What is Delta in Options Trading

What is Delta (∆)?

Delta expresses the change in an option's price for every +$1 change in the underlying asset's price. Calls will quote a positive Delta and puts will quote a negative Delta.

Calls

- ITM – Between 1.00 ∆ to 0.51 ∆

- ATM – At 0.50 ∆

- OTM – Between 0.49 ∆ to 0.00 ∆

Puts

- ITM – Between -1.00 ∆ to -0.51 ∆

- ATM – At -0.50 ∆

- OTM – Between -0.49 ∆ to 0.00 ∆

One thing to note is that options Deltas are not linear, so just because a stock goes up by +$1 does not necessarily mean that it will appreciate by the Delta amount at order entry; this is because options are logarithmic. Many factors—such as time and volatility expansions or contractions—can affect an options Delta over the life of the trade.

Delta does more than just let you know the overall rate of change of your options position based on a +$1 move up of the underlying. It also can help you determine the following:

- Directional exposure

- Approximate probability of the option expiring ITM

- Share equivalency in terms of exposure

Directional Exposure

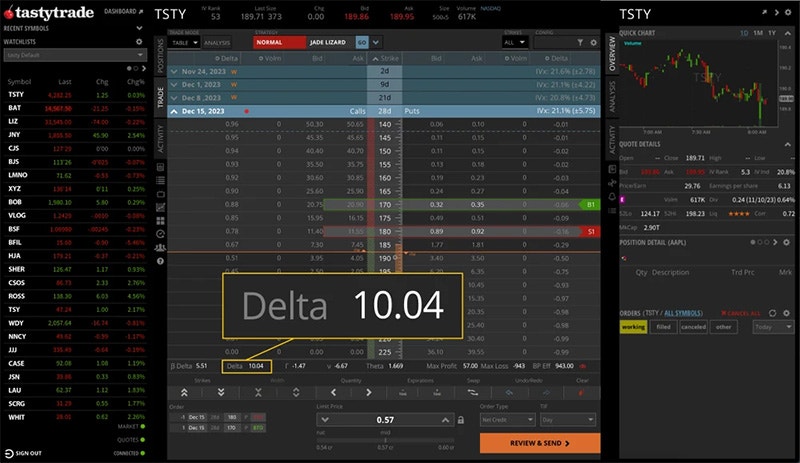

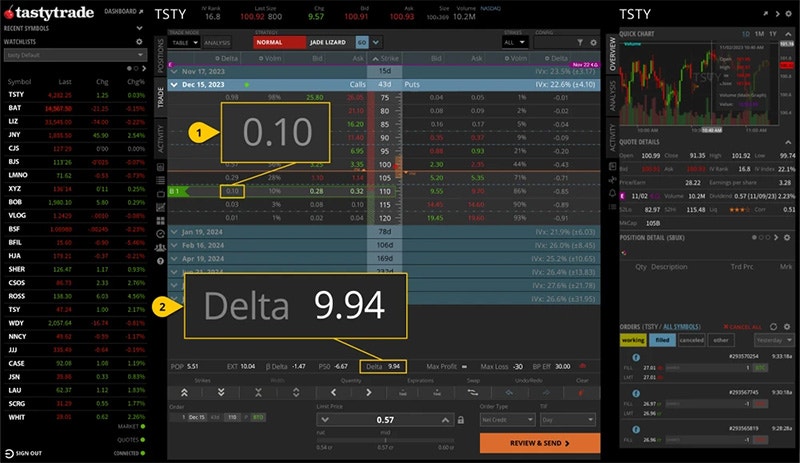

Delta provides traders with their directional exposure in the options position. A positive Delta indicates a bullish position. A negative Delta indicates a bearish position. A Delta near zero is a neutral position. Traders can see their Delta exposure during order entry in the Trade Info bar above the order ticket and on their Positions tab after establishing the position.

Probability Percentage of Expiring ITM

Delta also acts as a proxy of the option's probability of expiring ITM, also available on the platform as “ITM %” when viewing the options chain in Table mode. So, traders that may not have ITM % displayed on Table Mode can also refer to their Delta to approximate their ITM probability at expiration.

Share Equivalency

When an investor buys a single share of stock and the price goes up by $1, the investor stands to make $1. As a result, each share of stock equals 1 ∆. Therefore, 100 shares of stock equals 100 ∆. In the trading world, shares of stock are referred to as "static Deltas" since the Delta exposure of a share does not change. However, an option’s Delta is dynamic based on market conditions and can change day-to-day.

Traders can see their long or short share equivalency by referencing their options Delta. Share equivalency can inform traders about their synthetic share exposure in comparison to stock. In the example below, the 110-strike call shows a Delta of 0.10, which provides about ten shares of equivalent long stock exposure per contract, as illustrated in the Trade Info bar above the order ticket.

What Is “Raw” Delta vs. Beta-Weighted Delta?

Two terms you may hear regarding your options Delta exposure is "raw" Delta and beta-weighted Delta (β∆). Raw Delta refers to the actual Delta of the option to the underlying. In other words, the Delta displayed in the options chain while using Table Mode on the tastytrade platform is the options raw Delta and only relates to that underlying.

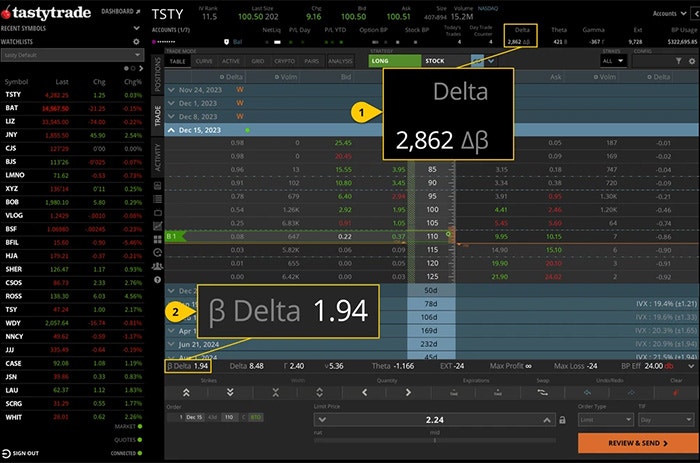

However, a beta-weighted Delta is a bit different. Since not all stocks have comparable price action, beta-weighting provides traders with an "apples-to-apples" comparison to see their option's theoretical Delta based on a $1 move of a different symbol.

The tastytrade default beta-weight symbol is SPY, the S&P 500 ETF (Exchange Traded Fund), which will provide your theoretical Delta exposure given a 1-point up move of the S&P 500 ETF or the "overall market." tastytrade users can specify any symbol as their beta-weighting symbol. Please visit the tastytrade Help Center to learn more about customizing beta-weighting symbols.

Users can view their beta-weighted Delta during order entry, their portfolio's overall beta-weighted Delta for their portfolio, and each position in the Positions tab. Visit the tastytrade Help Center to learn more about customizing the data displayed in the Position tab. The example below illustrates the beta-weighted Delta of a 110-strike call and the overall portfolio beta-weighted Delta listed in the accounts pane.

Delta (∆) at a Glance for Equity Options | |

|---|---|

What is it | The theoretical price change of the option after a +$1 move of the underlying. |

Where to locate it |

|

Quoting method | Per-share basis |

How to read it | Delta x 100 |

Exposure | Directional

|

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.