What is Earnings Season & What to Look for in Earnings Reports?

Earnings season provides a great opportunity for equity traders to gain insight on stocks they have invested in, while also offering context to potential share price moves. Read more on what earnings season is, earning announcement dates to know, and what to look for in an earnings report.

What is Earnings Season & Why Is It Important?

Earnings season is a period each fiscal quarter, usually lasting several weeks, when many of the largest listed companies announce their latest financial accounts. An earnings report consists of revenue, net income, earnings per share (EPS) and forward outlook, amongst a bevy of other data points, which can help to provide investors with insight relating to the current health and outlook for the company. This information can be found on sec.gov, various financial publications, and individual companies' websites.

Earnings season is important because it helps market participants glean information from the companies that they are monitoring along with the broader index. For example, a strong Apple (AAPL) earnings report may see investors bullish on Nasdaq 100 futures, a concept discussed further below when looking at bellwether stocks.

Something else that can accompany an earnings release is an earnings call. This is a conference between the company and analysts, press, and investors which discusses the outcome of an earnings report and in many cases, opens the floor for questions for company management. Such scrutiny of the reports can enable traders to access more information to further inform their decisions, although not all companies make earnings calls.

When is Earnings Season & When Do Reports Come Out?

Earnings season typically takes place a few weeks after each quarter ends (December, March, June, September). In other words, earnings season begins around January-February (Q4 results), April-May (Q1 results), July-August (Q2 results) and October-November (Q3 results), with the unofficial start of earnings season usually marked by when the major U.S. banks report results.

This typically coincides with an increase in the number of earnings being released, while the unofficial end of earnings season is usually around the time that Walmart (WMT) announces its earnings report.

3 Things to Look for in Company Earnings Reports

There are a number of factors to look for in company earnings reports. Traders should be most mindful of the performance of the largest ‘bellwether’ stocks, understand the significance of an earnings recession in a given stock, and grasp how a stock’s earnings announcement might impact a relevant index depending on the weighting of the given security.

1. Performance of Bellwether Stocks

When analyzing company earnings, it is important to look out for ‘bellwether’ stocks which can be seen as a gauge for the performance of the macro-economy. While the status of a bellwether stock can change over time, the largest and most-established companies are typically considered a bellwether stock.

Examples of bellwether stocks:

- FedEx (FDX) - Ships goods for consumers and businesses across the globe.

- Caterpillar (CAT) - World’s largest heavy-duty machinery maker that's been viewed as a bellwether given its large exposure to construction, manufacturing, and agricultural industries, particularly in China.

- 3M (MMM) - Gauge for the health of the manufacturing sector.

- Apple (AAPL) - Among the world’s largest companies. Important for key suppliers, in particular, chipmakers.

2. Earnings Recession

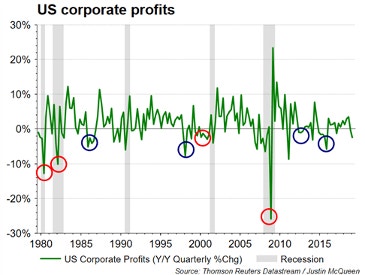

An earnings recession is characterized as two consecutive quarters of year-on-year declines in company profits. However, while earnings are a crucial factor in stock market returns over the long term, an earnings recession does not necessarily coincide with an economic recession.

The chart below shows that in the past six earnings recessions witnessed in the U.S., only two had coincided with an economic recession. The blue circles show where there was an earnings recession without an economic recession, while the red circles represent where both an earnings and economic recession occurred.

3. Earnings and Stock Index Weighting

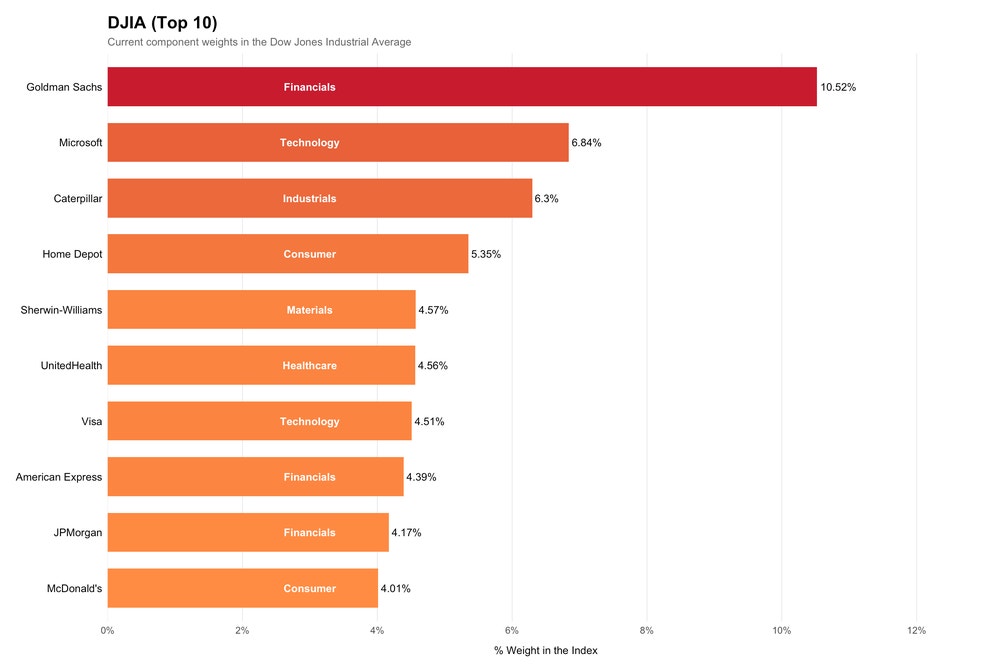

Traders should understand that when trading earnings, certain stocks will have a greater impact on the wider index according to their index weighting. For example, when trading the Dow Jones, Goldman Sachs releasing its earnings will be highly influential on the index, while Visa likely won’t be as influential, due to the former’s 10.85% weighting compared to the latter’s 4.73%, as shown in the table below. This highlights the importance of paying close attention to bellwether stocks and how they may impact a broader equity index.

Trading During Earnings Season: Top Tips

1. Know the ‘Expected’ Results

Being cognizant of what is ‘expected’ with regards to the revenue/sales and earnings per share (EPS) figures are important because a company’s share price reaction can often be determined by the amount by which they beat/miss an aggregate of analysts' expectations.

2. Stay Alert to Surprise Announcements

Any surprise announcements that coincide with an earnings report can also impact the share price of a company. These may include stock buybacks/share repurchase programs and company guidance.

3. Be Aware of Spillover Effects Between Stocks

An example of spillover impact could be if an investor has a chipmaker stock within their portfolio (EG Dialog Semiconductor), earnings from Apple could have a sizeable impact on the stock. Consequently, it is important to assess related stocks, given that they may reveal the outlook for a sector, thus sparking a possible sector rotation.

4. Consider Volatility Over the Bearing of an Expected Move

Working out the ‘expected move’ on a directional basis for a stock in reaction to the binary earnings event can be a fraught endeavor. Alternatively, a view taken with volatility in mind can prepare investors for significant movement without positioning on the wrong side of the eventual outcome.

Earnings Season: Key Takeaways for Investors and Stock Traders

In summary, earnings season can be an influential driver in a trader’s experience. Make sure you know when the key earnings are released for individual companies in order to proactively plan. Be aware of how bellwether stocks, potential earnings recessions and stock index weightings can influence price movements. Keep a handle on what results are expected for each stock. Be mindful of greater potential volatility for either analytical or strategic purposes and understand how one stock’s performance may impact another’s (or an index as a whole).

Following these key tips can help traders to attempt to weather earnings season and navigate the period more consistently.

FAQs

Earnings season’s impact on the global economy can depend on anything from the performance of given sectors to a variety of fundamental factors. While bellwether companies meeting or exceeding expectations can reflect a strong corporate environment, the stock market interacts with the economy in many ways. Therefore, the relationship between the two isn’t always predictable.

Financial downturns may impact earnings season in a significant way—dampened demand for products and services caused by a downturn or more prolonged recession can naturally mean earnings failing to hit expectations in multiple sectors. However, perceived defensive stocks such as those in consumer staples or healthcare may weather downturns better or perhaps even become more attractive in such a backdrop.

When it comes to the US/UK earning season dates, UK and European companies tend to get the bulk of their earnings about two to three weeks after the US.

Want to build your equities knowledge further? Make sure to check out our stock market articles with useful, straightforward insight into analyzing the most common capital market asset. Here are a few articles to get you started:

This content, including the use of actual symbols, any visual display or other reference to product, type of investment, strategy, or service offered, is for educational and informational purposes only. It is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.