What Are Index Futures and How Do They Work?

Equity indices and volatility futures offer investors the ability to speculate on overall market direction and sentiment. Equity index futures enable traders to potentially benefit from market direction and sector-specific trends, while volatility futures allow traders to speculate on future market sentiment.

Equity index futures are contracts to buy or sell a specific equity index at a predetermined price on a specified future date. Popular indices include S&P 500, Nasdaq-100, and Dow Jones Industrial Average.

Volatility futures are contracts that let traders speculate on future market volatility rather than direction.

The relationship between equity index levels and market volatility is inverse. When equity indices rise, market volatility usually decreases, and vice versa. Understanding this relationship is crucial for traders using futures, as movements in equity indexes can be precursors to changes in volatility levels.

Equity Indices

Equity index futures, a widely traded asset, are popular among investors aiming to speculate or hedge, as futures contracts offer leverage. With that said, it's important to understand the risks and rewards associated with trading futures products. tastytrade offers investors all four major U.S.-based indices ranging from the large-cap stock indices like the Dow, Nasdaq-100, and S&P 500 to small-cap stock with the Russell 2000. Additionally, each standard E-mini index futures contract also has a micro-sized contract that is 1/10th the size in notional value.

- /ES – E-mini S&P 500

- /MES – Micro E-mini S&P 500

- /NQ – E-mini Nasdaq-100

- /MNQ – Micro E-mini Nasdaq-100

- /YM – E-mini Dow

- /MYM – Micro E-mini Dow

- /RTY – E-mini Russell 2000

- /M2K – Micro E-mini Russell 2000

All equity index futures at tastytrade are financially settled. All equity index futures have options except for /MYM and /M2K.

What Are Equity Index Futures Used For?

Equity index futures contracts offer exposure to broad-based market sectors and potentially greater leverage relative to other trading instruments such as ETFs and index options. In other words, futures contracts can be traded with a fraction of the capital relative to the actual risk of the product. With this leverage comes a greater potential reward, but also a greater potential risk of loss. Learn more about futures margin.

Aside from using equity index futures to provide directional exposure to the stock market by speculating, both large and small investors can use equity futures to hedge their portfolios. Equity index futures can help hedge a portfolio's directional exposure.

For example, institutional investors, primarily investors long S&P 500 stocks or managing a portfolio highly correlated to it, can sell E-mini S&P 500 futures (/ES) contracts to provide some downside protection if they believe the S&P 500 will fall. Conversely, institutional investors, primarily investors short S&P 500 stocks or negatively correlated to it, can buy /ES contracts to hedge or protect themselves from upside risk.

Retail investors with smaller accounts might use micro-sized futures contracts to hedge their portfolios or speculate as those might be a more appropriate size. Investors must review their account size, portfolio composition, and exposure levels when determining which futures contract—E-mini or Micro—is an appropriate level for a trade.

Notable Characteristics

Although traditional stock market indices like the Dow Jones Industrial Average, Nasdaq-100, and Russell 2000 tick in penny (0.01) increments, that does not apply to their respective futures contracts. Instead, index futures tick differently, each with a different minimum tick and a tick value. Please visit the tastytrade Help Center to view tick size and value of all futures contracts offered at tastytrade.

Another notable characteristic of equity index futures is that they all expire on the third Friday of every third month at 8:30 AM Central (Chicago Time). Moreover, all equity index futures contracts, E-mini and micros, settle financially (cash-settled) and can be traded or closed until expiration.

How to Read an Equity Index Futures Quote

Since the tick values for each equity index futures contract vary, investors that want to trade them must know the notional value and tick values of each contract to understand their exposure. Let's look at a standard E-Mini S&P 500 futures (/ES) contract and a Micro E-Mini S&P 500 futures (/MES) contract to illustrate the difference in notional exposure and risk.

Investors may notice when quoting the same contract month of both contracts that they quote and tick in lockstep together. The main difference between the E-mini and micro contracts is their total notional value.

The standard E-mini S&P 500 that quotes a last price of 4,591.75 has a notional value of $229,587.50 (4591.75 index price x $50 per point). A change of +38.00 equates to a $1,900 (38 x $50) gain when long a contract from its open price, or a loss of -$1,900 when short a contract. Moreover, the contract ticks in a quarter (0.25) increment instead of in pennies. Each tick is worth $12.50 ($50/4).

The Micro E-mini S&P 500, on the other hand, is 1/10th the size of its standard E-mini counterpart. As a result, an /MES contract has a total notional value of $22,958.75 instead (4,591.75 index price x $5 per point). A change of +38.00 equates to a $190 gain when long a contract from its open price or a loss of -$190 when short a contract. The micro contract also ticks in quarter increments, with each tick worth $1.25.

Price Impact Factors

Any investor who keeps a pulse on the stock market knows that anything can affect the current and future performance of the markets. Since futures markets trade nearly 23/5 and the stock market is only open from 8:30 AM to 3:00 PM CST, any world or business event outside regular trading hours is usually felt first in the equity index futures market. That said, factors that may affect equity index futures prices may include, but are not limited to:

- Politics

- Corporate earnings

- Geopolitical issues

- Currency valuation

- Economic news and releases

- Breaking news

Volatility Futures

Unfortunately, not every day is a sunny day, and that is apparent in all markets. Investors at tastytrade have access to two distinctly sized volatility futures contracts that can be used in various account sizes to speculate or potentially protect their portfolios from unexpected volatility. Just like trading equity futures, volatility futures offer leverage which can result in greater returns, but also greater risk. Be sure to understand all risks associated with futures trading.

- /VX – Cboe Volatility Index (VIX) futures

- /VXM – Mini Cboe Volatility Index (VIX) futures

Both volatility futures are financially settled and do not list available options.

What Are Volatility Futures Used For?

When understanding volatility futures, investors must know about the Cboe Volatility Index (VIX Index), otherwise known as the VIX. The VIX, commonly called the "fear index," tracks the current volatility of the S&P 500 through options of the S&P 500 Index. The VIX typically swells when the S&P 500 experiences heightened market volatility. Although the VIX typically increases when the S&P 500 markets experience large downticks, it can also increase when markets experience significant upticks.

Large investors concerned about future volatility can establish long VIX futures (/VX) positions against their portfolio to hedge against volatility. However, VIX futures are not exclusive to large investors. Individual or retail investors with smaller accounts seeking to protect their portfolio potentially from an uptick in volatility can use Mini VIX futures (/VXM) to hedge their portfolios instead.

Aside from using volatility futures as a hedge against a portfolio, investors can also use them to speculate any uptick or downtick in the volatility (VIX) by going long or short the contract.

Notable Characteristics

Volatility futures are also financially settled (cash settled). As a result, volatility futures positions can be held to expiration since there is no way to "deliver" the index, like equity index futures. However, unlike equity index futures contracts, volatility futures terminate trading at 8:00 AM CST on the Wednesday before the third Friday of the calendar month the contract expires.

How to Read Volatility Futures Quotes

Investors looking to use VIX futures to hedge their portfolios against volatility or speculate on the direction of the VIX must understand several nuances. They include the notional value, tick size, and tick value of the standard and mini contract to gauge their exposure and risk.

Investors may notice when quoting the same contract month of both E-mini and mini contracts that they quote and tick in lockstep together. The main difference between the standard and mini-sized contracts is their total notional value.

The standard VIX future (/VX) with a last quote of 15.80 has a total notional value of $15,750. Each point gained or lost equates to $1000 in notional value change. A change of -0.10 equals a -$100 loss when long a contract or +$100 when short. One thing worth noting about /VX futures is although it trades and the bid/ask price quotes in nickel (0.05 or $50) increments, the last and change price can quote in nickel increments based on the prior trading day's closing settlement price determined at the exchange.

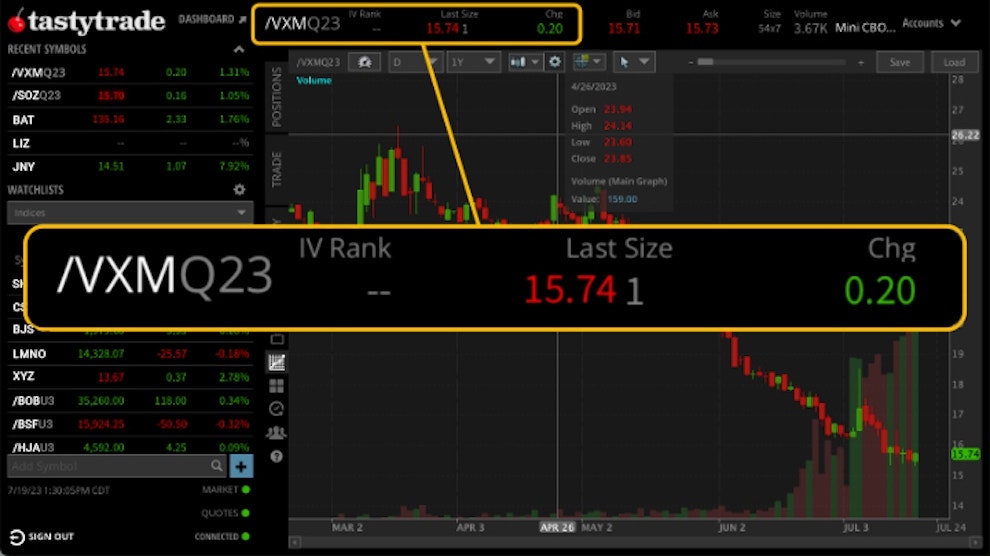

A mini volatility index contract is 1/10th of the size of the standard volatility contract. As a result, a last price of 15.74 equates to a notional value of $1,574. Each point gained or lost equates to $100 in notional value change. A change of +0.20 will result in a +$20 gain when long a contract or -$20 when short. Moreover, unlike the standard-sized volatility contract, the mini-sized contract ticks in a penny (0.01 or $1) increment.

Price Impact Factors

An endless number of reasons can cause markets to become volatile. However, some factors include, but are not limited to:

- Adverse news

- Economic news and announcements

- World event

- Politics

- Investor sentiment

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC). All customer futures accounts’ positions and cash balances are segregated by Apex Clearing Corporation. Futures and futures options trading is speculative and is not suitable for all investors. Please read the Futures & Exchange-Traded Options Risk Disclosure Statement prior to trading futures products.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.