Futures Options

Futures options are derivatives of specific futures contracts that allow traders and investors to hedge and speculate against futures contract price movement. Like equity options, futures contracts have different strike prices, expiration dates, and premiums associated with them. Futures options can be bought or sold on the open market, and many futures markets have much broader trading hours than standard equity markets.

What are Options on Futures?

Options contracts on futures products allow you to control the notional equivalent of one futures contract for a fraction of the cost, utilizing the futures option as the trading vehicle. Each options contract has a strike price and expiration date, just like equity options. If you understand equity options, futures options are very similar as they both use the Black-Scholes options pricing model. One key difference is that futures options expire to the specific futures contract, whereas equity options expire to the underlying stock.

When buying a futures options contract, the total monetary risk on the futures option is significantly less than buying or shorting the futures contract outright, but the futures option carries a lot more leverage. In addition, losing 100% of the investment is much more probable when buying a futures option compared to a futures contract. To lose full value on a futures options contract, the futures option just needs to expire out-of-the-money (OTM) and worthless. To lose full value on a futures contract you bought, the futures contract itself would have to go to zero.

When selling a futures options contract, the same high leverage trade can be achieved because futures options require much less capital than owning the futures contract outright, even though the notional risk is the same beyond the strike price.

In short, options on futures are leveraged, derivative products that are used by traders and investors to speculate on or hedge against the future potential price movement of the futures contract itself.

How to Trade Futures Options: A Step-by-Step Guide

- Learn about futures options and how they work

- Open a tastytrade brokerage account and enable futures trading

- Choose the futures contract you want to trade options in

- Identify your first futures options trading opportunity

- Open your first futures options position

- Monitor and manage your futures options trades

1. Learn About Futures Options and How They Work

When it comes to futures options trading, knowing your futures product and how it works is of the utmost importance. After all, futures options are a derivative market of that futures product. Unlike equities that are priced in a universal way, futures contracts all have different notional values, tick sizes, tick values, and more. Be sure to fully understand how your futures product behaves before diving into the options market on the futures contract.

Learn more about futures specifications

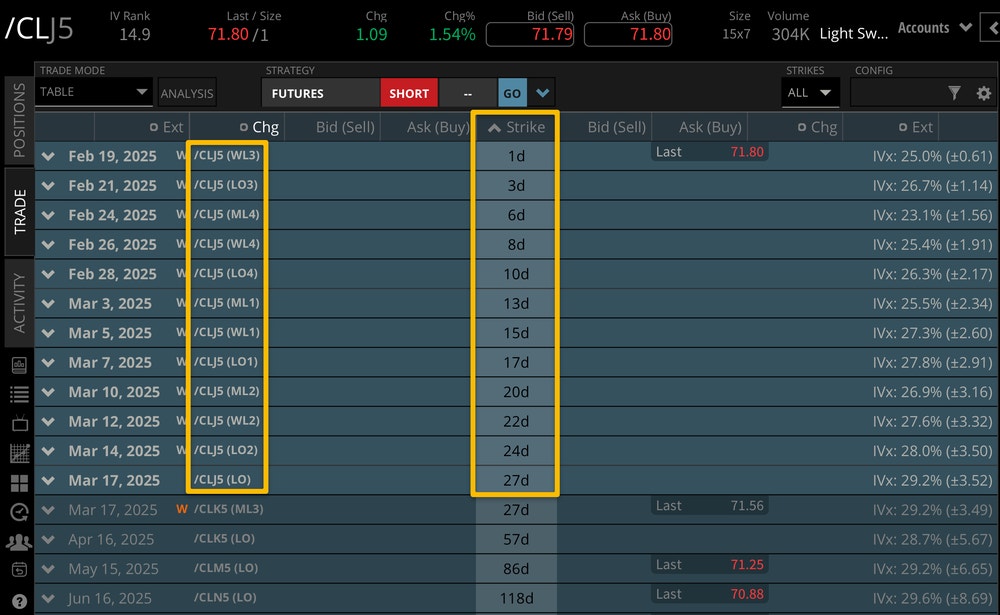

One of the most important aspects of futures options trading is that different futures options expirations settle to different futures contracts. The organization on tastytrade trading platforms makes this easy to see:

Looking at the futures options example in /CL, which is the Crude Oil futures contract, we can see that all option expirations in the light blue shade expire to the /CLJ5 contract. Options that are in the darker shade below the highlighted sections expire to different /CL futures contracts that have their own price.

As you can see, it’s important to know what futures options contract you’re trading in, and how that may expire to the futures contract itself. Each futures contract has different specifications, and that means the options market is unique as well. Know your product before diving into the derivate market with futures options.

2. Open a tastytrade Brokerage Account and Enable Futures Trading

Trading futures and futures options on the tastytrade platform is quick and easy. After opening a trading account, enable futures trading with a few clicks. Utilize tastytrade platform features like the bracket order system to create conditional orders to lock in profits or cap losses. Easily view futures options contract expirations to see which options are associated with specific futures contracts.

Ready to Trade?

3. Choose the Futures Contract You Want to Trade Options In

The beauty of futures contracts is that there are many different sectors you can trade. In the equity world, trade volume concentration may revolve around sectors like the S&P500 and big tech. In the futures world though, traders and investors can participate in many different product sectors and engage in futures options within them.

Agricultural Futures Options

Futures products like corn, soybeans, and wheat offer futures options in many different expirations.

Currency Futures Options

Traders and investors can participate in currency futures options markets like the Japanese Yen, Euro, Australian Dollar, Canadian Dollar, and British Pound.

Energy Sector Futures Options

Crude oil and natural gas futures offer futures options as well. Micro crude oil futures have an options market that is 1/10th the notional size of the standard crude oil futures contract size.

Equity Indices Futures Options

Traders can participate in the S&P 500, Nasdaq, and Russell 2000 futures options markets, with the S&P 500 and Nasdaq futures offering micro contracts as well.

Interest Rate Futures Options

Interest rates, such as the 2-year, 10-year, and 30-year notes, offer futures options as well.

Precious Metal Futures Options

Gold, silver, and copper futures contracts offer futures options markets.

Cryptocurrency Futures Options

Even Bitcoin and Ethereum futures contracts have options markets that are tradable.

Livestock Futures Options

If you’re looking to trade livestock futures, lean hogs and live cattle futures contracts offer futures options markets.

While futures contracts offer a wide variety of sector diversity, there are also different notional value contract sizes like standard, e-mini, and micro futures contracts that offer futures options. Futures Options can be an efficient way to create portfolio diversity in many different sectors.

4. Identify Your First Futures Options Trading Opportunity

Once you’ve determined which futures product you would like to trade, creating an options strategy can be as simple or complex as you would like to make it. As stated earlier, futures options use the Black-Scholes options pricing model just like equity options. The difference is the notional control associated with each options contract, and that differs between futures contracts. With that said, there are plenty of tools you can use to help shine light on a trade idea.

Futures Contract Price Alerts

Within the tastytrade platforms, you can set a price alert for when certain upper or lower price thresholds are breached. When the alert is triggered, you’ll get a mobile push notification, or an email sent your associated account email address. From there, you can decide to place a futures option trade or hold off for another setup.

Chart Indicators for Futures Options Trades

The tastytrade platforms also have a myriad of chart indicators that can be deployed from the charts tab. Whether you like to look at moving averages, stochastic indicators, or more granular indicators, chart indicators can help formulate an assumption for a futures options trade.

5. Open Your First Futures Options Position

If you’ve gotten this far, you may have an idea of what futures contract you want to trade, and what futures options strategy you want to deploy. It may be time to open your first futures options position.

On the trade tab, you can choose to view your potential futures options trade in the visual curve mode, or the more traditional table mode. Neither is better or worse, just a personal preference of whether you want to see all options prices in one place with the table mode, or a more visual representation of your risk and profit potential with the curve mode.

After selecting a trade strategy manually or using the strategy drop-down menu along the top of the trade tab, you can hit review & send to review the details of your trade, including commissions and fees.

Once the order is routed to the market by pressing the send order button, the market will attempt to fill your trade. Once the trade is filled, you can monitor and manage your futures option trade from the positions tab.

6. Monitor and Manage Your Futures Options Trades

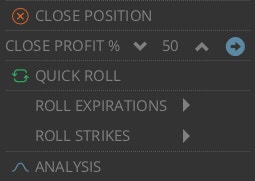

Once your futures options position is filled and visible in your portfolio tab, you can roll, close, or set profit target orders from there. If you have multiple strike prices associated with your futures options trade, you can select them to make a macro adjustment. If you’re ready to manage or close the position, right-click the selection if you’re using the web or desktop trading applications.

If you’re on mobile, use the tools along the bottom of your screen to close or roll the position.

Remember, if you’re trading a futures options contract and rolling to the next options expiration, it could shift you into the next futures contract code. If this occurs, your new options metrics will change with the new futures contract price. Be sure to understand which futures options expirations relate to each futures contract before rolling into a new timeframe.

Options on Futures Trading Example

With the tastytrade platform, you can build a futures options strategy using the strategy menu or you can build it manually. To use the strategy menu, click the drop down along the top of the trade page to load a strategy. To build it manually, select the bid price on the strike you want to sell, or the ask price on the strike you want to buy.

/ES Future Options Trade Examples

Building it manually:

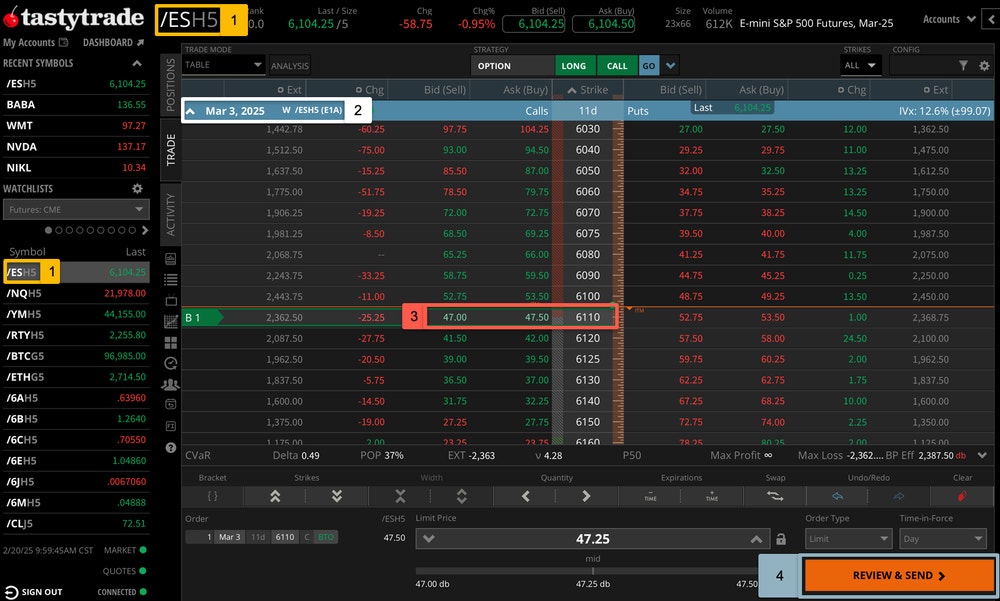

Log in on your web, mobile, or desktop tastytrade platform. The image below is an example from the tastytrade desktop platform.

- Click on a futures symbol from a watchlist, or manually type one in. In this example, we used /ES S&P 500 futures to exemplify buying a call option.

- Select a futures option expiration that’s associated with the futures contract you want to trade.

- To buy a call, click on the Ask (Buy) price next to the strike price you want to trade. Adjust the strike as you see fit by clicking and dragging it or using the toolbar just below the strike page.

- After reviewing the trade details along the bottom of the page, click REVIEW & SEND to review all aspects of the order, including commissions and fees and send the order.

Using the Strategy Menu:

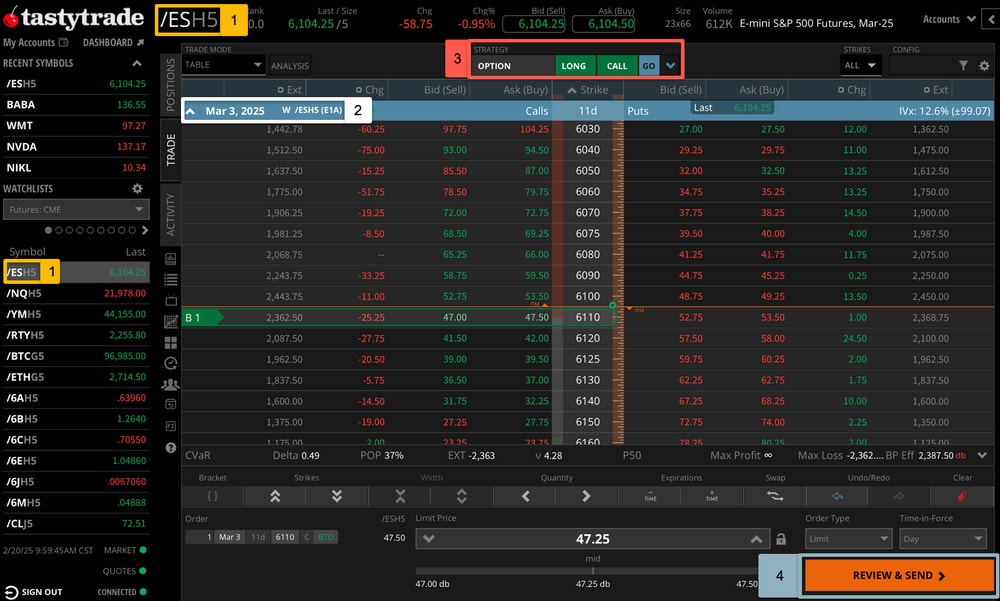

Log in on your web, mobile, or desktop tastytrade platform. The image below is an example from the tastytrade desktop platform.

- Click on a futures symbol from a watchlist, or manually type one in. In this example, we used /ES S&P 500 futures to exemplify buying a call option.

- Select a futures option expiration that’s associated with the futures contract you want to trade.

- To buy a call using the strategy menu, click on the menu along the top of the trade page. For a single call option, make sure LONG and CALL are toggled. Click the blue GO button to load the strategy onto the trade page. Adjust the strike as you see fit by clicking and dragging it or using the toolbar just below the strike page.

- After reviewing the trade details at the bottom of the page, click REVIEW & SEND to review all aspects of the order, including commissions and fees. Then, send the order.

FAQs

Options on futures allow traders and investors to hedge against or speculate on the price movement of futures contracts. They can be an efficient tool for developing a diverse portfolio, with so many unique product sectors available.

If a trader is bullish on a futures contract, they may decide to buy a call or sell a put in the futures product with an expiration that settles to the futures contract they want to trade. Both strategies are high leverage strategies, as futures options can require much less capital to deploy when compared to equity markets. Similar to equity markets though, futures options are priced using the Black-Scholes options pricing model. Futures options can be bought or sold just like equity options as well.

Yes, traders can buy options on futures. Buying an option on a futures product is a defined risk strategy that can be deployed in both bullish and bearish assumptions.

While both options and futures are derivative products in isolation, futures options are derivatives of the specific futures contract you're trading. Like an equity market, where options settle to the underlying stock, futures options settle to the underlying futures contract, and that futures contract eventually settles to cash or a physical product. The difference between equity options and futures options is that futures contract prices can differ from month to month as each futures contract has a unique contract code, where equity options settle to the underlying stock or ETF.

There are many different product sectors that offer futures options contracts. A few are currencies, precious metals, interest rates, equity indices, and the energy sector.