How to Trade & Invest in Stocks

Trading stocks lets you gain a directional position on how you think the stock will move, usually with a short timeframe in mind. Investing in a stock long-term gives you a stake of ownership, also known as equity, in that company with the intention of sticking around for the long haul. Discover how to trade and invest in stocks below.

What are Stocks?

Stocks are units of ownership in a publicly traded company held by shareholders. When you own shares of stock, you may be eligible for certain benefits like voting rights and receiving dividends if the stock offers such things to shareholders.

Trading vs. Investing in Stocks: What’s the Difference?

The difference between trading and investing typically comes down to the time in the trade. Trading focuses on making returns by using short-term transactions in the market. Alternatively, investing uses a long-term approach, with assets being held for an extended time, generally a year or more.

Regardless of the strategy, the buyer has direct ownership of the stock until it is sold. That comes with potential voting rights, dividend payments, and the chance to profit from an increase in the stock price.

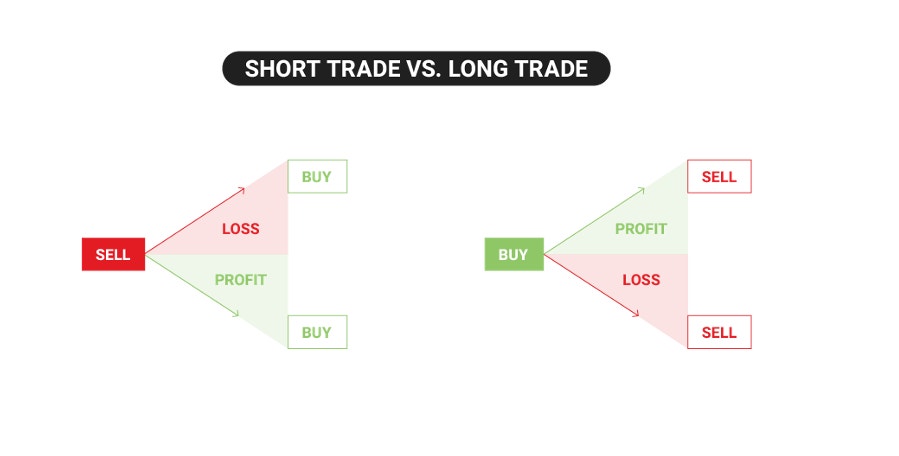

In stock trading, going long—or buying—means that your directional assumption is bullish, and you think the stock price will rise. On the contrary, going short or selling—means that you are bearish and you believe the stock price will drop.

When trading short stock, you do not own the stock—you borrow the shares and sell it on the open market with the intention of buying it back at a lower price to close the trade. If the price of the stock rises above the price you sold it at, you would incur a loss on the position. Stock prices can theoretically rise forever and the risk of loss for short selling can be unlimited for this reason.

Investing in stocks is often referred to as a “buy and hold” strategy, which typically excludes brief time horizons — something more often employed in trading. You take a long-term view and expect to weather the volatility of short-term price swings. You can profit from a stock investment by selling the shares at a higher price than you bought them for. However, if you sell your shares at a lower price, you incur a loss.

Consider the Benefits and Risks of Trading and Investing in Stocks

Stock traders and investors should weigh the pros and cons of utilizing stock in a portfolio. Here are a few of the benefits and risks to evaluate.

Benefits of Stock Trading:

- Trading offers the potential to earn quick profits

- Potential opportunities to capitalize on binary events like earnings announcements and company news

- Quickly enter and exit positions to help manage your risk

- Utilize short trades and other strategies like swing trading, which is typically not used in investing

Benefits of Investing in Stock (Buy-and-Hold):

- Investing helps build wealth over a long period of time, which is ideal for retirement saving and other long-term financial goals

- Long-term gains can have tax advantages when compared to short-term gains1

- Investors typically place fewer orders, which may reduce commission fees

- Potential regular income from dividend-paying stocks; build on a position by dollar cost averaging

Risks of Both Trading and Investing:

- Volatility can affect your ability to enter or exit a position at your preferred price point

- Utilizing stocks can be capital intensive

- Investors typically place fewer orders, which may reduce commission fees Both trading and investing come with the risk of losing your money

- Stock prices are vulnerable to volatility caused by systematic risk and/or binary event risk2

Open a Brokerage Account

Open, manage, and close stock positions with a tastytrade brokerage account. Check out some platform features below:

- Trade over 8,000 US-listed stocks at no commission3

- Get inspiration for your trading strategies from the Follow Feed and video feed

- Enjoy the perks of an award-winning platform4

Ready to Trade?

Research Stocks and Create a Plan

If you feel ready to start trading or investing, you will want to identify potential stocks to purchase or sell short. To do that, you will want to do some research. Below are some helpful steps to get started:

- Starting with companies you already know is a common strategy that provides a segue into your research journey.

- Fundamental and technical analysis are used often in stock picking, with many relying on a combination of the two. These methods are discussed more below.

- Financial metrics like revenue, net income, earnings per share (EPS), P/E ratio, and return on equity (ROE) represent fundamental information.

- The stock’s price history charted on a graph, with trendlines and price action are common technical analysis strategies.

- A general understanding of current macroeconomic conditions such as monetary and fiscal policy, labor market conditions, and international trade may help to better inform your analysis.

Creating a trading plan is a way of detailing, consolidating and working towards your goals. Here are some factors to consider when drawing up your trading plan. Capital: Figure out how much money you can set aside, how often you can make deposits, etc.

- Risk tolerance: Decide what sort of stocks you are interested in trading — growth stocks may be more volatile than blue-chip stocks that may offer dividends, but all stocks can be volatile in turbulent market conditions.

- Pick a product: Scan by indices, sectors, and industries, then narrow down and decide what stock is right for you. Utilize fundamental and technical analysis. This could help you narrow your pool of stocks.

- Time horizon: Determine how many days, weeks, months, or years you would like to keep your position open.

- Have a plan: Decide when to enter and exit trades or investments based on profit targets or loss thresholds.

- Track your progress: Use the tastytrade platform’s features and account statements to track Profit/Loss and your most successful strategies and positions.

- Rinse & repeat: Continue educating yourself and exploring other products that interest you.

Fundamental Analysis

Fundamental analysis is a technique of examining an asset to estimate its intrinsic value. That can help to reveal if the market is overvaluing or undervaluing its price. Traders and investors use a broad range of techniques to accomplish that analysis, which helps to inform a trading decision. This can be specific to the company, industry, or the economy; for the former, common metrics include but are not limited to:

- Financial statements (income, balance sheets, market share, changes in equity)

- Cash flow and discounted cash flow (DCF)

- Industry trends and economic data

- An analysis of the historic or projected price-earnings (P/E) ratio

The fundamental analyst can then use those metrics or others to compare the company to similar businesses within the same industry or sector to help identify the best trading opportunities. Macroeconomic factors such as monetary policy, inflation, and international trade can also be included in fundamental analysis. Note that fundamental analysis does not guarantee results—markets can still move in favor or against you, even with great fundamentals in the short and long term.

Technical Analysis

Technical analysis is a method of evaluating an asset’s price history by using charts to identify potential trading opportunities. With technical analysis, a trader identifies previous patterns, or price levels and assumes that the stock’s price could react in a specific way based on the technical pattern that is forming. Historical price charts and market statistics are used in this form of analysis and can include other data, like volume and moving averages.

Fundamental and technical analysis are not mutually exclusive, and many traders use a combination of approaches to analyze a stock and generate an assumption on it. Technical analysis does not guarantee results—markets can move for or against you regardless of your analysis.

Stock Trading Examples

Once you’ve completed all your research, you can take your first position on a stock. There are many variables which may have to be considered when trading stocks, such as margin requirements, volatility, and trade volume. It is important to remember that markets are dynamic, and you must constantly be open to learning and recognizing learning curves. Check out some brief stock trading examples below, demonstrating how your directional assumption can result in your trade being a winner or a loser.

Buying Stock (Going Long) Example

When the public thinks about investing, buying stock is usually the first thing that comes to mind. Establishing a stock position by buying shares is inherently bullish since the objective is to sell the shares above the purchase price to yield a profit. When investors purchase stock, it can also be called “being long” stock. In other words, being long refers to a position type that investors must purchase to establish. Investors at tastytrade can establish a long stock position in any kind of account, including cash, margin, and IRAs.

Furthermore, investors with a margin account can buy stock on margin5 or borrow cash if the margin6 account has at least $2,000 in marginable equity (cash and eligible position types). Although there is no minimum to open a margin account, a minimum is required to have and maintain margin privileges (borrow cash to establish stock positions). However, cash accounts cannot borrow and do not have a minimum balance requirement.

Company XYZ currently trades at $45 per share. You believe the price will rise in the short term and decide to purchase 100 shares. The stock moves in your favor to $50, and you close the trade at a profit.

The value of 100 XYZ shares at trade entry was $4,500 in notional value risk compared to $5,000 when closing it, resulting in a $500 profit (excluding any trading fees). To calculate the profit or loss on the long shares, simply multiply the entry price of the stock by 100, the number of shares you own, and compare that to the closing price calculation. Had the price moved to $42 instead, you would have realized a loss of $300 (excluding any trading fees).

Learn about buying power requirements for long stocks

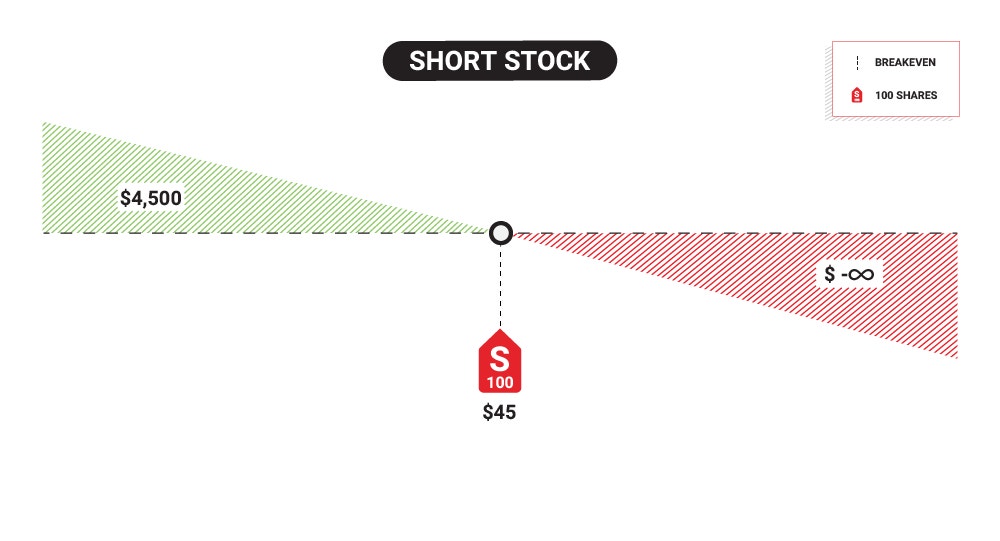

Selling Stock (Going Short) Example7

When investing in stocks, investors usually think of going long by purchasing shares in hopes of price appreciation. However, investors can also establish a short stock position which benefits an investor when the stock price falls. As a result, a short stock position is inherently bearish. Instead of buy-to-open and sell-to-close, which describe opening and closing a long stock position, it is the opposite when going short or sell-to-open and buy-to-close.

When an investor establishes a short stock position, the investor initially will sell-to-open a short position and collect the sale proceeds from the short stock sale. When closing a short stock position, an investor covers or buy-to-close the short position. The best case is to buy the short shares back to cover at a lower price than the sale price to yield a profit. Some unique characteristics of establishing and holding a short stock position are the additional risks and potential costs.

Some of the risks include but are not limited to:

- Unlimited loss potential

- Owing dividends and other cash distributions

- Hard-to-borrow fees

First, a short stock position theoretically has unlimited loss potential since a stock can continually rise in perpetuity. Secondly, investors holding a short stock position in an underlying that pays any dividend or cash distribution will also be responsible for paying them when maintaining a short share position. Lastly, investors may face hard-to-borrow (HTB) fees while maintaining a short stock position when the demand to short the specific underlying increases. Please visit the tastytrade Help Center to learn more about HTB fees.

Establishing a short stock position at tastytrade requires a margin account with our highest trading level—"The Works."8

You are bearish on Company XYZ, which is currently trading at $45. You decide to short 100 shares at the current price. The stock moves against you and rises to $55. You close the trade at a loss. The value of the 100 short shares at entry had a max profit of $4,500 if it were to go to $0. At the time of closing, the shares were valued at $5,500 after the $10 rally, resulting in a loss of $1,000 on your 100 short shares (excluding any trading fees).

To calculate the profit or loss on the short shares, simply multiply the entry price of the stock by 100, the amount of shares you are short, and compare that to the closing price calculation. Had the stock price dropped from $45 to $37 instead, you would have realized a profit of $800. Shorting the shares at a notional value of $4,500 and buying them back to close the trade at $3,700 (excluding any trading or short selling fees).

Monitor and Manage Your Portfolio

Your portfolio needs regular monitoring and management, regardless of whether you are speculating on short-term price movement, or if you have a longer time horizon with a stock investment. As a trader/investor, you will have to consider various factors such as company news, binary events, economic data, etc. Following the trading and investing plans you set for your portfolio can be especially important.

While there is a crossover in some respects between what short-term traders and long-term investors can evaluate, there are also aspects that are exclusive to each. A short-term trader may only focus on one earnings announcement, whereas an investor may focus on the cumulative projection of earnings reports through an entire year. The tastytrade platform empowers you to monitor and manage your portfolio efficiently by allowing you to customize the data displayed in the Positions and Watchlist tabs so that you have all your preferred metrics in one place.

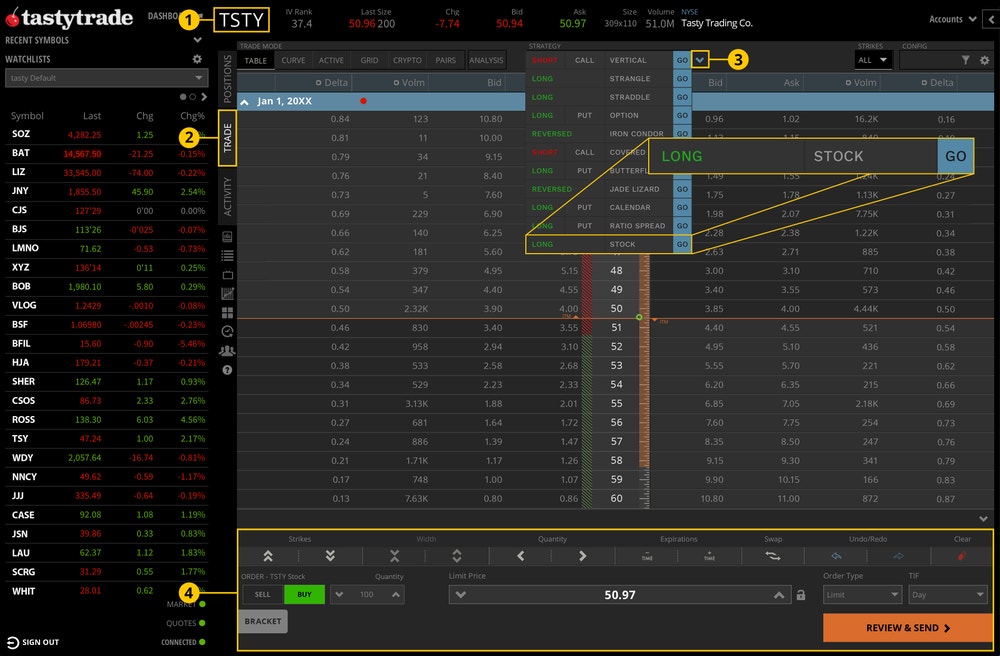

How to Buy Stock on tastytrade

Using the Strategy Menu

- Enter a symbol.

- Navigate to the Trade tab.

- Locate the Stock strategy and click each column to display Long, Stock, and Go.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

Building it Manually

- Enter the symbol.

- Click the Ask price.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

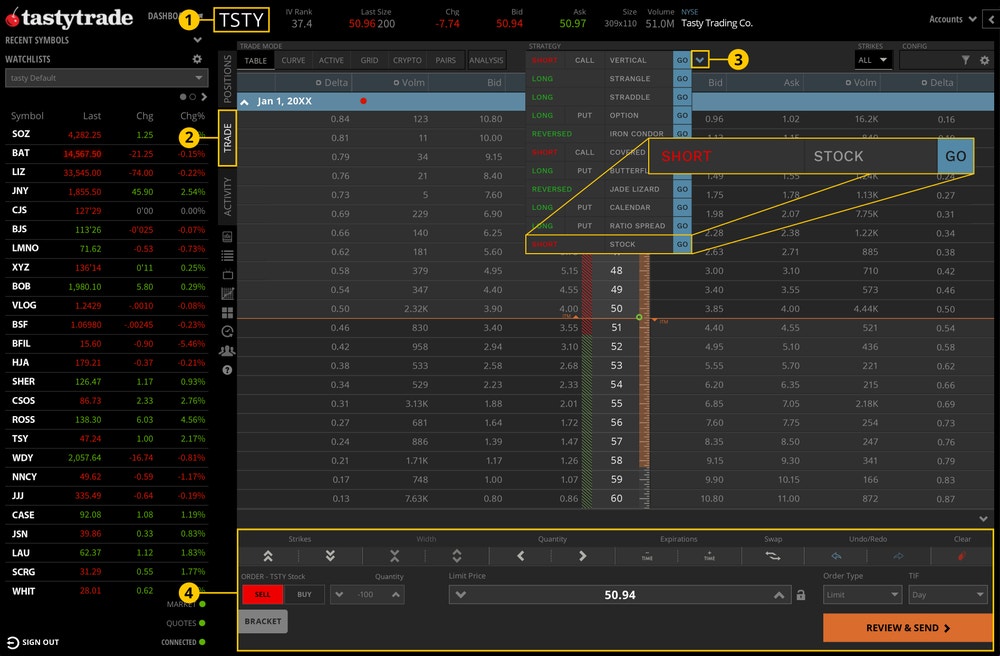

How to Short Stock on tastytrade

Using the Strategy Menu

- Enter a symbol.

- Navigate to the Trade tab.

- Locate the Stock strategy and click each column to display Short, Stock, and Go.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

Building it Manually

- Enter the symbol.

- Click the Bid price.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

FAQs

You need to meet the buying power requirements to buy stocks. This requirement differs based on the individual stock and your account type.

Trading in a cash account means you are limited to cash in the account, as you must pay for the entire position upfront, which is equivalent to the full risk of the position.

Margin accounts are subject to initial and maintenance requirements, typically around 50% of the stock price* in buying power requirement for initial stock trades, and leverage is allowed based on cash and marginable securities in the account. This means you put up about half of the actual risk of the stock going to $0 in a margin account.

*Not all stocks are marginable

There are several ways you can find a stock trading or investment opportunity. You can look at the default watchlists on the tastytrade trading platform to find potential trade ideas. Creating a custom watchlist is another option to help you build awareness and track specific stocks and sectors to trade in the future. You can also set alerts on the tastytrade platform so that you receive notice when a stock reaches a certain price point.

When you short a stock, you sell a stock to open the trade, which requires you to borrow the shares from the market. Unlike going long or buying stock to open, which benefits from price appreciation, you short a stock when you think its price will fall. If correct, you would profit from the trade.

To close a short trade, you need to buy back the shares from the market. Those shares are then returned to the market. If the stock price rises above your entry price, you would incur a loss when closing the trade. The losses on a short stock trade may be unlimited because the price of a stock can theoretically rise without limitation.

Shorting stocks requires a margin account and there may be a minimum funding requirement.

Remember, the concept of shorting a stock to open and buying it back to close is the exact opposite of buying shares to open and selling them to close the trade.

Most stocks listed on major exchanges can be sold short but sometimes shares are unavailable to borrow. There may also be daily hard-to-borrow (HTB) fees associated with short shares of stock due to heightened short demand–so researching the stock you intend to short is vital before doing so.

There are various stock order types: market order, limit order, stop market order, and stop limit orders are among the most common. Each enables you to make specific requirements before your order is filled.

- Market Order: This order instructs your broker to buy or sell the shares as soon as possible at the current market price. Although your entire order is filled as soon as possible, the final price is unknown until your order is complete. Market orders can fill higher than the Ask price when buying or lower than the Bid price when selling.

- Limit Order: This order instructs your broker to buy or sell at a designated price, or better. If you enter a limit order to purchase stock at $100 per share, your order won’t execute unless the price falls to or below $100 per share. Therefore, order fill is not guaranteed with limit orders.

- Stop Market Order: Like a limit order, a stop order instructs your broker to execute your trade once a specific price is reached. However, a stop order does not guarantee a fill at a certain price but instead converts the order to a market order once that price is reached. That said, a stop order may fill at a worse-than-expected price, especially during high periods of volatility or poor liquidity.

- Stop Limit Order: A stop limit order is an order to buy or sell a stock at a specified price once the target price reaches a specified level. This order will only be filled at the specified price or better, and not at a higher price compared to a stop market order. After the stop price is reached, the limit order will then be placed and processed by the exchange — this order type does not guarantee order fills either, as the fill must be the exact price specified even if the order routing trigger is met.

1 This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

2 Systematic risk is the risk inherent in the overall market, which affects all investments, while binary event risk is the risk that comes from a particular event like corporate earnings or a change in interest rates.

3 All stock trades incur a clearing fee of $0.0008 per share, and applicable exchange and regulatory fees. Other fees may apply.

4 Named #1 Desktop Options Trading Platform by Stockbrokers.com

5 Margin requirement for a stock greater than $5 without elevated requirements and has margin privileges. Please visit the tastytrade Help Center to learn more about long stock buying power requirements in a margin account.

6 Purchasing stock on margin requires at least $2,000 in marginable equity (cash and eligible marginable positions).

7 Short-selling is only permissible in a margin account and has the risk of unlimited loss as there is no cap on how high a stock can go.

8 The initial requirement for short stock is typically 50% or $10 a share, whichever is greater. Some stocks may have elevated margin requirements. Selling stock requires a margin account with "The Works" with least $2,000 in marginable equity (cash and eligible marginable positions).

All investments involve the risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.

Trading in a margin account is not suitable for all investors. It is important that investors understand the risks involved in trading securities on margin prior to investing in a margin account. Please read the Margin Disclosure Statement.