Short Iron Condor Options Strategy Explained

Short Iron Condor Summary

- A short iron condor consists of four options in the form of two short vertical spreads: a short out-of-the-money (OTM) call spread and a short OTM put spread.

- Short iron condors may yield a profit when the stock that the iron condor tracks remains between the short strikes over time. If the stock exceeds the short strikes, the strategy may yield a loss.

- Time decay favors short iron condors and can help yield a profit before expiration when covered for a debit less than the initial credit received. If the stock moves quickly though, the directional move can offset time decay and yield a loss prior to expiration.

- The max profit for an iron condor is the initial credit received.

- The max loss is the spread width less credit received and occurs when the entire call or put side expires in-the-money (ITM).

Short Iron Condor

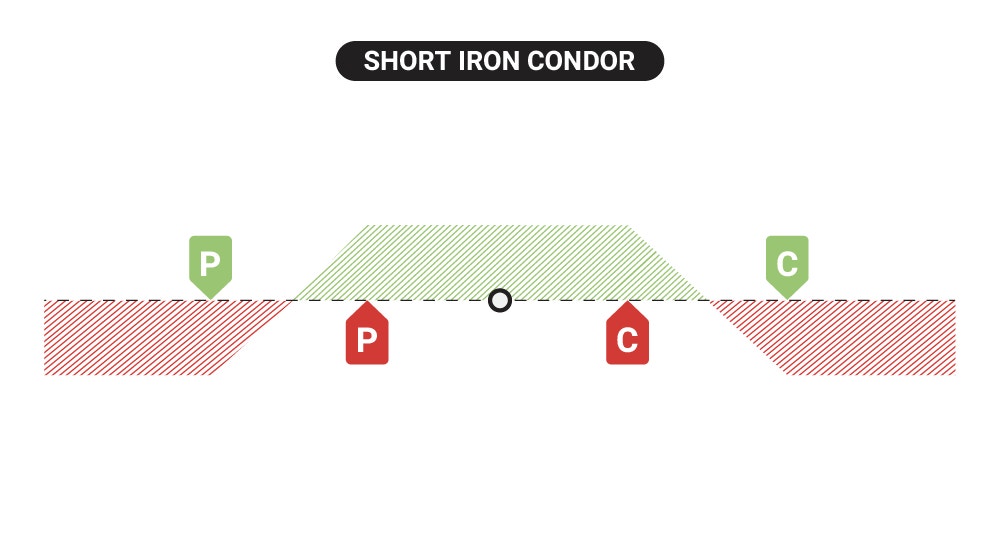

A short iron condor consists of four options in the form of two short vertical spreads: a short out-of-the-money (OTM) call spread and a short OTM put spread. Short iron condors provide short upside and downside volatility exposure. They can benefit when the stock or ETF the iron condor tracks remains neutral within the range between the short strikes and doesn't experience any sort of sharp upward or downward move in price.

Short iron condors have a max profit equivalent to the credit received up front when opening the trade. This max profit is realized if all options expire OTM and are worthless.

The max loss on a short iron condor can be found by taking the width of the widest spread and subtracting the credit received from trade entry. Iron condors generally have short put and call spreads that are the same width, but if they are not, the max loss is the width of the wider spread. When the underlying breaches the short call or put vertical and the entire vertical closes ITM at expiration, the max loss is defined due to the protection the long option offers against the short option’s risk a few strikes away. This is illustrated in the profit and loss diagram where the red loss zone flattens.

In short, the best-case scenario for a short iron condor is when the underlying remains constant, does not experience sharp upward or downward moves, and remains between the short strikes as expiration nears. Time decay favors premium sellers since it can help yield a profit when covered for a debit less than the credit received prior to expiration as well.

The worst-case scenario for a short iron condor is if the underlying experiences a sharp movement towards or through one of the spreads, in which case the trade can yield losses prior to and/or at expiration.

Prior to expiration, an ITM short option can be assigned, and the short option contract can convert to 100 long or short shares. In this case, the trade is still risk-defined because the long option protects the assigned shares from sustaining additional losses. The trader can keep the assigned stock if they have sufficient account equity or can close it for the current P/L at that time. Alternatively, the trader can perform a covered stock order by closing the assigned shares with the corresponding long option or submit an exercise request to flatten the position, which will likely incur a loss. The OTM long options will expire worthless after the close on its expiration date.

Expiration Risk for Short Iron Condors

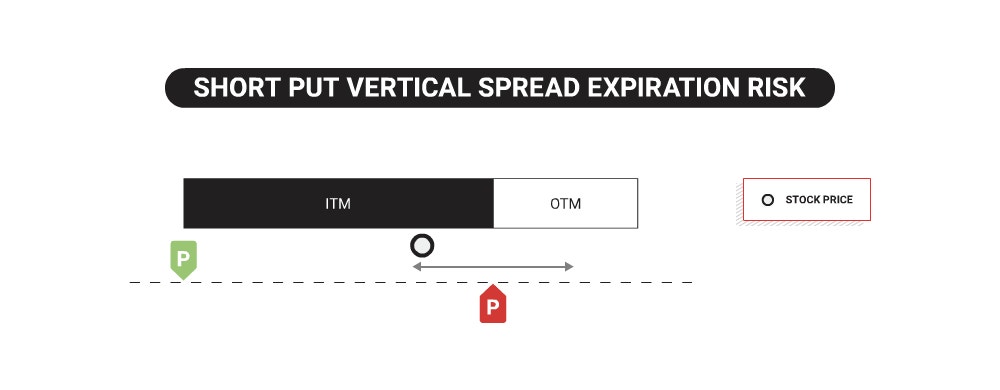

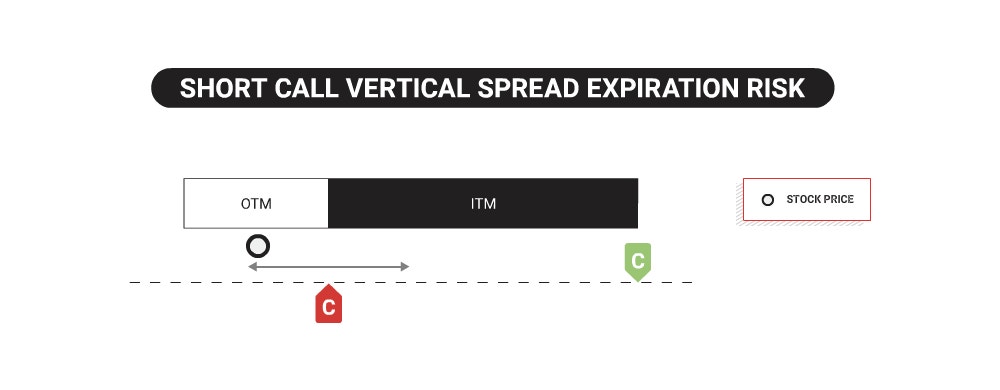

A defined-risk vertical spread is no longer a defined risk position if one leg of the spread expires in the money, and the other does not. The risk lies with pin risk on the day of expiration, which is the risk surrounding the uncertainty of where the underlying will close to determine whether an option is in or out of the money.

Options that expire in the money by $0.01 or more are automatically exercised, resulting in the short put option assignment converting to 100 long shares of stock, or the short call option converting to 100 short shares of stock.

In the case of a short put vertical spread, a partially ITM spread will convert to 100 long shares through short put assignment, and the OTM long put option would not get automatically exercised to offset the long shares by selling it.

In the case of a short call vertical spread, a partially ITM spread will convert to 100 short shares through short call assignment, and the OTM long call option would not get automatically exercised to offset the short shares by covering the short shares.

Additionally, any options strategy involving short options may face after-hours risk on the day of expiration. In summary, although the vertical may have expired OTM based on the stock's closing print, an OTM short put option or short call option can become ITM based on any extreme price movement after the market close, resulting in an unexpected assignment of shares. As a result, the investor would assume the risk of 100 long or short shares per contract assigned. The only way to eliminate after-hours risk is by closing any short options positions before expiration.

Due to the risk of getting assigned long shares through a short put, or short shares through a short call, it's crucial to have a plan, like closing or rolling the position before expiration, to avoid this potential assignment risk, especially when the account does not have sufficient account equity to take on the resulting position. Please visit the tastytrade Help Center to learn more about expiration risk, including more about pin risk and after-hours risk.

Profit & Loss Diagram of a Short Iron Condor

A short iron condor consists of an OTM put credit spread, and an OTM call credit spread, to create a neutral zone of profitability between the short strikes. If all contracts expire worthless, max profit is realized which is equivalent to the credit received up front for opening the trade. If one of the spreads expires ITM, max loss will be realized which is equivalent to the width of the spread less the credit received.

The breakeven zones can be seen in the image below where the green shifts to red and vice versa. This can be calculated by adding the credit received to the short call strike to the upside and subtracted from the short put strike to the downside.

What’s Required for a Short Iron Condor?

Two short OTM vertical spreads in the same expiration (4 options)

- One OTM short call vertical spread

- One OTM short put vertical spread

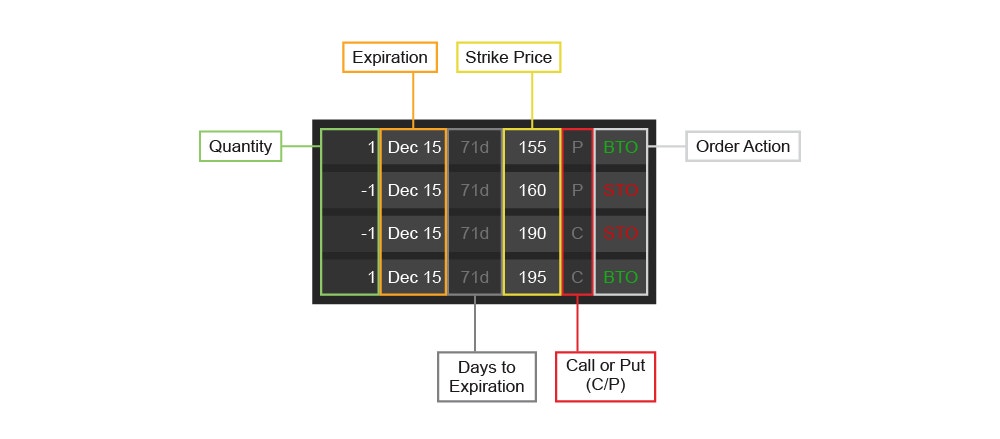

Example of a Short Iron Condor

XYZ currently trading @ $175

- -1 XYZ 190-strike call @ $2 credit

- +1 XYZ 195-strike call @ $0.50 debit

- -1 XYZ 160-strike put @ $2.25 credit

- +1 XYZ 155-strike put @ $0.75 debit

Vertical call spread credit: $1.50

Vertical put spread credit: $1.50

Total collected: $3 [($1.50 +$1.50) x 100 = $300]

Factor | Explanation |

|---|---|

Time Decay Affect | Works in your favor as time can decay the value of the iron condor |

Max Profit | Total credit received |

Max Loss | Upside: Total credit received – [(Spread width) x 100 options multiplier] $300 – [($95 - $90) x 100] = -$200 Downside: Total credit received - [(Spread width) x 100 options multiplier] $300 - [($65 - $60) x 100] = -$200 |

Breakeven Price (at expiration) | Upside: Short call strike + credit received $190 short call strike + $3 = $193 upside breakeven Downside: short put strike – credit received $160 long put strike - $3 = $157 downside breakeven |

Buying Power Requirement | |

Account Type Required | Margin IRA |

Factor | Explanation |

|---|---|

Time Decay Affect | Works in your favor as time can decay the value of the iron condor |

Max Profit | Total credit received |

Max Loss | Upside: Total credit received – [(Spread width) x 100 options multiplier] $300 – [($95 - $90) x 100] = -$200 Downside: Total credit received - [(Spread width) x 100 options multiplier] $300 - [($65 - $60) x 100] = -$200 |

Breakeven Price (at expiration) | Upside: Short call strike + credit received $190 short call strike + $3 = $193 upside breakeven Downside: short put strike – credit received $160 long put strike - $3 = $157 downside breakeven |

Buying Power Requirement | |

Account Type Required | Margin IRA |

How to Place a Short Iron Condor Order

Using the Strategy Menu

- Enter a symbol.

- Navigate to the Trade tab.

- Go to the Table mode.

- Click on an expiration date to expand.

- Click the Strategy Menu dropdown. From left to right, click each column to display Normal, Iron Condor, and Go.

- The short put vertical side will display in the expanded expiration. To adjust the vertical, drag each strike up or down to the desired strike price.

- The short call vertical side will display in the expanded expiration. To adjust the vertical, drag each strike up or down to the desired strike price.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc. before clicking "Review & Send." Review everything including commissions and fees before sending the order.

Building it Manually

- Enter a symbol.

- Navigate to the Trade tab.

- Go to the Table mode.

- Click on an expiration date to expand.

- Click the Bid price of OTM long put, then click the Ask price of a further OTM short put to sell against the long put.

- Click the Bid price of OTM long call, then click the Ask price of a further OTM short call to sell against the long call.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc. before clicking "Review & Send." Review everything including commissions and fees before sending the order.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.

Multi-leg option strategies incur higher transaction costs as they involve multiple commission charges.