What is Forex (FX) Trading & How Does it Work?

What is Forex Trading?

The foreign exchange market (Forex or FX) involves converting one nation's currency into another. Every forex transaction requires two currencies, traded in pairs—simultaneously purchasing one currency while selling another.

Currencies are identified using standardized three-letter codes similar to stock symbols, with two characters typically representing the country and one representing the currency name.

For example:

- GBP stands for the British pound

- USD stands for the US dollar

- In the GBP/USD pair, going long or buying the pair means you are buying British pound by selling US dollars

How Does Forex Trading Work?

The global forex marketplace operates without a central exchange, unlike stock markets. Instead, transactions occur directly between participants through an over-the-counter (OTC) network comprising global financial institutions and organizations.

Trading activity flows continuously between four primary financial hubs across different time zones: London, New York, Tokyo, and Sydney. This decentralized structure enables round-the-clock trading five days a week.

Although some key figures like governments do hold currency reserves, many forex market participants aren't interested in physically possessing currencies. Rather, they aim to profit from exchange rate fluctuations. Most commonly, traders utilize derivative instruments like the rolling spot forex contracts available through brokers such as tastyfx (now available through tastytrade).

With derivatives, you can benefit from price movements without actual currency ownership. For example, when engaging in spot forex trading, you're trading contracts that have no expiry date, unlike futures or options. This means your positions can remain open indefinitely as long as you maintain the required margin, and accounting for possible overnight costs.

Types of Forex/Currency Pairs

Forex market participants often categorize currency combinations into distinct groups:

- Major pairs: The dominant seven currency combinations representing approximately 80% of worldwide forex volume, including EUR/USD, USD/JPY, GBP/USD, and USD/CHF

- Minor pairs: less popular, but still fairly liquid combinations frequently featuring major currencies paired against each other rather than against the US dollar, such as GBP/CAD, EUR/CHF, and GBP/JPY

- Exotic pairs: Combinations that unite established currencies with those from developing or smaller economies, including USD/MXN, EUR/ZAR, and GBP/SGD

- Regional pairs: Currency combinations grouped by geographic proximity like Scandinavia or Australasia, such as EUR/NOK, AUD/NZD, and AUD/SGD

What Are Base and Quote Currencies?

In a forex pair, the first currency listed is called the base currency, and the second currency is called the quote currency. The price of a forex pair represents how much one unit of the base currency is worth in the quote currency.

For example, if EUR is the base currency and USD is the quote currency, and EUR/USD is trading at 1.12361, then one euro is worth 1.12361 dollars.

If the euro strengthens against the dollar, a single euro will be worth more dollars, and the pair's price will increase. If it weakens, the pair's price will decrease. Therefore:

- If you believe the base currency will strengthen against the quote currency, you can buy the pair (go long)

- If you think it will weaken, you can sell the pair (go short)

What is Leverage in Forex Trading?

A key advantage of spot forex, like futures, is the ability to open a position on leverage. Leverage allows you to increase your exposure to a financial market without having to commit as much capital.

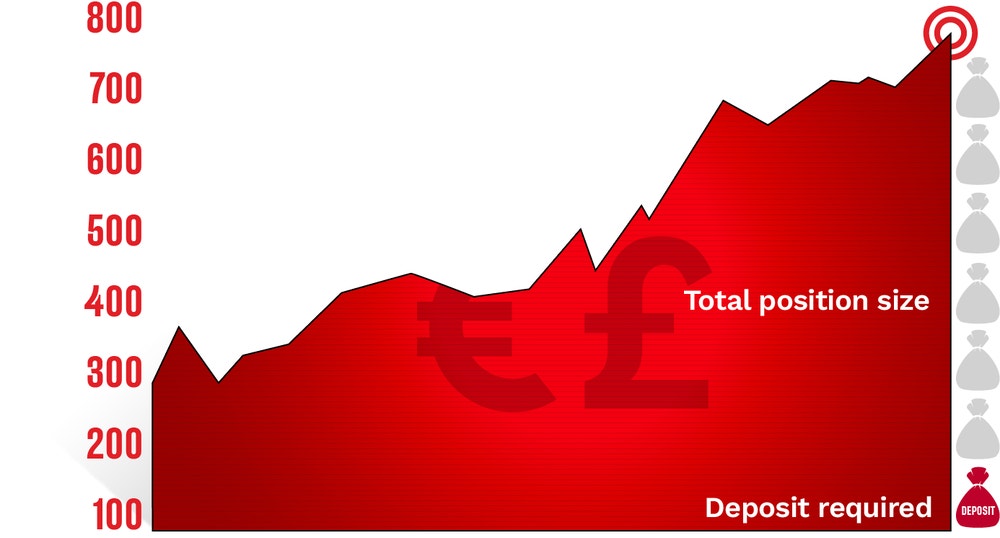

When trading with leverage, you don't need to pay the full value of your trade upfront. Instead, you put down a small deposit, known as margin. When you close a leveraged position, your profit or loss is based on the full size of the trade.

This means that leverage can:

- Magnify your profits

- Also bring the risk of amplified losses—including losses that can exceed your initial deposit

Leveraged trading, therefore, makes it extremely important to learn how to manage your risk.

What is Margin in Forex Trading?

Margin is a key component of leveraged trading. It refers to the initial deposit you put up to open and maintain a leveraged position. Your margin requirement will vary depending on your broker and trade size.

Margin is usually expressed as a percentage of the full position. For example, a trade on EUR/USD might only require a deposit of 2% of the total position value to be opened. This means that while you're risking $10,000, you'd only need to deposit $200 to get the full exposure.

What is a Pip in Forex Trading?

Pips are the units used to measure movement in a forex pair. A forex pip typically refers to a movement in the fourth decimal place of a currency pair. For example:

- If GBP/USD moves from $1.3201 to $1.3202, it has moved a single pip

- The decimal places shown after the pip are called micro pips or pipettes, representing a fraction of a pip

The exception to this rule is when the quote currency is listed in much smaller denominations, most notably the Japanese yen. In this case, a movement in the second decimal place constitutes a single pip. For instance, if EUR/JPY moves from ¥185.123 to ¥185.133, it has moved a single pip.

What is a Lot in Forex Trading?

Currencies are traded in lots—standardized batches of currency. In forex trading:

- A standard lot equals 100,000 units of currency

- A mini lot equals 10,000 units of currency

- A micro lot equals 1,000 units of currency

Even though traders using leverage do not need to post the full amount in margin, it is important to remember that profits and losses are based on the full trade size.

What Affects Currency Prices?

Currency prices mainly respond to supply and demand. Understanding what drives these forces helps traders make better decisions.

Central Banks

Central banks control currency supply through their policies:

- When they print more money (quantitative easing), this can weaken the currency

- They also set interest rates that affect the broader economy

Interest Rates

Interest rates create significant currency movements:

- Higher interest rates often attract investors looking for better returns, which can strengthen a currency

- But higher borrowing costs can also slow down business growth, sometimes weakening the currency over time

Economic Data

Money tends to flow toward economies that show strong performance:

- Good economic news usually brings investment, increasing demand for that currency

- Bad economic news typically reduces investment, lowering currency demand

As a result, exchange rates often reflect how healthy an economy appears to be. Key economic indicators to watch include:

- Inflation reports

- GDP growth figures

- Manufacturing and service output

- Retail sales numbers

- Employment statistics

Why Trade Forex?

Forex trading offers numerous advantages for certain types of traders including 24/5 market access, the inherent ability to profit from both rising and falling markets, and exceptional liquidity due to high trading volumes. The market's volatility creates profit opportunities, while leverage allows traders to control larger positions with minimal capital.

Traders can choose from a diverse selection of over 80 currency pairs including major, minor, emerging, and exotic combinations. Additionally, forex provides effective hedging opportunities to manage risk through strategic positions in correlated currency pairs, though it's important to note that correlations can change and hedging doesn't eliminate risk entirely.

FAQs

Like any investment, forex trading carries risks and opportunities for profit. All spot forex markets are traded on leverage, meaning profits can be amplified—but so can losses. Success depends on your trading strategy, risk management, and market knowledge.

The amount you need depends on which currency pairs you want to trade. The smallest trade size through tastyfx offered on tastytrade is around $25 for a 0.01 lot position in EUR/USD. Many beginners start with small accounts and increase their trading size as they gain experience.

Gaps are points in a market where there is a sharp movement up or down with little or no trading in between, resulting in a 'gap' in the normal price pattern. Gaps occur less frequently in forex than in other markets because forex is traded 24 hours a day, five days a week.

However, gapping can occur when:

- Unexpected economic data is released

- Trading resumes after weekends or holidays

Although the forex market is closed to speculative trading over weekends, it remains open to central banks and related organizations, meaning Monday's opening price might differ from Saturday's closing price.

You can open a forex trading account with tastyfx directly from the tastytrade web platform. Forex trading is provided by tastyfx. Simply click on the tastytrade logo in the upper left-hand corner of the platform and click on tastyfx from the dropdown menu to start the account opening process.

Yes, multiple national regulatory authorities worldwide oversee domestic forex operations to ensure market integrity and participant protection. In the US, primary regulatory oversight falls under the Commodity Futures Trading Commission (CFTC) and the National Futures Association, which establish and enforce standards governing market conduct and participant safeguards. An example of standards they set are the margin rates for each currency pair.

Ready to Diversify Your Portfolio?

Forex trading offered by tastyfx LLC (“tastyfx”), an affiliate company of tastytrade, Inc. ("tastytrade"). Both companies are under common control through IG US Holdings, Inc. tastytrade and tastyfx are separate legal entities, have separate businesses and are not responsible for each other’s products, services, or policies.

This is for informational purposes only. It is not trading or investment advice nor should it be considered as a recommendation. All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.