What is XRP (Ripple) & How Does it Work?

XRP is a cryptocurrency designed for speed, low fees, and global payments. Built by Ripple Labs, XRP runs on its own blockchain, the XRP Ledger, and differs from Bitcoin in both design and utility. We’ll break down how XRP works, what sets it apart, and why it still matters.

What is XRP?

At its core, XRP is built to move money quickly and efficiently. It powers transactions on the XRP Ledger, a purpose-built blockchain created by Ripple Labs in 2012 to solve inefficiencies in cross-border payments. Instead of relying on miners or slow settlement networks, XRP aims to make global finance feel a lot more like sending an email.

The asset was created by Ripple Labs to improve traditional cross-border payment systems. While Bitcoin was built to replace banks, Ripple's strategy has been to work with them.

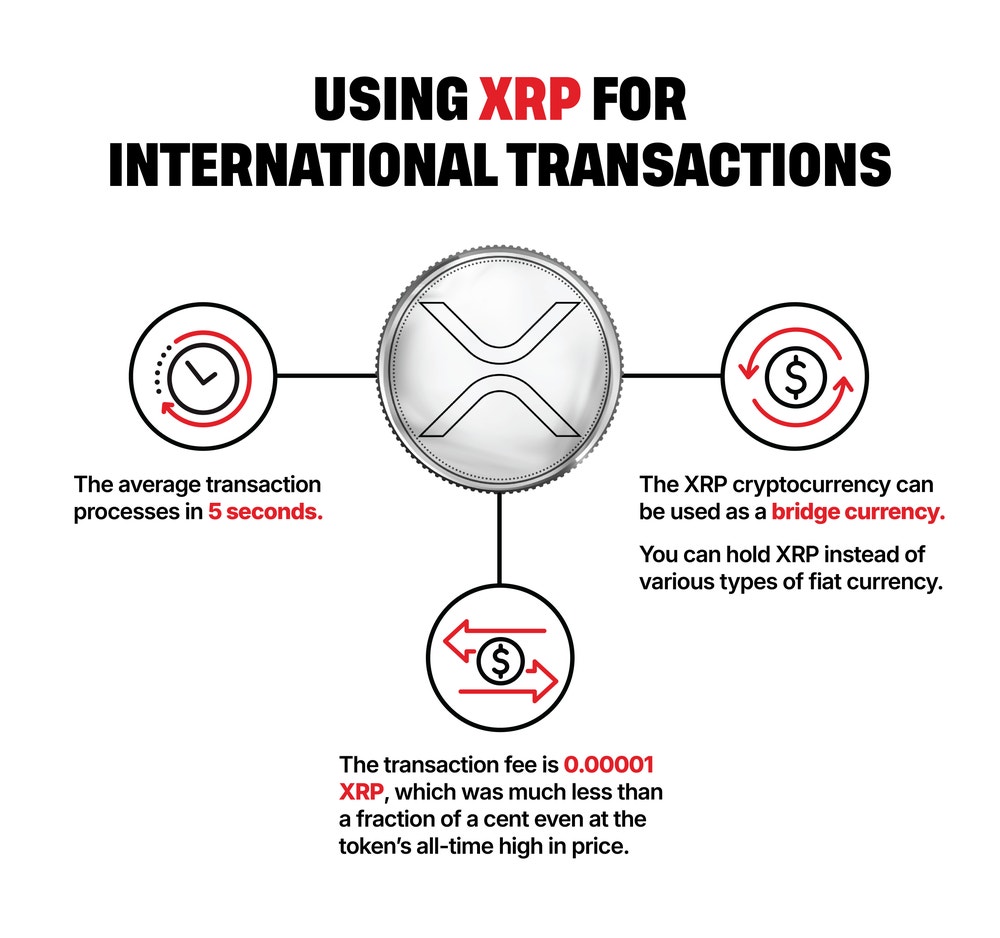

XRP transfers typically settle in 3–5 seconds, with minimal fees. This makes it one of the fastest crypto assets when it comes to settlement.

A Brief History of XRP

XRP launched in 2012, developed by engineers David Schwartz, Jed McCaleb, and Arthur Britto. The trio later co-founded Ripple Labs. The goal was to improve on Bitcoin’s limitations, particularly transaction speed and energy efficiency. XRP was designed with a fixed supply of 100 billion tokens, and unlike Bitcoin, it was not mined.

Ripple Labs became the main company supporting XRP’s ecosystem and promoting its use in financial institutions. The company created RippleNet, a network of partners using Ripple's payment technology. Some of these partners use XRP for on-demand liquidity.

XRP vs. Bitcoin

While both are cryptocurrencies, XRP and Bitcoin serve different purposes. Bitcoin is decentralized, mined, and widely viewed as a store of value. XRP, on the other hand, is built for speed and cost efficiency, often used to facilitate money transfers.

Feature | Bitcoin | XRP |

|---|---|---|

Purpose | Store of value | Global payments |

Consensus | Proof of work | Unique consensus |

Settlement time | ~10 minutes | ~3-5 seconds |

Energy use | High | Low |

Supply | 21 million | 100 billion |

Feature | Bitcoin |

|---|---|

Purpose | Store of value |

Consensus | Proof of work |

Settlement time | ~10 minutes |

Energy use | High |

Supply | 21 million |

Feature | XRP |

|---|---|

Purpose | Global payments |

Consensus | Unique consensus |

Settlement time | ~3-5 seconds |

Energy use | Low |

Supply | 100 billion |

How the XRP Ledger Works

The XRP Ledger (XRPL) is an open source blockchain that uses a consensus protocol, not mining, to validate transactions. Independent validators maintain the network, including universities, businesses, and individuals.

The ledger processes thousands of transactions per second with low fees, typically less than a penny. This makes it suitable for real-time payments and micropayments.

Is XRP Decentralized?

This is a point of debate. Ripple Labs created XRP and still owns a large portion of its supply, which has led some to question the asset’s decentralization. However, the XRP Ledger is maintained by independent validators, many of whom are not affiliated with Ripple.

Over time, Ripple has reduced its control over which nodes validate transactions. Today, no single entity can alter the ledger without consensus from others on the network.

XRP Use Cases

XRP’s primary use case is facilitating fast, affordable cross-border payments. RippleNet uses XRP for on-demand liquidity (ODL), allowing institutions to move value across borders without the need to pre-fund accounts in different countries.

Other emerging use cases include:

- Micropayments

- Remittances

- NFT settlement on XRPL

- Institutional settlement

Regulation and the SEC Lawsuit

In December 2020, the SEC filed a lawsuit against Ripple Labs, alleging that XRP was sold as an unregistered security. This sent shockwaves through the crypto industry.

In July 2023, a federal judge ruled that XRP is not a security when traded on public exchanges, offering partial legal clarity. However, the case remains ongoing with further court proceedings and appeals expected.

This legal backdrop has impacted exchange listings, partnerships, and U.S. market adoption. It also set an important precedent for how digital assets might be classified.

XRP’s Global Reach

Despite regulatory uncertainty in the U.S., XRP continues to gain traction abroad. Ripple has announced partnerships with financial institutions in regions like Asia, Latin America, and the Middle East.

Its fast settlement time and low cost make it attractive for markets with high remittance activity and limited access to traditional banking infrastructure.

How to Buy and Trade XRP

- Open a tastytrade account

- Enable cryptocurrency trading

- Select XRP from the crypto tab and open your first trade via Zero Hash

Ready to Trade?

XRP Summed Up

- XRP is a digital asset optimized for fast, low-cost payments

- It runs on its own blockchain: the XRP Ledger (XRPL)

- Created by Ripple Labs to support global money movement

- XRP is not mined like Bitcoin and uses less energy

- Regulation and legal challenges have shaped XRP's public perception

FAQs

Primarily for cross-border payments and liquidity provisioning. Some also use it for micropayments and remittances.

XRP transfers typically settle in 3 to 5 seconds.

No. Ripple is a company. XRP is the digital asset.

A 2023 court ruling said it is not a security when traded on public exchanges.

The XRP Ledger is maintained by independent validators, but Ripple Labs is still closely associated with its development.

XRP is a volatile asset and may not be suitable for all investors. Whether it fits your strategy depends on your goals and risk tolerance.

XRP runs on the XRP Ledger, which has been operational since 2012. As with any crypto asset, security depends on how it’s stored and used, and its safety is not guaranteed.

XRP is legal to own and trade in many countries, including the U.S. A 2023 court ruling clarified that XRP is not considered a security when traded on public exchanges.

Cryptocurrency trading provided by Zero Hash Liquidity Services LLC, MSB # 31000181510564, and cryptocurrency custody provided by Zero Hash LLC NMLS # 169937. Zero Hash is a licensed virtual currency business by the New York State Department of Financial Services. Cryptocurrency accounts are not protected by SIPC coverage. Cryptocurrencies are not covered by the FDIC, which covers fiat currency. Cryptocurrency trading is not suitable for all investors due to the number of risks involved, including volatile market prices, illiquid market conditions, lack of regulatory oversight, market manipulation, and other risks. You are solely responsible for evaluating your financial circumstances and determining whether or not trading cryptocurrencies is appropriate for you. Please read the General Risks of Digital Assets risk disclosure. tastytrade, Inc. is a separate company and is not an affiliate company of Zero Hash Liquidity Services LLC or Zero Hash LLC.

TASTYTRADE, INC. IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.