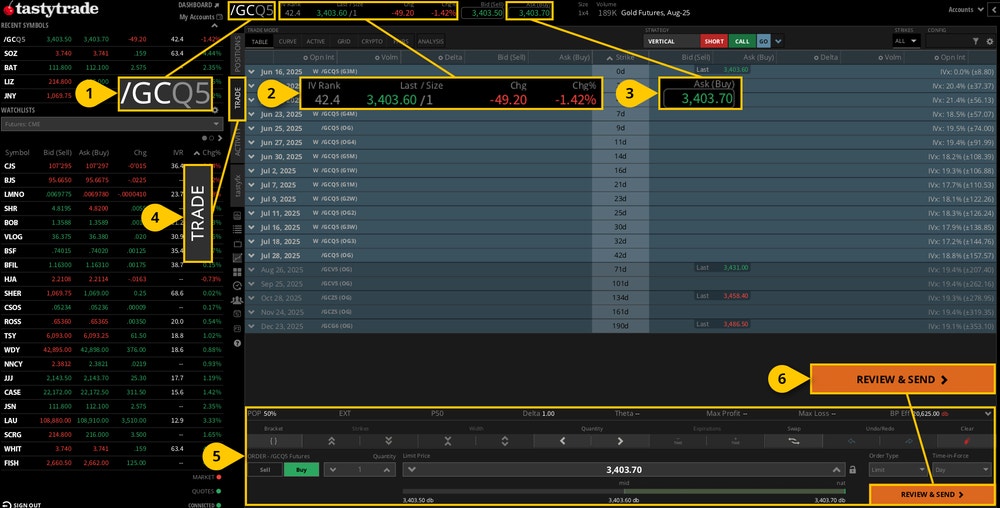

To open a gold futures position on the tastytrade platform, first enter the ticker symbol for gold, which is /GC, on the top left of the platform. The active month quote will generate in the quote box. You will click on the “Ask” to go long a contract, or on the “Bid” to go short a contract. The trade ticket at the bottom of the screen will populate automatically. At this point, you can adjust the quantity, price, and order type. Click on “Review & Send”, check commissions and fees, and click “Submit” when you are ready to enter your trade.

- Ticker symbol box

- Quote information

- Bid (Sell), Ask (Buy)

- Trade tab

- Order ticket

- Review & Send

Gold ETF / Stock Trading Example

The process is largely the same for gold ETFs and stocks. Locate the search bar on the top left and enter the symbol for the gold ETF or stock of your choice. For this example, we’ll use the VanEck Gold Miners ETF, with the ticker symbol GDX.

To go long, click on the “Ask” price. To go short, click on the “Bid” price. The order ticket at the bottom of the screen will automatically show up. You can adjust the quantity, order type, and time-in-force. You can also adjust your limit price in the trade ticket. Check commissions and fees. Once you are ready to submit your order, hit the “Review & Send” button on the bottom right of the trade ticket.

- Ticker symbol box

- Quote information

- Bid (Sell), Ask (Buy)

- Trade tab

- Order ticket

- Review & Send

FAQs

You can trade gold with a tastytrade account, where you can find gold futures, gold stocks, ETFs, and options on gold futures.

Investing in gold is simple on the tastytrade platform. If your strategy calls for holding positions over the long term, tastytrade makes it intuitive to buy gold stocks and ETFs.

The best way to buy gold depends on your trading strategy and individual risk tolerance. tastytrade offers a variety of gold products that can suit almost any trading strategy.

Trading and investing in gold offers the potential for profits. However, like all financial products, gold trading and investing comes with inherent risk, including the loss of your capital.

The price of gold depends on supply and demand, geopolitics, monetary and fiscal policies, and overall market sentiment.

1 All stock trades incur a clearing fee of $0.0008 per share, and applicable exchange and regulatory fees. Other fees may apply. Named #1 Desktop Futures Trading Platform by StockBrokers.com, 2024 Annual Awards.

Investors should obtain a copy of the investment company’s prospectus, which contains important information about the investment company, related risks, and expenses. Carefully read the prospectus before investing in an ETF.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.