What is the VIX Volatility Index and How Can You Trade It?

The VIX is the S&P 500 “fear gauge” that tracks the implied volatility of the S&P 500 on a 30-day forward-looking basis. The VIX is a cash-settled index, so it can only be traded using options. Volatility futures are available to trade as an alternative. Learn what the CBOE VIX volatility index is, how it works, and how to trade it using options and futures.

What is the VIX Volatility Index?

The Cboe Volatility Index (VIX) is a cash-settled index that represents the market’s expectations for S&P 500 Index (SPX) volatility. The VIX is derived from SPX options prices with near-term expiration dates, generating a 30-day forward-looking projection of implied volatility. Implied volatility, or how much a given trading product price is expected to change, is often seen to gauge market sentiment and the degree of fear among traders and investors. When the VIX is high, general market uncertainty is high, and investors should expect larger moves. When the VIX is low, complacency is high, and fear is low. One of the unique characteristics of the VIX is that it is a mean-reverting asset. Unlike equities that can stay above or below a mean price forever, the VIX rises above the mean and falls below the mean regularly. Because it’s an index that represents implied volatility, it ebbs and flows with market sentiment.

The index is more commonly known by its ticker symbol and is often referred to simply as “the VIX.” As it provides a quantifiable estimation of future market movement for a benchmark index like the S&P 500, it’s a valuable tool for both traders and investors alike to understand.

How Does the VIX (Volatility Index) Work?

The goal of the VIX is to measure the implied volatility of the S&P 500 on a 30-day forward-looking basis. When the VIX is above average, market volatility is typically more apparent than when the VIX is below average. The VIX is tradable via options, as it is a cash-settled index and does not settle to stock. Traders and investors can also participate in VIX futures contracts, volatility ETFs, and more.

In general, volatility can be measured using two different methods: historical and realized volatility, or implied or future volatility. Historical volatility tells us how a product has moved, and traders can build assumptions from that data.

The VIX is a measure of implied volatility, which involves using options prices to solve for future potential price movement in SPX. Option prices are a direct reflection of how wild a stock price is expected to move. The more expensive options are relative to the underlying price, the higher the implied volatility will be.

Since the possibility of such price moves happening within the given time frame is represented by the implied volatility, the Black-Scholes pricing model allows us to solve for implied volatility figures. Implied volatility is forward-looking, and certainly not guaranteed, as it ebbs and flows with options prices. This is how expected stock price ranges are derived over specific periods of time, even though implied volatility is traditionally presented on a one-standard-deviation, annual basis.

How to Trade the VIX

Understand What the VIX is and How It Works

The VIX is the implied volatility gauge, otherwise known as the “fear gauge” of the S&P 500. Implied volatility is traditionally presented on a one-standard-deviation annual basis, but the VIX is presented on a 30-day forward-looking basis. The VIX is tradable directly using options strategies, as it is a cash-settled index.

Learn What Affects the Price of the VIX

The VIX is essentially a barometer for how expensive or cheap the options premium is within the S&P 500 index (SPX). This information is then used to determine market sentiment in the S&P 500. When markets are volatile, options prices can spike as more traders look to hedge against and speculate on big moves. When SPX options are expensive relative to the price of SPX, the VIX will have a higher reading than if markets are calm and SPX options are relatively cheap.

For context, the VIX has an average price in the teens over time. When markets react to uncertain times, the VIX can spike to much higher levels. During the mortgage crisis of 2008, the VIX spiked to over $80. During the COVID-19 lockdown in 2020, the VIX closed at an all-time high of $82.69. Be aware of the VIX price as you manage your portfolio, as it can be a telling sign of implied volatility or lack thereof.

Open a Trading Account

Open a tastytrade brokerage account to gain access to volatility trading products like the VIX, /VX futures, and more. The VIX can only be traded with options, so an account with options privileges would be required to trade the VIX.

The Market's Moving, Are You?

Select a Way to Trade the VIX

Before trading the VIX, it’s important to understand how the VIX options are priced, as they are unique and very different than regular equity options.

VIX Options

VIX options have different expirations, just like equity options. However, each VIX expiration is associated with a /VX futures contract with a similar expiration date. The futures contracts all have different prices, and this is especially apparent when markets are very volatile. Sometimes you can see a difference of a few or many points between one /VX futures contract and the next. The VIX will drift up or drag down in price over time, all else equal, to settle to the /VX futures contract price.

For example, if the VIX is trading at $20, but the /VX futures contract is trading at $25, the ATM options that are similarly priced in VIX will be around $25, even though the VIX is trading at $20. Because of this abnormality, VIX options can look weird visually, as the highest extrinsic value is not at the current price of the VIX – it's near the futures contract price. This is one of the main differences between VIX options and equity options, where equity options have the highest extrinsic value near the current stock price.

In the example above, we can see that the VIX is trading at $23.68, but the /VX futures contracts are trading around $21.5. The price point where puts and calls are trading for around the same value in VIX is near the $21.5 strike, instead of the spot price of $23.68. In other words, the VIX options look to the futures market for the underlying ATM price near the same expiration. All else equal, in this example, the VIX spot price will drag down towards $21.5 by the expiration date.

VIX Futures

If you’re looking for a cleaner way to trade S&P 500 volatility, VIX futures are an alternative. With that said, /VX futures contracts are significantly larger in size than VIX itself. Furthermore, there can be a huge divergence between one /VX futures contract and the next, so calendar spreads can be very risky in these products. Sticking to one futures contract expiration when trading futures will ensure that your notional value risk is bound to that contract in isolation. /VX futures are cash-settled products, which means the futures contract will eventually expire to cash instead of a physical product.

Open Your First Trade

Once you decide whether to trade the VIX, /VX futures, or another volatility product, it’s time to open your volatility trade. Using the tastytrade platform, you can use the bracket order system to set profit targets and stop loss thresholds with conditional orders, right from the beginning. Regardless of your trading instrument, be mindful of your risk, have a plan for exiting the trade, and understand that volatility products are...well...volatile.

Monitor and Close Your VIX Position

Once your VIX or /VX futures position is open, you’ll be able to manage it on your positions tab on the tastytrade platform. If you have a multi-leg options strategy, you can select each leg before closing or rolling the full position. You can also analyze the position or create a bracket order on your active position from the positions tab.

Learn more about managing your positions with tastytrade platform guides

VIX Trading Example

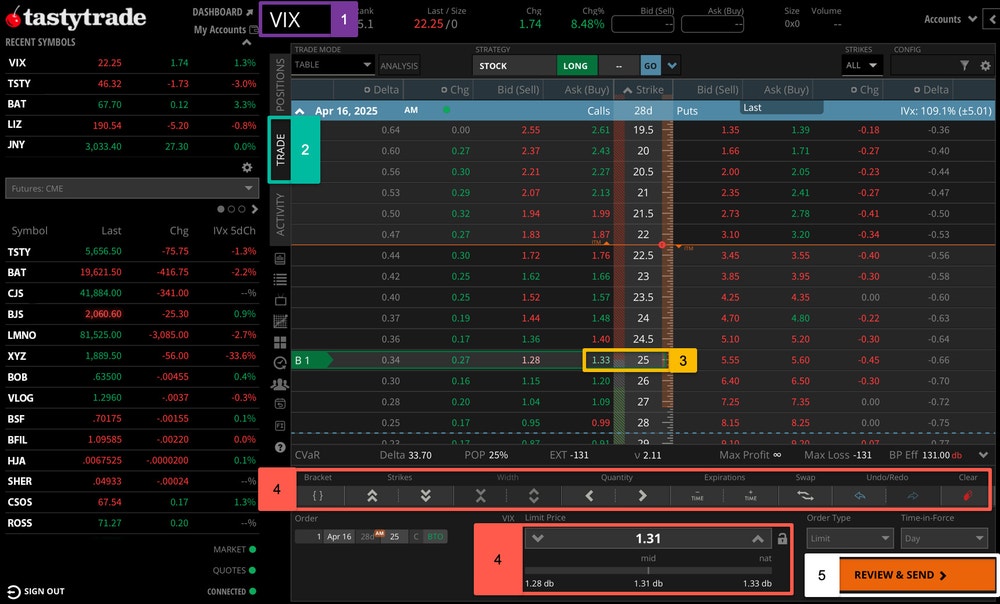

Log in to your web, mobile, or desktop tastytrade platform. In this example, we’ll look at buying a call option in the VIX on the tastytrade desktop platform.

- Enter VIX into the ticker symbol box along the top of the tastytrade platform.

- Click on the table trade view so you can see the options chain. This is where available options expirations are listed, and you can click into an expiration to see the call and put options.

- To buy or sell an option on tastytrade, click on the Bid (Sell) or Ask (Buy) next to the strike price of the call or put you want to trade. When you click on one of the prices, your VIX options trade will populate on the trade page. This example shows buying a 25-strike call option in VIX in the April expiration cycle.

- Along the bottom of the trade page, you adjust the quantity of options contracts, the purchase price, order type, and time-in-force (TIF) which is how long an order stays active before it expires. You can also move the strike up or down, adjust the expiration, and much more using this toolbar.

- Click the REVIEW & SEND button to review the trade details. On the final page, review all aspects of the order including commissions and fees and send the order.

FAQs

When the VIX is high, the “fear” in the S&P 500 market is higher. Markets are typically volatile with some sort of catalyst of uncertainty. For reference, the most recent highs in the VIX were related to the COVID-19 shutdown, and the financial crisis of 2008 to name a few.

Whether the VIX being high or low as a positive signal depends on who you ask. For traditional long-term investors that are bullish on many different products, a low VIX generally means market complacency, no surprises projected, and a market that typically drifts higher over time. For traders with a short-term scope, the VIX being high means more volatile markets, more two-sided action, and more tradable opportunities in the markets.