Futures vs. Options: What Are the Differences?

Futures contracts allow market participants to speculate on or hedge against the future price of the underlying asset. Futures contracts have multiple expiration codes, and each contract has a different price and settlement timeframe.

Options contracts on ETFs and equities may have different strike prices and expiration dates, but they all settle to the single underlying price.

What Are Futures?

Futures contracts are financial derivative contracts that allow market participants to trade against the future price of an underlying asset. Futures contracts offer traders and investors unique exposure to markets like agricultural futures, energy futures, precious metals, and more. While there is some overlap between sector coverage between futures and equities or ETFs, futures contracts have specific expiration dates and prices that are unique to those futures contract expirations. Market participants can trade cash-settled futures or futures that settle to physical products, like gold or silver. With futures, traders can take physical delivery of such products if they so choose.

Futures are popular trading instruments because they generally require less buying power to hold positions. In other words, more leverage is offered to futures contract buyers and sellers compared to equity or ETF buyers and sellers. This leverage can magnify profit potential but also magnify risk. Futures contracts also have extended trading hours compared to the standard equity and index trading sessions, which enables traders to participate in international market movements, overnight moves, and more. As it stands, futures trading offers the most flexibility when it comes to the ability to trade or hedge market exposure around the clock.

Unlike equity markets that stick to a pretty standard trading timeframe, futures contracts can have their own unique trading hours. Futures contracts also have their own unique notional values, tick sizes, and settlement styles. It is imperative to fully understand the futures market you’re trading in before diving into the product, as the specs of one futures contract can be completely different than another.

What Are Options?

Options contracts are derivative trading instruments that allow traders and investors alike to speculate on or hedge against market movements in an underlying asset. Options contracts can be as simple or complex as the market participant desires, as there are many different combinations of contracts that create bullish, bearish, and neutral strategies. Options contracts have different strike prices, expiration dates, and underlying factors that contribute to changes in options prices.

In the options market, there are call and put options. A call option gives the owner the right to purchase 100 shares of the underlying stock at the strike price by the expiration of the contract. A put option gives the owner the right to sell 100 shares of the underlying stock at the strike price by the expiration of the contract.

Traders can close options contracts prior to expiration, as there is no requirement to hold them until the expiration date. If a trader buys an option and holds it to expiration though, if the option has no intrinsic value it will expire worthless and the trader will lose 100% of the cost of the option. This is one of the differing characteristics between options and futures—while both contracts expire, futures contracts trade statically, whereas options contracts are much more dynamic.

One unique factor of options contracts is the fact that they have extrinsic value. Since options expire, there is an external premium associated with the option price that is attributed to a combination of implied volatility of the underlying asset and the time left before the options contract expires. The more time there is until an option expires, the more expensive it will be. The more the underlying asset is expected to move, the more expensive the option will be.

Extrinsic value is what creates a dynamic options trading world with many different strategies; static futures and stock trading are much more binary. Like futures trading, options contracts can be bought or sold to open or close a position. Some futures contracts even have options markets within them, but the more popular method of options trading is via equities and indices.

What Are the Differences Between Futures and Options?

Futures and options are both contracts that can be bought or sold, but they have distinct differences in practical trading.

Futures Contract Basics

- A futures contract owner needs the price of the underlying futures contract to go up to be profitable.

- If you buy a futures contract, you want the underlying price to go up.

- If you short a futures contract, you want the underlying price to go down.

- Futures offer leverage through buying power relief, which is the ability to hold a contract for much less than the risk it carries.

- Futures contracts can settle to cash or a physical product like gold or silver.

- Futures contracts require movement in the underlying to see profit or loss.

Options Contract Basics

- An options contract owner needs the price of the options contract to go up to be profitable, and that depends on the strategy.

- If you buy a call option contract, you want the options contract to increase by the underlying price increasing.

- If you buy a put option contract, you want the options contract to increase by the underlying price decreasing.

- Options contracts settle to cash, 100 shares of the underlying stock, or expire worthless.

- Options contracts can lose 100% of their value if the underlying doesn’t move at all due to the extrinsic value associated with the options contract. This can be good for options sellers, but the worst-case scenario for options buyers.

Futures vs. Options Examples

Both futures and options can be used as trading instruments to hedge or speculate in a brokerage account. When it comes to popular sector benchmarks like the S&P 500, there are many different futures, index, and ETF products that can be traded. In the sections below, you’ll see the differences and similarities between trading an E-mini S&P 500 futures contract in /ES and a futures options contract in /ES with the same directional assumption.

Trading Index Futures: E-mini S&P 500 Futures Example

E-mini S&P 500 futures (/ES) are priced at the value of the index, multiplied by $50. In the image below, the S&P 500 is at 5,337 points, which means the notional value risk of a long contract is $266,850. As discussed previously, the owner of the contract can hold this notional risk for a fraction of the cost in buying power requirement. To open this contract, it only requires $21,973.60, even though the risk is more than 10x that amount. This buying power requirement can and will change as markets move and implied volatility changes.

If the futures price increases by 10 points, the trader will make $500. If it decreases by 10 points, the trader will lose $500.

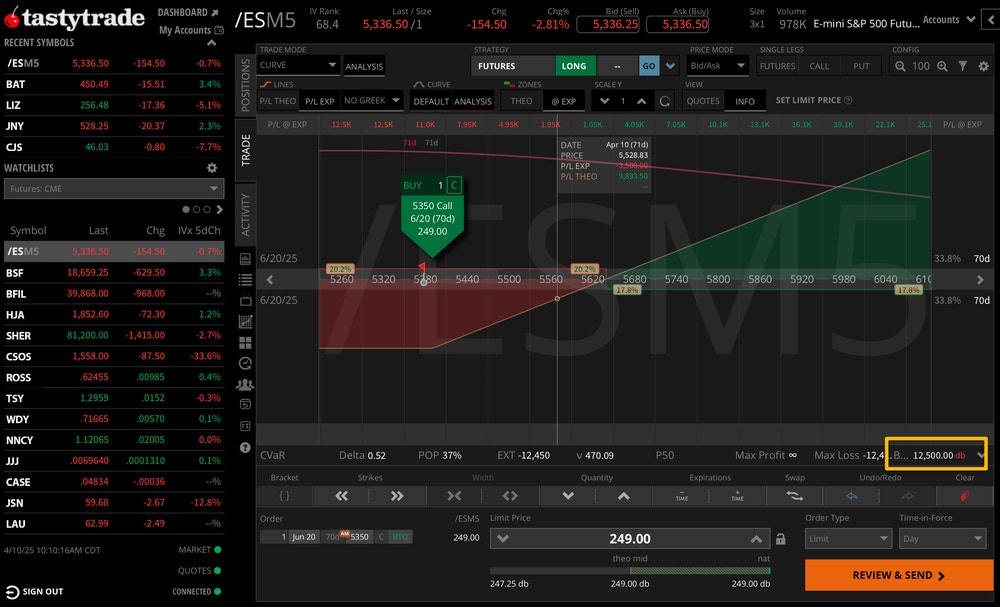

Trading Index Options: E-mini S&P 500 Call Option Example

If a trader wanted to purchase a call option instead, which allows the owner to control one futures contract above the strike price, the risk profile looks a bit different. The max loss on a $5,350 call option with an expiration date 71 days away is $12,500. This is also the buying power requirement. If /ES drops dramatically, the max loss is simply the debit paid of $12,500. Long option trades have defined risk in this sense. If /ES rises dramatically, the profit potential is dynamic before expiration, as there is extrinsic value associated with the contract. At expiration, though, if /ES is at $5,800, the trader would make $10,000.

The difference between the strike price of $5,350 and $5,800 is $450. This is a gain of $22,500 ($450 x 50), but the trader paid $12,500 up front for the contract. This reduces the net profit substantially and speaks to the extrinsic value cost of options contracts.

If the market doesn’t move at all, and /ES stays around $5,350 by the expiration of the options contract, the long call owner would lose $12,500. The futures contract owner would barely make or lose anything at all, as the price would be right where the contract was purchased.

As you can see, options contracts carry more variables that must be accounted for when compared to a simpler futures trade.

What to Consider Before Starting Trading Futures or Options

Before you start trading futures, options, or even options on futures, it’s important to understand the risk and reward profile of every trade you make. Futures trading is much more binary than options trading, but futures contracts are generally much bigger in size when compared to options contracts.

Options contracts offer leverage in the sense that you can control 100 shares of the underlying asset for a fraction of the cost of 100 shares, because options contracts have a limited timeframe. Options contracts can be bought or sold, and complex strategies can be constructed with the flexibility of call and put options, strike prices, and expiration dates.

Futures contracts offer leverage by allowing you to buy or short the contract outright without having to put up the full notional value risk of the contract itself. This buying power reduction relief is often significant when compared to the equity and index world. Futures contracts enable traders to participate in extended trading hours, unique marketplaces, and much more.

Regardless of whether you’re trading futures or options, be sure to fully understand the contract specifications related to your trade or investment. Have a management plan for taking profits, cutting losses, and defending trades.

FAQs

Futures contracts are trading instruments that allow market participants to speculate on the future price of an asset, where different futures expirations settle to different futures prices, even if it’s the same product in question.

Options are a derivative marketplace of futures, equities, and ETFs, where different strike prices and expirations can be traded, but everything settles to the singular underlying price.

Options are not better or worse than futures contracts, but options are certainly more flexible when it comes to trading strategically, simply because there are many more variables like strike and expiration choices when trading options on a product compared to trading an outright futures contract.

Futures and options trades both carry plenty of risk when participating in these markets. Options can be defined risk, where futures trading is more like stock trading in the sense that you have sizable risk and you’re trading the up and down price movement in the futures product. In other words, options trading can result in a smaller monetary risk with defined risk strategies, while futures trading generally carries more risk.

Futures and options strategies can both be profitable, but each are unique in arriving at profitability while carrying risk. Futures can be bought or sold, but you need the underlying market price to move in your favor to realize profitability. Options can be bought or sold, but options can be traded on a very short timeframe for a fraction of the price. This can result in much more wild P/L swings on a percentage basis. Aligning your trading style with a trading instrument and strategy is important when developing a trading plan, regardless of whether you’re trading options, futures, or both.