What Does a Forex Spread Tell Traders?

Brought to you by tastyfx

It’s important for traders to be familiar with FX spreads as they are the primary cost of trading currencies. In this article, we explore how to calculate forex spreads and costs, and why spreads widen or narrow during different market conditions to maximize your trading success.

- Spreads are based on the buy and sell price of a currency pair.

- Costs are based on forex spreads and lot sizes.

- Forex spreads are variable and should be referenced from your tastyfx platform.

What is a Spread in Forex Trading?

Every market has a spread, and forex is no exception. The spread is the difference between the price a trader can buy and the price they can sell an underlying asset. In equities, traders often refer to this as the bid-ask spread.

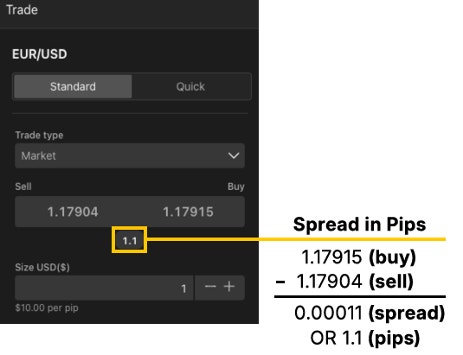

Below, we can see an example of the forex spread being calculated for the EUR/USD. First, we will find the buy price at 1.17915 and then subtract the sell price of 1.17904. This calculation gives us a value of 0.00011. Because the pip value for EUR/USD is the 4th digit after the decimal, the final calculated spread here is 1.1 pips.

Now that we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders.

How to Calculate the Forex Spread and Costs

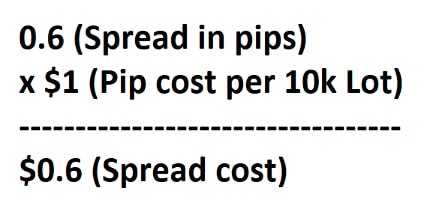

Before we calculate the cost of a spread, remember that the spread is just the ask price minus the bid price of a currency pair. So, in our example below, 1.13404-1.13398 = 0.00006 or 0.6 pips. Therefore, a trader would incur 0.6 pips of cost as soon as the trade is opened.

To find the total spread cost, multiply the spread by the pip cost and the total amount of lots traded:

- For a 10,000-unit (10k) EUR/USD lot: 0.00006 X 10,000 = $0.60

- For a 100,000-unit (standard) lot: 0.00006 pips X 100,000 = $6.00

Understanding a High Spread and a Low Spread

It’s important to note that the FX spread changes throughout the day, ranging between a ‘high spread’ and a ‘low spread.’ This is because the spread can be influenced by multiple factors like volatility or liquidity.

- High spreads: These occur when the bid-ask difference is large, often during times of high volatility in the market (such as major news events) or low liquidity due to out-of-hours trading. Emerging-market currency pairs also tend to have higher spreads than major currency pairs.

- Low spreads: These occur when the bid-ask difference is small, often during the major forex sessions when liquidity is high and volatility is low. Major currency pairs typically trade with low spreads.

Keeping an Eye on Changes in the Spread

News events often cause market uncertainty. Releases on the economic calendar happen sporadically, and prices can fluctuate rapidly as a result. Just like retail traders, large liquidity providers do not know the outcome of news events prior to their release! Because of this, they look to offset some of their risk by widening spreads.

Spreads Can Cause Margin Calls

If you are currently holding a position and the spread widens dramatically, you may be stopped out of your position or receive a margin call. The only way to protect yourself during times of widening spreads is to limit the amount of leverage used in your account. Spreads can also naturally widen during certain periods of the day when liquidity is low, which often occurs when trading hours transition from one market to the next, such as between the U.S. to Asian trading hours.

Further Reading to Take Your Forex Trading to the Next Level

If you’re new to forex, we recommend our free Beginners' Forex Trading Guide, which provides tips and insights on the market and ways to trade.

This article is provided by tastyfx LLC, a separate but affiliated entity and business of tastytrade Inc. Forex trading involves risk, losses may exceed deposits.

This content, including the use of actual symbols, any visual display or other reference to product, type of investment, strategy, or service offered, is for educational and informational purposes only. It is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.