Futures Characteristics

Summary

- A futures symbol has three components: a root that identifies the asset, a month code, and a year code.

- Since futures are leveraged instruments, they have a unique quoting and pricing methodology, as each contract controls a unique set quantity of an underlying asset.

- Understanding each contract's tick size and value is essential when trading futures since each price increment represents a particular dollar value.

- Contango describes when back-month or further-dated futures contracts are more expensive than the active or current month contract. Backwardation occurs when back-month or future-dated contracts are less expensive than the active or current month.

- Futures are subject to mark-to-market, which will realize futures positions held over multiple trading sessions by sweeping cash from your futures account to your securities, and vice-versa, to account for the profit or loss on your futures position from the last trading session.

Unique Characteristics of Futures

There are a lot of characteristics that set futures and options on futures apart from equity and equity options. Equity and equity option investors looking to expand into futures trading may discover significant differences when diving into futures and options on futures.

Whether you're looking to trade futures only or expand into futures trading from equity and equity options trading, this section of the tastytrade futures education center outlines some characteristics that set it apart from other products available for trading at tastytrade.

Futures Symbols and Quotes

Unlike a stock symbol with 1 to 4 letters resembling a company's name or business, futures do not follow the same logic. As a result, knowing futures symbols off-hand is more a function of memory as there is no "intuitive" way to determine a futures symbol. However, there's no need for memorization because investors can refer to the futures-specific preset watchlists in the tastytrade trading platform.

Futures Symbol Anatomy

Since futures are a derivative with a finite lifespan, a futures symbol must reflect their limited lifespan. That said, a futures symbol has three components to it:

- Root symbol

- Month code

- Year code

Root Symbol

A futures root is a futures contract's symbol that uniquely identifies it. Some asset classes, like agriculture, currencies, volatility, and interest rates, have a consistent root naming convention. For example, the root for all non-micro currency futures begins with a "/6" with an additional letter. When using the tastytrade trading platform, investors can simply enter a futures root symbol to populate the active contract's quote details. In short, investors can quickly identify a futures quote since they all begin with a forward slash (/) as part of their symbology.

Month Code

After a futures root symbol is a futures contract's month code, unfortunately, the month codes for futures may not be intuitive for some and will require some memorization if you plan to trade or quote a later month or back-month contract. Fortunately, all futures contracts use the same month code. However, not all futures carry the same months available for trading.

As mentioned in the Root section above, investors using the tastytrade trading platform can enter a futures root to populate the active contract's quote, so there's no need to memorize all the future month codes when looking up the active month.

An active or front-month futures contract refers to the current futures month with the most trading activity. As a result, active month contracts are generally more liquid. Back-month contracts refer to contract months beyond the active month. For example, if it was January, the active contract for an E-Mini S&P 500 futures contract is March (H), and a back-month contract would be the June (M) contract.

- F – January

- G – February

- H – March

- J – April

- K – May

- M – June

- N – July

- Q – August

- U – September

- V – October

- X – November

- Z – December

Year Code

As the name suggests, the year code after the month code denotes the year of the futures contract. The year code becomes essential when trading back-month contracts near the end of a calendar year or looking up a back-month contract quote in a future calendar year. tastytrade users seeking to trade or look up a back-month contract's quote can enter the last digit of the year after the month code. For example, if it is June 2023 and you want to look up the quote for a futures contract for March 2024 it will require entering a "4" after the month code.

How to Read Futures Quotes and Price

Aside from the unique symbology, futures quote differently from other tradeable asset classes. Since futures are leveraged instruments that allow investors exposure to various asset classes, a one-point move up or down does not necessarily denote a $1 gain or loss. Moreover, not every futures contract moves in a penny increment either. In some cases, some only move in whole points, while others move in a sub-penny or a specific increment. Lastly, since futures are derivative, they have a finite lifespan. Investors may notice that future-dated or back-month contracts may exhibit a higher or lower price than the current or active futures contract.

Leverage

Since futures contracts provide investors with leveraged exposure to a specific asset, it will affect each contract's notional value. In other words, since each futures contract controls a set quantity, it will determine how much an investor will make or lose when prices increase or decrease. For example, a crude oil futures contract (/CL) has exposure to 1,000 barrels of oil. As a result, each whole point it moves up or down equates to $1,000.

Since futures are hedging and risk-management instruments primarily used by producers or institutions, they inherently provide considerable leveraged exposure to a specific asset. Investors looking for reduced leveraged exposure can seek Micro contracts instead. It's important to note that not all standard or E-mini futures contracts may have a corresponding Micro contract available for trading.

You can find a more comprehensive table of available futures contracts in the tastytrade help center for more information. Below are a few examples:

Agricultural:

- Symbol = /ZC – Corn

- Contract units = 5,000 bushels

- Full point value = $50

Energy:

- Symbol = /CL – Crude Oil

- Contract units = 1,000 barrels

- Full point value = $1,000

Equity Indices:

- Symbol = /ES – E-Mini S&P 500

- Contract units = 50 x S&P 500

- Full point value = $50

Tick Size & Tick Value

Since futures provide investors with leveraged exposure to a specific asset, any price movement increment or a tick will equate to a particular dollar value. When trading futures, the value of each price increment is known as the tick value, and the price increment is known as a tick size.

The notional value of a futures contract and its tick value are directly correlated. For example, the E-Mini S&P Futures contract (/ES) ticks in 0.25 increments valued at $12.50, resulting in $50 per point. Meanwhile, the Micro E-Mini S&P Future contract (/MES), which is 1/10 the standard E-Mini contract, also ticks in 0.25 increments. As a result, the tick value of the micro contract is $1.25, resulting in $5 per point.

Knowing the tick value and tick size of each futures contract will keep you well-informed when determining your position's daily performance. You can find a table of all the futures contracts available for trading and their tick size and tick value on the tastytrade Help Center.

Agriculture:

- Symbol = /ZC – Corn

- Tick size = 0.25

- Tick value = $12.50

Energy:

- Symbol = /CL – Crude Oil

- Tick size = 0.01

- Tick value = $10

Equity Indices:

- Symbol = /ES – E-Mini S&P 500

- Tick size = 0.25

- Tick value = $12.50

Contango & Backwardation

When trading futures, there is an active month and a back month. The active month refers to the upcoming futures contract month that expires next, excluding contracts under first notice or subject to a last trade date. It is referred to as the active contract since it typically has the most trading activity and usually has the most market participants. A back month refers to any futures contract beyond the active contract month.

Entering the root symbol of a future when trading or viewing the quote of outright futures contracts at tastytrade will populate the active contract. However, including the month and year code are required when setting up a back-month contract trade or when viewing a back-month futures contract quote. Please visit the tastytrade Help Center to learn more about quoting or trading back-month futures contracts.

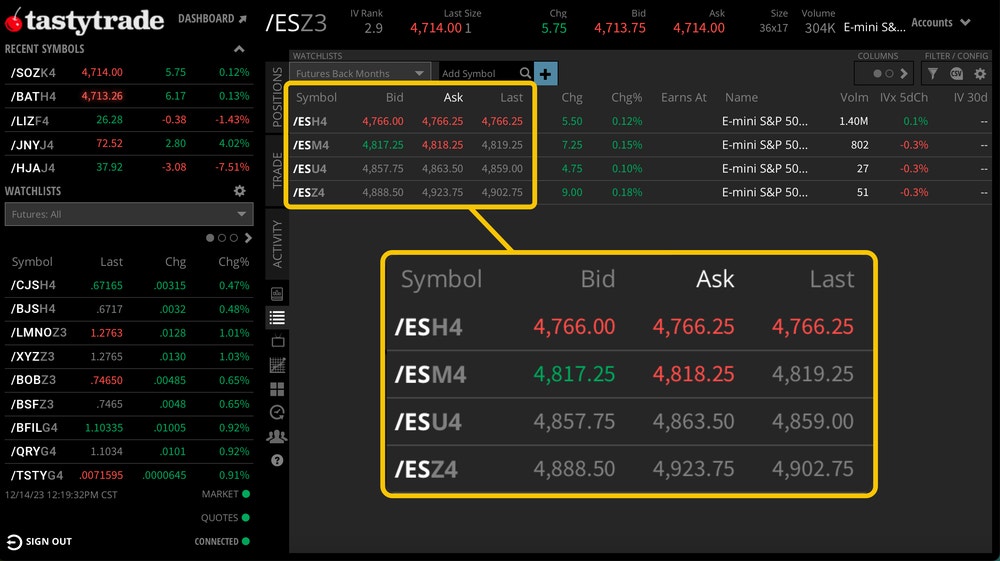

Many factors can affect the prices of back-month futures contracts. When back-month contracts exhibit higher prices, they are in contango, as illustrated below with the E-Mini S&P Futures contract below. You'll notice that the value of each contract gets more expensive in later months.

When back-month contracts are cheaper, they are in backwardation, as illustrated below with Natural Gas futures. You’ll notice that the value of the contract gets cheaper in later months.

Carrying costs or seasonality associated with the asset a futures contract tracks are some reasons back-month contracts may exhibit contango or backwardation. Examples of carrying costs include interest rates for commodities. Storage and seasonal demands can affect back-month contracts for physical commodities like natural gas or livestock. An example of seasonality include cyclical demand. For instance, demand for natural gas could be higher in winter compared to warmer months.

Futures traders can use this information to speculate whether back-month futures prices will converge or diverge by establishing an outright futures calendar spread position. An outright futures calendar spread position describes a strategy where an investor will either buy or sell the active month futures contract and perform the opposite order action to a back-month contract.

It's important to note that some futures contracts only offer specific months available for trading. Please visit the tastytrade Help Center to see all futures contracts available for trading at tastytrade and the supported months.

Trading Characteristics

Futures differ vastly from other tradeable assets. Whether you’re an active trader speculating on direction or using futures to hedge your portfolio, understanding some of their characteristics will keep you attuned to how futures can affect your portfolio.

Mark-to-Market

A unique characteristic of futures is the daily mark-to-market process when an investor holds an open futures position over multiple trading sessions. Mark-to-market for any open futures position refers to determining the profit or loss of the position based on a closing settlement price published by the futures exchange.

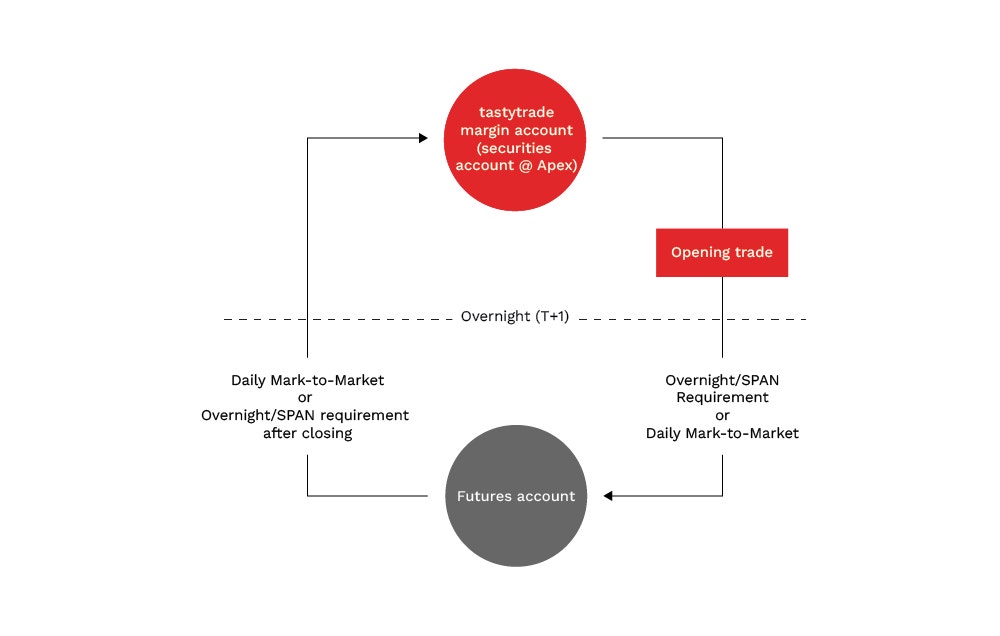

After the exchange determines the profit or loss from the settlement price, it will settle in cash. Any gains will result in cash sweeping from your futures account to your securities account and vice versa when incurring a loss, and the settlement price will become the new reference price for the next trading session. The process will repeat each day the futures position is open. The diagram below illustrates the cash sweep process between your securities account and futures account when holding a futures position by highlighting the overnight/SPAN requirement and daily mark-to-market P/L performance.

Although your open futures position may appear "realized" daily due to mark-to-market, it never fully realizes until the investor closes it or faces expiration, depending on the contract specification. The three-day scenario below illustrates how mark-to-market works.

Monday

- Position & Mark: Buy to open +1 /MES @ 3,000

- Closing Mark: 3,025

- P/L & Cash Sweep Amount: +$125 [(3,025-3,000) = 25 x $5]

Tuesday

- Position & Mark: /MES @ 3,025

- Closing Mark: 3,015

- P/L & Cash Sweep Amount: -$50 [(3,015-3,025) = -10 x $5]

Wednesday

- Position & Mark: Sell to Close -1 /MES @ 3,020

- Closing Price: 3,020

- P/L & Cash Sweep Amount: +$25 [(3,020-3,015) = 5 x $5]

Total P/L from /MES

- Monday ($125) + Tuesday (-$50) + Wednesday (+$25) = $100

Please visit the tastytrade Help Center to learn more about cash sweeps and their potential impact on your securities account.

1256 Product (60/40)

Futures and options on futures are also known as 1256 products or 60/40. 1256 refers to the IRS Section Number that classifies products subject to mark-to-market reporting. Unlike stocks or equity options subject to holding periods when determining short-term or long-term capital gains/losses, futures and options on futures do not have set holding periods when determining short- or long-term capital gains/losses.

Instead, gains or losses on futures are subject to a 60/40 split, which refers to 60% long-term and 40% short-term capital gains/losses. For example, if you made $1,000 over a calendar year, then $600 would be subject to long-term capital gains, and $400 would be subject to short-term capital gains.

Please visit the tastytrade Help Center to learn more about the 1256 tax treatment. Your tax treatment may differ if you’re an investor based outside the US.

No Day Trading Rules

Futures, micro-futures, and options on futures are not subject to pattern day trading (PDT) rules. If an account is flagged as a PDT account, investors holding any futures positions overnight can receive an Equity Maintenance (EM) Margin Call if their securities account equity drops below $25,000 due to futures cash sweeps. Please visit the tastytrade Help Center for information about how accounts are separated.

No Time Decay

Although outright futures contracts are derivatives, they do not experience time decay. As a result, buying or selling an outright futures contract will not "decay" over time. Instead, outright futures contracts will actively track the spot price, and your initial entry point will determine the profit or loss made on the contract, also referred to as the spread. However, options on futures experience time decay as that is technically “a derivative of a derivative.”

Futures account approval is subject to tastytrade suitability requirements. Futures and futures options trading is speculative and not suitable for all investors. Please read all applicable futures risk disclosures.

Increased leverage can result in significant losses in the event of adverse market conditions.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.