What Are Options Greeks & How to Use Them

Options Greeks Summary

- Options Greeks inform traders of their exposure on a position or portfolio basis, can provide valuable insight into risk exposure, and aid with managing risk in portfolios.

- Delta (∆), Gamma (Γ), Theta (θ), and Vega (V) are the four major options Greeks traders use.

- Options Greeks can help traders determine their exposure during order entry and understand their options positions' risk and reward potential.

- Investors must consider all four Greeks together to understand the risk and reward potential of an options position during order entry or when analyzing any open options positions.

- Options traders must be mindful of the limitations of focusing only on one options Greek, as a trader could overlook information about the risk and reward potential of their options positions.

Introduction to Options Greeks

Options, aside from trading them, are used by investors to manage risk. But what does risk management mean? Individual or institutional investors who hold a portfolio of stocks are concerned with preserving their investments and can use options to hedge their exposure. Whether protecting against an asset or providing synthetic exposure, options have a finite lifespan which means their characteristics will change over time and as the underlying price fluctuates.

Traders can measure and determine their risk by referring to the options Greeks, also admirably referred to by traders as the “Greeks." Investors must have a firm understanding of the Greeks if they intend on trading options, as it helps put context around the amount of risk or exposure when establishing an options position or evaluating their portfolio.

The four prominent Greek figures all options traders should have a firm understanding of are as follows:

- Delta – Direction (bullish/bearish/neutral)

- Gamma – Options sensitivity to changes in direction

- Theta – Time Value in options prices

- Vega – Options sensitivity to changes in volatility

When traders want to know a portfolio's exposure, they rely on the Greeks. By understanding the Greeks, options traders can determine their exposure during order entry, understand the risk and reward potential of their options positions, and gain valuable insight into their overall portfolio exposure. Greek exposure can take on different forms, but it mostly stems from direction and volatility. Traders can stay informed about their exposure by learning how to interpret the Greeks and how the market can impact their options positions.

How Options Greeks Quote on a Trading Platform

When you check the options Greeks in Table mode while using the Trade tab to place an order on the tastytrade platform, Greeks display with a long bias—showing your exposure when you buy the option. Like options prices, you can multiply Greeks by 100 (except for Theta) on the tastytrade platform, which displays the total dollar amount per contract. Therefore, just like when determining an option's total price, you must multiply Delta, Gamma, and Vega by 100 to determine the option's exposure from a monetary standpoint. For example, if an option has a delta of 0.25, that translates to an implication of 25 real dollars after multiplying 0.25 by 100.

.jpg?format=pjpg&auto=webp&quality=90&width=1000&disable=upscale)

Where Do Options Greeks Come From?

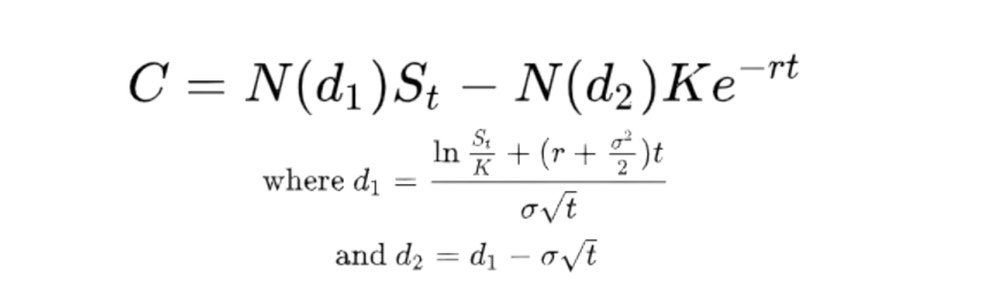

You can thank the Black-Scholes options pricing model when it comes to options pricing. The Black-Scholes (B-S) model is a mathematical formula used to determine the theoretical value for a call or put option, using multiple inputs like the underlying asset price, the option's strike price, the time to expiration, and the risk-free interest rate. So, where does each Greek figure come from? In short, the Greeks derive from the B-S model, and by understanding the Greeks and how they affect the option's price, traders can make informed decisions about buying, selling, hedging, and their portfolio's risk based on price movement.

In the image above, you can see there are many inputs in the Black-Scholes pricing model for call options. The most basic are the stock price (S), time to option expiration (t), the strike price (K), and risk-free rate of return or interest rate (r). These inputs assist in solving for C, which is the theoretical call option premium.

Greek Exposure Method

A quick mental trick to help you determine your directional exposure during order entry is tying a buy with a positive one (+1) and a sell with a negative one (-1) and multiplying it by the call or put and quoted options Greek you want to trade. Since the Greeks quote with a long bias on trading platforms, you can understand your option's exposure using that trick. We included a +1 and -1 in each Greek section when viewing each Greek's long and short exposure.

- BUY(+1) CALL (+delta)

- SELL (-1) CALL (+delta)

- BUY (+1) PUT (-delta)*

- SELL (-1) PUT (-delta)*

*For example, although buying a -20 ∆ (+1 x -20 ∆) put provides negative Deltas and is a bearish strategy, selling the same put would provide +20 ∆ (-1 x -20 ∆) positive Deltas and become a bullish strategy.

Understanding Risk vs. Reward

Investors must take a comprehensive approach when viewing options Greeks during order entry and when analyzing open options positions. Focusing too much on one Greek can be detrimental, because all Greeks ebb and flow as the market moves around during the day. Traders should consider all four major Greeks to understand their options positions' risk and reward potential.

For instance, an investor focusing only on Deltas, which indicates direction, may be problematic and could overlook information about the risk and reward potential of their options position that Gamma, Vega, and Theta can help provide.

Similarly, traders must understand that each Greek has limitations. Therefore, traders should not view any Greek in isolation. For instance, an investor focusing too much on Theta because it measures time decay may overlook other risks. Theta only measures the time decay portion of the option's extrinsic value and does not consider other factors like price movement and volatility changes.

Therefore, investors should consider all four Greeks together to understand the risk and reward potential of an options position during order entry or when analyzing their options positions. For instance, Delta and Gamma can provide insight into directional exposure and sensitivity to changes in direction. Vega measures option price sensitivity to changes in volatility. At the same time, Theta can give insight into the time decay portion of the option's value.

Finally, investors must also understand that options Greeks are not static and can change constantly based on market conditions until they expire. Therefore, traders should understand the Greeks during order entry and when regularly monitoring their positions to ensure they know their options positions' risk and reward potential.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.