What is a Short Put Option & How to Trade it?

Short Put Option Summary

- Selling an uncovered put is a bullish strategy that can benefit when the stock remains above the short put's strike price or rises.

- Like other short premium options strategies, naked put sellers benefit from time decay, which can erode the option's value, allowing the investor to buy it back at a lower price to yield a potential profit.

- A short put can be a more capital-efficient way of gaining bullish exposure to a specific underlying than buying it outright.

- The maximum profit for a naked put is the initial credit received. The max loss for an uncovered put is limited to the strike price x 100, less the credit received upfront since a stock price can only drop to $0.

Short Put Option

A short put is a neutral to bullish options trading strategy that involves selling a put contract at a strike typically at or below the current market price of a stock. The short put strategy also goes by other names, including bull put, naked put, or uncovered put.

Selling a naked put can be an alternative method of gaining bullish exposure to a particular underlying without purchasing shares outright. Investors can sell to open out-of-the-money (OTM) or in-the-money (ITM) put(s) when establishing a naked put position.

The ideal scenario when selling OTM uncovered puts is when the underlying does not breach or approach the short put's strike price over the life of the trade and it expires worthless. This allows the put to lose all of its extrinsic value by the expiration of the contract to yield maximum profit. However, when selling ITM naked puts, investors require a much larger upward price move so the option goes OTM and, ideally, expires worthless to yield a maximum profit.

OTM puts are usually valued less than ITM puts, and that's because they only have extrinsic value and no intrinsic value. ITM options have intrinsic and can have extrinsic value. Intrinsic value describes an option's immediate value for being ITM, while an option's extrinsic value depends on several factors, such as time or volatility.

Time decay can help erode an OTM put option's value when the underlying price remains stable and doesn't approach the short put option's strike price. Time decay can also benefit investors who hold a naked ITM options position if it has any extrinsic value. However, potential profits on a short ITM put are generally more pronounced when the price of the underlying rises, ideally above the short put strike, so it does not have any intrinsic value.

Aside from holding the naked put to expiration to yield a max profit, investors can also profit by buying (covering) the short put back before it expires at a price lower than the initial sale price. Investors can incur a loss when covering a short put at a price above the initial sale price.

It's also worth noting that ITM options generally have higher (early) assignment risk than OTM options. When investors are short a put, it can convert to 100 long shares per contract before expiration, and investors will assume the risk of long shares after assignment.

Short puts are allowed in all account types. However, puts sold in a cash account or IRA must be completely cash-secured, giving them the name cash-secured puts instead of naked or uncovered puts. This means the account must have the notional value of the put contract as available options buying power to establish the position. For example, selling a 50-strike put will require at least $5,000 of options buying power ($50 strike price x 100 options multiplier) in cash accounts or IRAs. On the other hand, margin accounts generally require a lower buying power requirement, Regulation-T requirement, when selling naked puts or short option positions.

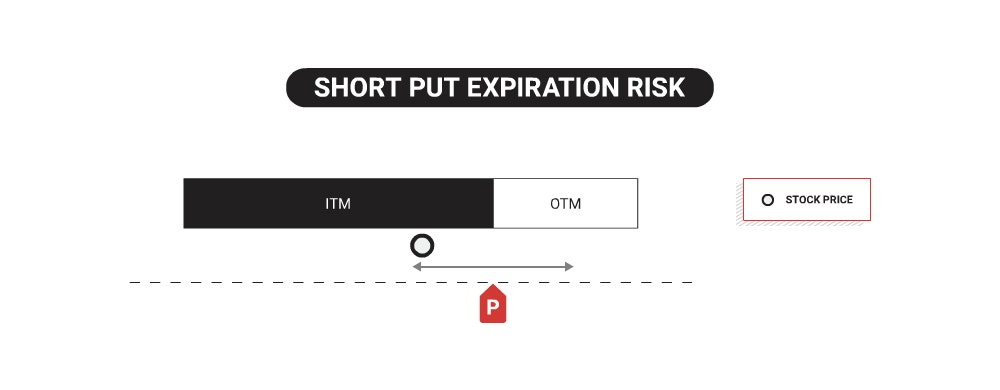

Expiration Risk for Short Put Vertical Spreads

Options that expire in the money by $0.01 or more are auto-exercised, resulting in an assignment of 100 long shares of stock for each ITM short put.

Moreover, any options strategy involving short options, including a naked short put, may face after-hours risk on the day of expiration. In summary, although the short put may have expired OTM based on the stock's closing print, an OTM short put option can become ITM based on any extreme downward price movement after the market close, resulting in an unexpected assignment of long shares. As a result, the investor would assume the risk of 100 long shares per contract assigned. The only way to eliminate after-hours risk is by closing any short options positions before expiration.

It's crucial to have a plan, like closing or rolling the position before expiration, if assignment isn’t part of your strategy. Please visit the tastytrade Help Center to learn more about Expiration Risk, including more about pin risk and after-hours risk.

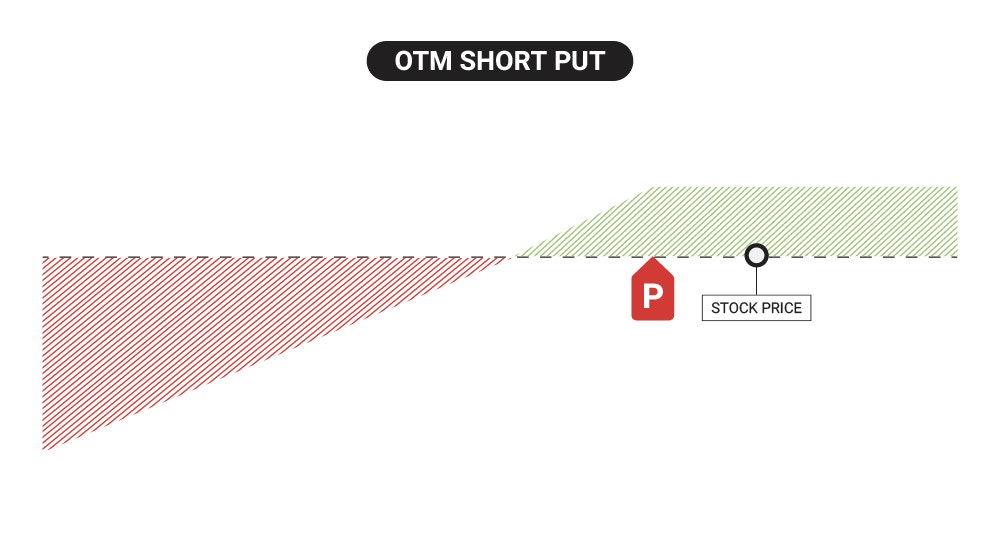

Profit & Loss Diagram of Selling an OTM Short Put

A short/naked put can achieve a maximum profit if it expires OTM and is worthless, as illustrated in the flattened green shaded area below. Naked puts can potentially remain profitable if the underlying remains above the breakeven price, as shown where the red and green zones converge on the x-axis. This is why the short put is said to be neutral to bullish, as opposed to a purely bullish strategy like buying shares of stock.

When selling options, the max profit on the strategy is the initial credit received. A short put will incur losses if the put closes below the breakeven zone at expiration, which is defined as the short put strike less the credit received up front for selling the put contract.

Please be mindful of assignment risk for ITM short options, as assignment can happen at any time up to the expiration date. As always, manage your options positions closely.

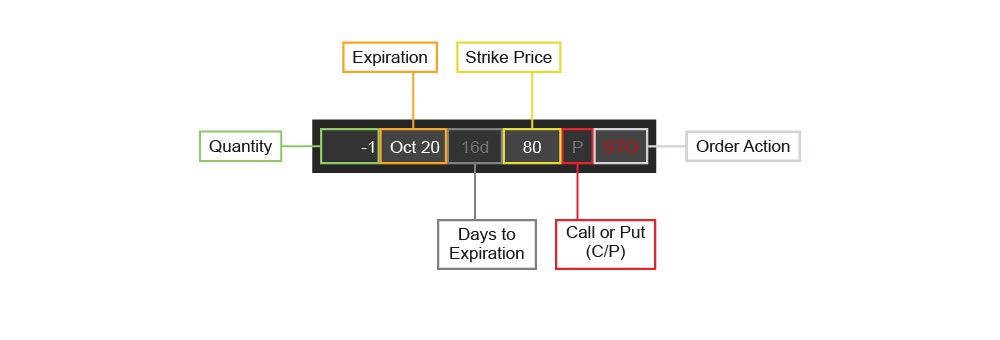

Example of Selling an OTM Short Put

XYZ trading @ $45

- Sell to Open -1 XYZ 40-strike put @ $4 credit

Collect a $4 credit ($400 total)

Factor | Explanation |

|---|---|

Time Decay Affect | Works for you by decaying the value of the put |

Max Profit | Total credit received $400 |

Max Loss (if the stock goes to $0) | Total credit received - (strike price x 100) $400 - ($40 x 100) = -$3,600 |

Breakeven Price (at expiration) | Strike price – credit received $40 - $4 = $36 |

Buying Power Requirement | Account and underlying dependent |

Account Type Required | Cash*, Margin, and IRA* |

Other Names |

|

Factor | Explanation |

|---|---|

Time Decay Affect | Works for you by decaying the value of the put |

Max Profit | Total credit received $400 |

Max Loss (if the stock goes to $0) | Total credit received - (strike price x 100) $400 - ($40 x 100) = -$3,600 |

Breakeven Price (at expiration) | Strike price – credit received $40 - $4 = $36 |

Buying Power Requirement | Account and underlying dependent |

Account Type Required | Cash*, Margin, and IRA* |

Other Names |

|

*A short put in a cash or IRA account is cash-secured. For example, a short 40-strike put that generated a $4 credit ($400 total credit), would require $3,600 in options buying power, not considering commissions and fees.

How to Sell a Naked Put

Using the Strategy Menu

- Enter a symbol.

- Navigate to the Trade tab.

- Go to the Table mode.

- Click on an expiration date to expand.

- Click the Strategy menu. Locate the option strategy and (from left to right) click each column to display Short, Put, and Go.

- The short put will appear in the expanded expiration as a red bar. Drag the bar up or down to adjust the strike.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking Review and Send. Review the order thoroughly including commissions and fees, then send the order.

.jpg?format=pjpg&auto=webp&quality=90&width=1000&disable=upscale)

Building it Manually

- Enter a symbol.

- Navigate to the Trade tab.

- Go to the Table mode.

- Click on an expiration date to expand.

- Click the “bid” price to sell the strike price you choose. The short put will appear in the expanded expiration as a red bar. Drag the bar up or down to adjust the strike.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking Review and Send. Review the order thoroughly including commissions and fees, then send the order.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.