Long Call Diagonal Spread

Long Call Diagonal Summary

- A long call diagonal spread consists of two legs that span two expiration dates and resemble a calendar spread but with different strike prices like a vertical spread.

- Setting up a long call diagonal involves buying a closer-to-the-money call option in a further-dated expiration and selling a further out-of-the-money call in a near-dated expiration, resulting in a net debit.

- Long diagonal call spreads can have efficient exposure to implied volatility, but also experience time decay like any long options strategy.

- Peak profitability for a long diagonal spread may occur when the underlying rises to the short call’s strike price near the expiration of the short call.

- The max loss on a call diagonal spread is the debit paid up front if all options expire out-of-the-money (OTM).

- Diagonals can be set up as a Poor Man's Covered Call (PMCC) to potentially provide a more capital-efficient method of gaining synthetic long share exposure with an in-the-money (ITM) long call and generate interim income with the short call.

Long Call Diagonal Spread

A long call diagonal spread consists of two call options in two separate expirations where the long call has more value and is closer to the stock price than the short call. For example, a trader may buy a call option with a strike price that is at-the-money (ATM) in a further-dated expiration, and short a near-term call option that is further out-of-the-money (OTM) than the long call. Diagonals resemble a calendar spread because the strategy spans two expiration dates. However, unlike a calendar, a diagonal will have different strike prices like a vertical spread.

.png?format=pjpg&auto=webp&quality=90&width=1000&disable=upscale)

Not only can the value of a long diagonal call spread rise when the price of the underlying rises sharply and approaches the strike prices of the spread, but the increase can reflect heightened uncertainty due to any recent price action, also known as implied volatility. A long diagonal call spread can benefit from increased implied volatility since long options strategies also provide positive exposure to implied volatility by way of Vega.

Long call diagonals experience time decay, like any other options strategy. The value of the long diagonal may depreciate over time when the value of the underlying rises, falls, or remains constant. As a result, the underlying price must rise faster toward the diagonal spread’s strike price to make up for any lost value due to time decay. It is important to note that the short call is more sensitive to time decay since it has a shorter duration, but the short call only hedges the long call to a certain degree. The overall effect of time decay increases as time passes.

Depending on the strike selection, a long call diagonal spread may also be known as a poor man's covered call (PMCC). A PMCC is a diagonal spread that consists of buying an ITM call instead of an ATM/OTM call. When executed correctly, a PMCC may be a capital-efficient strategy for gaining long share exposure while generating income by selling near-dated calls against the long call option.

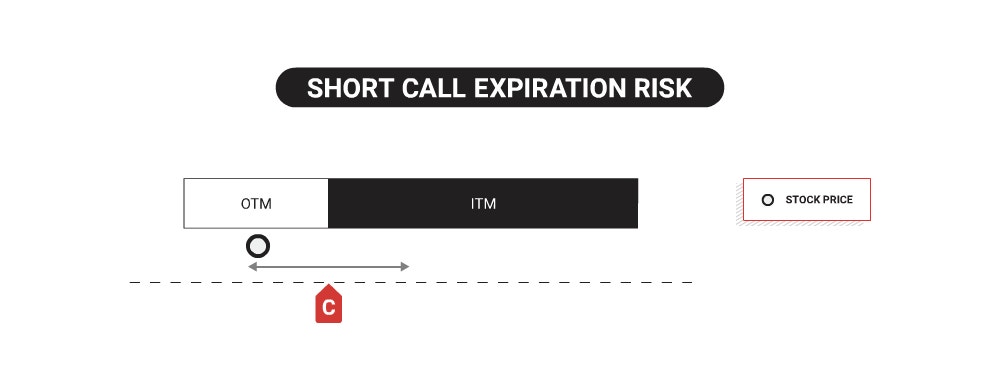

Expiration Risk for a Short Call in a Call Diagonal Spread

In a long call diagonal spread setup, the short call has a closer expiration date than the long call and will have assignment risk implications if in-the-money (ITM) or close to being ITM near expiration.

Options that expire ITM by $0.01 or more are auto-exercised, resulting in an assignment of 100 short shares of stock for each ITM short call.

Any options strategy involving short options, including a naked short call, may face after-hours risk on the day of expiration. In summary, although the short call may have expired OTM based on the closing price of the underlying, an OTM short call option can become ITM based on any extreme upward price movement after the market close, resulting in an unexpected assignment of short shares. As a result, the investor would assume the risk of 100 short shares per contract assigned. Normally this would yield unlimited risk to the upside, but in the case of a long call diagonal spread, the long call option would still exist and offset the intrinsic value risk of the 100 short shares after assignment. With this said, the risk of the position does not change after assignment if it happens, but buying power requirements can shift. The only way to eliminate after-hours risk is by closing any short options positions before expiration.

It is crucial to have a plan, like closing or rolling the position before expiration, if a short share assignment is not part of your strategy. Please visit the tastytrade Help Center to learn more about expiration risk, including more about pin risk and after-hours risk.

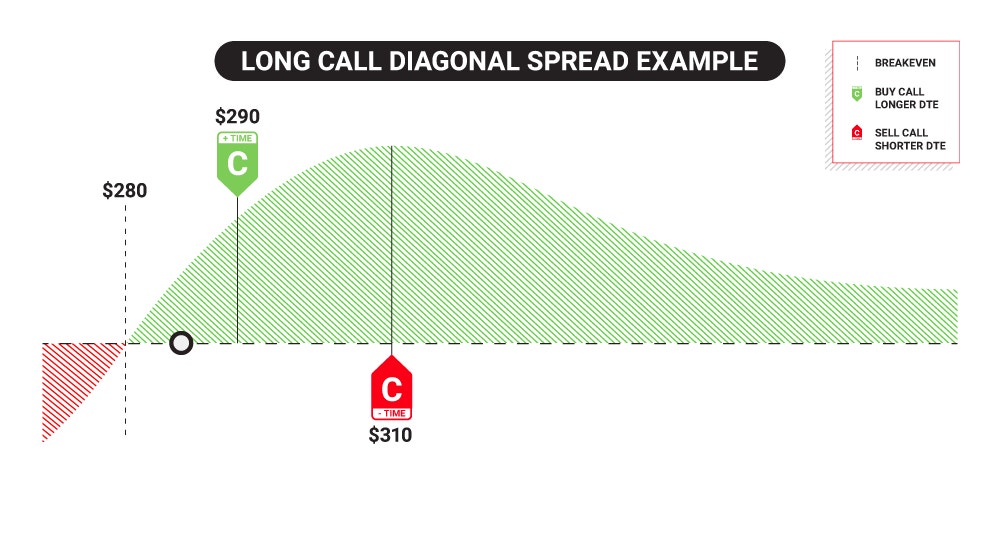

Profit & Loss Diagram of a Long Call Diagonal Spread

Long call diagonals can be profitable as the underlying approaches the long call options strike price. Since the long call option has a later expiration, it may appreciate faster than the near-dated short call due to its extended time value (and Delta exposure). Like long calendar spreads, calculating the max profit of a long diagonal spread is impossible due to different expiration dates and the inability to estimate remaining extrinsic value in the long option when the short option expires. However, peak profitability could occur when the underlying rises to the near-dated short call's strike price. The max loss for the spread is the debit paid and can occur when both legs expire OTM and are worthless. The profit and loss graph below assumes a scenario where both legs have not yet expired.

What’s Required for a Long Call Diagonal Spread?

A long call diagonal spread consists of two legs:

- A long call in a further-dated expiration

- A short call in a near-dated expiration above the strike price of the long call

Example of a Long Call Diagonal Spread

XYZ currently trading @ $45 in February

- Buy to open +1 XYZ June 50-strike call @ $5 debit

- Sell to open -1 XYZ March 55-strike call @ $1 credit

Cost: $4 debit ($400 total)

Example of a Poor Man's Covered Call

XYZ currently trading @ $45 in February

- Buy to open +1 XYZ June 39-strike call @ $9 debit (ITM call with $6 of intrinsic and $3 of extrinsic)

- Sell to open -1 XYZ March 55-strike call @ $1 credit

Cost: $8 debit ($800 total)

Factor | Explanation |

|---|---|

Time Decay Affect | Works against the spread’s value |

Max Profit | Estimated as max intrinsic value + long option’s remaining extrinsic value at short option’s expiration |

Max Loss | Total debit paid |

Breakeven Price (at expiration) | Estimate of long call strike + debit paid |

Account Type Required | Margin and IRA |

Other Names | Poor Man's Covered Call (setup dependent) |

Factor | Explanation |

|---|---|

Time Decay Affect | Works against the spread’s value |

Max Profit | Estimated as max intrinsic value + long option’s remaining extrinsic value at short option’s expiration |

Max Loss | Total debit paid |

Breakeven Price (at expiration) | Estimate of long call strike + debit paid |

Account Type Required | Margin and IRA |

Other Names | Poor Man's Covered Call (setup dependent) |

How to Place a Long Call Diagonal Spread Order on the tastytrade Desktop Platform

- Enter a symbol.

- Navigate to the Trade tab.

- Go to the Table mode.

- Click on an expiration date to expand.

- Click the Bid price of the short call leg in the near-dated expiration. Drag the bar up or down to adjust the strike.

- Click the Ask price of your long call leg in the further-dated expiration. Drag the bar up or down to adjust the strike.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc. before clicking "Review & Send." Review everything including commissions and fees before sending the order.

.jpg?format=pjpg&auto=webp&quality=90&width=1000&disable=upscale)

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

Multi-leg option strategies incur higher transaction costs as they involve multiple commission charges.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.