What Are Stablecoins and How Do They Work?

A stablecoin is a type of cryptocurrency designed to hold a steady value, most often tied to the U.S. dollar. While most digital assets rise and fall in price, stablecoins are built to stay consistent at one dollar. For traditional traders, this stability offers something new—fast, reliable funding.

What Is a Stablecoin?

Stablecoins are cryptocurrencies designed to maintain a consistent value, typically pegged 1:1 to the U.S. dollar. Unlike most crypto assets, which fluctuate in price, stablecoins aim to remain steady.

With stablecoin funding support at tastytrade, you’ll be able to move money into your account anytime. Nights, weekends, and holidays are no longer off-limits.

Think of stablecoins as digital dollars that move on a faster rail. They give you a simple way to transfer value without relying on banks or waiting on business hours. Whether you’re exploring crypto or just want flexible account access, stablecoins are a practical tool.

tastytrade now supports stablecoin deposits via ZeroHash.

A Brief History of Stablecoins

Stablecoins emerged in response to one of crypto’s biggest challenges: volatility. In 2014, Tether (USDT) became the first widely used stablecoin, offering traders a way to hold value without exiting the crypto ecosystem. Years later, USDC entered the market with a stronger focus on transparency and compliance.

During periods of market stress, stablecoins proved their utility. In 2020, when global markets were disrupted by the pandemic, traders used stablecoins as a digital safe harbor. Today, they are used for payments, trading, cross-border finance, and even humanitarian aid.

How Do Stablecoins Maintain Their Price?

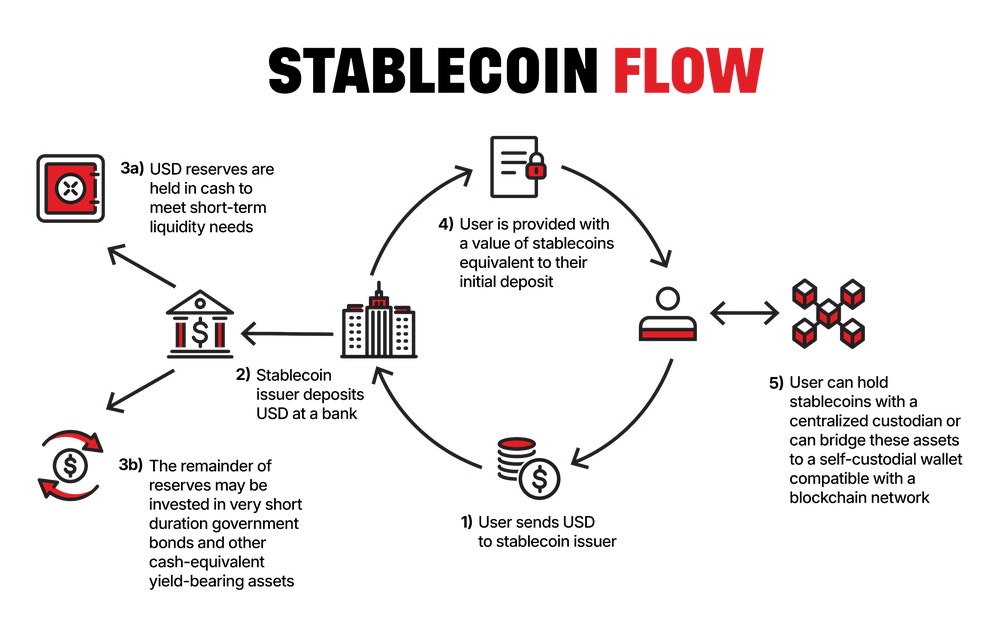

Stablecoins maintain their “peg” using different models. Some hold traditional assets like cash or short-term Treasuries in reserve. Others rely on collateralized crypto or algorithmic systems. Here’s a quick breakdown.

Fiat-backed Stablecoins

These are backed by reserves of traditional currency, usually held in custodial bank accounts. When you redeem one token, the issuer removes an equivalent amount from circulation. Examples:

- USDC (by Circle): Backed by cash and U.S. Treasuries, audited monthly

- USDT (Tether): Widely used, though historically less transparent

Crypto-backed Stablecoins

These are overcollateralized with other cryptocurrencies. If you want to mint $100 in stablecoins, you might have to lock up $150 in ETH or other assets. Smart contracts handle minting and redemption. Example:

- DAI (by MakerDAO): Backed by ETH, USDC, and other assets

Algorithmic Stablecoins

These use code and incentives to maintain price, expanding and contracting supply based on market demand. While interesting in theory, some have failed dramatically. Example:

- UST (by Terra): Collapsed in 2022, highlighting the risk of algorithmic models without strong collateral

Why Are Stablecoins Important?

Stablecoins combine the stability of traditional currency with the speed of crypto. They let you move value 24/7, settle trades quickly, and interact with digital platforms without leaving the market.

For some traders, stablecoins can offer additional flexibility, especially when moving funds between platforms. They provide a way to keep digital dollars accessible outside of a traditional bank, which may be helpful when exploring crypto opportunities or managing funds across accounts.

How Are Stablecoins Used Around the World?

Stablecoins are more than just a tool for traders. Around the world, they provide access to dollars in countries with high inflation or unstable banking systems. In Argentina, Nigeria, and Turkey, stablecoins help people preserve value, send remittances, and even pay for everyday goods.

Non-governmental organizations (NGOs) have also used stablecoins to deliver fast, traceable aid in conflict zones and disaster recovery. In Ukraine, for example, USDC was used to deliver relief when banks were offline.

Stablecoins have growing real-world impact:

- Payment rails: Businesses use stablecoins to send payments internationally without waiting for bank wires

- On- and off-ramps: Traders and platforms use stablecoins to enter or exit crypto markets quickly

- Remittances: Migrant workers send money home faster and cheaper via stablecoins

- Access to dollars: In countries with inflation or capital controls, stablecoins provide a digital “dollar alternative”

Who Uses Stablecoins?

- Retail users looking to protect value or transfer money

- Traders hedging against volatility or moving between exchanges

- Developers building decentralized apps (dApps) that need predictable units of account

- Businesses and payroll platforms distributing payments across borders

They’re also growing in use among fintech firms, NGOs, and neobanks that offer crypto-powered services in emerging markets.

Are Stablecoins Regulated?

In the U.S., stablecoin regulation is evolving. Issuers may fall under state money transmitter laws or federal oversight depending on how coins are used and backed. The Financial Stability Board and U.S. Treasury have both issued reports recommending clear rules for reserves, disclosures, and operations.

Some proposals call for stablecoin issuers to be regulated like banks. Others suggest a framework similar to payment firms. Either way, the push for greater transparency and consumer protection is ongoing.

Circle, the issuer of USDC, publishes monthly attestations to prove it holds adequate reserves. Greater oversight is expected as stablecoin adoption grows.

Stablecoins vs. Other Crypto Assets

Stablecoins are designed for price stability, unlike most cryptocurrencies that often face sharp price swings. However, the differences between them extend well beyond just volatility. Stablecoins are primarily used as a medium of exchange or a store of value, whereas many cryptocurrencies—like Ethereum—also function as programmable platforms for dApps. Additionally, many stablecoins are backed by real-world assets like cash or U.S. Treasuries and often aim to comply with regulatory standards, whereas traditional cryptocurrencies tend to prioritize decentralization, innovation, and long-term value appreciation.

Feature | Stablecoins | Bitcoin/Ethereum |

|---|---|---|

Price stability | Pegged to fiat (e.g. $1) | Highly volatile |

Use cases | Payments, savings, DeFi | Investment, decentralization |

Backing | Fiat, crypto, or algorithm | None or PoW/PoS security |

Risk profile | Peg and issuer dependent | Market risk, custody risk |

Feature | Stablecoins |

|---|---|

Price stability | Pegged to fiat (e.g. $1) |

Use cases | Payments, savings, DeFi |

Backing | Fiat, crypto, or algorithm |

Risk profile | Peg and issuer dependent |

Feature | Bitcoin/Ethereum |

|---|---|

Price stability | Highly volatile |

Use cases | Investment, decentralization |

Backing | None or PoW/PoS security |

Risk profile | Market risk, custody risk |

Stablecoins are a gateway, not a replacement, for the rest of the crypto ecosystem.

What Stablecoins Does tastytrade Support for Funding?

tastytrade now supports USDC, USDT, PYUSD, and RLUSD deposits (via ZeroHash), with stablecoin withdrawals coming soon. This makes it easier than ever to fund your account from a digital wallet and stay connected to crypto markets, even when traditional banking isn’t available or convenient.

How to Deposit Stablecoins at tastytrade?

Ready to Trade?

What’s Next for Stablecoins?

Stablecoins may soon play a role beyond crypto. Some issuers are working on tokenized versions of other currencies like the euro and yen. Others are exploring how to integrate stablecoins into traditional payment systems, including B2B invoicing and ecommerce.

As regulation matures, stablecoins could reshape the way we store and move money—acting as a new layer between banks, apps, and financial markets.

Stablecoins Summed Up

- Stablecoins are digital tokens pegged to fiat currencies like the U.S. dollar

- They help stabilize crypto trading, enable payments, and improve global access to money

- They’re used for fast, low-cost funding, trading, payments, and transfers

- They can be fiat-backed (USDC), crypto-backed (DAI), or algorithmic (UST—failed)

- Regulation is evolving, but transparency is key

- tastytrade supports USDC, USDT, PYUSD, and RLUSD deposits to simplify crypto funding

FAQs

Stablecoins aim to be stable, but some risk remains. Look for transparency, liquidity, and reserve attestations.

Stablecoins are not illegal, but U.S. and global regulators are working on formal rules.

Yes. tastytrade now supports stablecoin deposits through ZeroHash, with withdrawal access coming soon.

Stablecoins are built for stability and typically used for transferring or storing value, while most other cryptocurrencies focus on growth, decentralization, or innovation.

The blockchain wallet address must be compatible with the cryptocurrency asset being transferred. Cryptocurrency asset transfers to an incorrect wallet address are irreversible due to the nature of the blockchain network. You are solely responsible for ensuring your wallet address is correct before submitting your cryptocurrency transfer request.

Cryptocurrency transaction and custody services are powered by Zero Hash LLC and Zero Hash Liquidity Services LLC. Learn more.

TASTYTRADE, INC. IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.