Commodity Futures

Commodity Futures Summary

- Commodity futures can be categorized into four categories: agriculture, energy, metals, and livestock.

- Commodity futures are contracts that obligate you to either buy or sell the underlying at a predetermined price at a certain date.

- Investors that speculate with commodity futures have no intention of delivering or taking delivery of the commodity they are trading. Instead, they aim to only trade the contract and profit from taking advantage of price fluctuations.

- Most commodity futures are physically delivered contracts. Investors at tastytrade may hold commodity futures positions until the first notice date.

- Speculators play an integral part in a futures market as they help provide a true market price of a commodity when considering all market conditions and factors.

Commodity futures are an essential part of the global financial market, representing a key investment opportunity for traders across the globe. They are essentially contracts that obligate you to either buy or sell the underlying at a predetermined price at a certain date. These contracts are traded on futures exchanges, which standardize the quantity and quality of the commodity being traded. They hold significant value in the financial market and play a crucial role in price setting and risk management.

Commodity futures fall into four categories: agriculture, energy, metals, and livestock. Agricultural futures include contracts for commodities like wheat, corn, and soybeans. Energy futures, on the other hand, include contracts for commodities like crude oil, natural gas, and gasoline. Metals include gold, silver, and copper. Livestock futures encompass contracts for live cattle and lean hogs.

For instance, a global food processing corporation may be heavily involved in agricultural commodities. A trader who anticipates a rise in the price of corn due to changing weather patterns might purchase a futures contract of corn to potentially offset the risk of rising costs. If the price rises as predicted, the trader can sell the contract for a profit.

Similarly, an international oil and gas company may also be deeply involved in energy futures. A trader who expects the price of crude oil to fall due to an increase in global supply might sell a futures contract of crude oil. If the price falls as predicted, the trader can buy the contract back at a lower price for a profit.

A meat processor of beef or pork may also be a major player in livestock futures. A trader who foresees a rise in the price of live cattle due to an outbreak of disease might buy a futures contract of live cattle. If the price rises as expected, the trader can sell the contract at a higher price for a profit.

Agriculture Futures

When investors think of commodity-based futures, agricultural products may come to mind first. Futures traders admirably refer to agricultural futures as the "softs." Agricultural futures such as corn, soybeans, and wheat are known as the "softs" because they are soft to the touch. A tongue-in-cheek reference also applies to the fact that it will not hurt if dropped on your toes, unlike a barrel of crude oil or a bar of gold.

Investors can choose between six agricultural futures contracts at tastytrade, including mini contracts that are one-fifth the standard contract's size.

Available agricultural futures at tastytrade:

- /ZC – Corn

- /XC – Mini Corn Futures

- /ZS – Soybeans

- /XK – Mini Soybean Margins

- /ZW – Chicago SRW Wheat

- /XW – Mini Chicago SRW Wheat

Agricultural futures with available options:

- /ZC – Corn

- /ZS – Soybeans

- /ZW – Chicago SRW Wheat

Learn more about how these futures are priced

What Are Agricultural Futures Used For?

Corn, soybean, and wheat farmers that are concerned about falling prices can lock in the sale price per bushel by selling futures against their crop. On the other hand, a producer, like a cereal maker, that relies on an agricultural commodity as an input for their business and is concerned about rising commodity prices can buy futures to lock in a purchase price per bushel. By establishing a futures position, each party will deliver or take delivery of the commodity at their set price on a future date.

Until the future reaches first notice, individual investors at tastytrade can speculate on potential price fluctuations by trading the outright contract. Speculators play an integral part in a futures market as they help provide a true market price of a commodity when considering all market conditions and factors.

Notable Characteristics

Unlike other futures products offered at tastytrade, agricultural futures have unique trading hours that start at 7:00 PM and trade until 7:45 AM (Central Time) the next trading day, then reopens 45 minutes later at 8:30 AM until 1:20 PM. Please visit the tastytrade Help Center to view the market trading hours for agricultural products and much more.

Another notable characteristic of agricultural futures is how the quote displays—agricultural futures quote in U.S. cents per bushel. However, the quote shows a whole number instead of traditionally displaying cents as $0.01. Hence, a penny is displayed as 1.00. As a result of quoting in whole numbers, each bushel can quote in sub-penny increments up to two decimal points.

Lastly, micro-sized agricultural futures are not financially settled. Instead, they are physically deliverable contracts. As a result, investors at tastytrade can hold micro-sized agricultural futures until the first notice date. Investors at tastytrade must roll to a further series or close their positions to avoid physical delivery, which tastytrade does not permit. Please visit the tastytrade Help Center to learn more about rolling an outright futures contract.

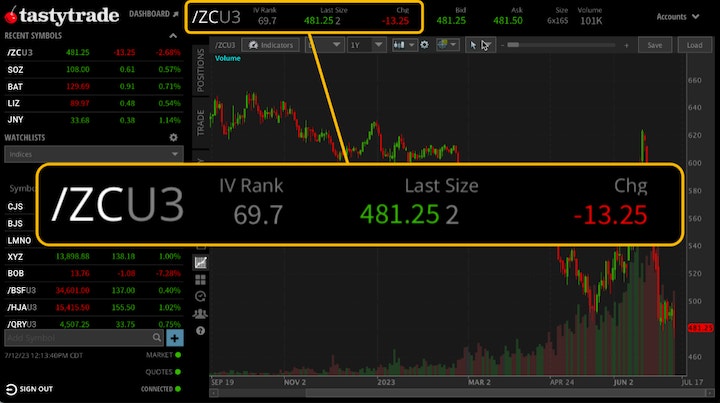

How to Read an Agricultural Futures Quote

For example, a corn futures (/ZC) contract quoting at a last price of 481.25 denotes that each bushel costs $4.8125 for a total notional value of $24,062.50 [(481.25/100) x 5,000 bushels of corn/contract]. Moreover, a price change of -13.25 denotes that the price of a bushel is down -$0.1325 a bushel. When accounting for the contract’s notional value, the change equals to a -$662.50 (0.1325 x 5000 bushels) loss when long a contract or +$662.50 gain when short.

Price Impact Factors

Like other asset classes, agricultural futures prices are a function of supply and demand. However, some factors that can affect supply and demand include but are not limited to:

- Adverse weather

- Geopolitical risks, such as sanctions

- Meat production (demand for feed)

- Currency

- Energy costs

- Crop disease

Energy Futures

Ever notice how gasoline prices fluctuate each time you pass a gas station or each time you turn on the heat at your house in the winter? Crude oil and natural gas prices can affect how much you pay when you fill your car or turn on the heat. Investors at tastytrade have access to seven different futures contracts, such as standard sized, mini, and micro contracts.

Available energy futures at tastytrade:

- /CL – Crude Oil

- /QM – E-mini Crude Oil

- /MCL – Micro WTI Crude Oil

- /NG – Henry Hub Natural Gas

- /MNG – Micro Henry Hub Natural Gas

- /QG – E-mini Natural Gas

- /RB – RBOB Gasoline

- /HO – NY Harbor ULSD (Heating Oil)

Energy futures with available options:

- /CL – Crude Oil

- /MCL – Micro WTI Crude Oil

- /NG – Henry Hub Natural Gas

Learn more about how these futures are priced

What Are Energy Futures Used For?

Like other commodity-based futures, it's about matching supply with demand. Companies drilling for oil or natural gas are known as price takers, similar to agricultural and livestock-based companies. Energy producers are price takers since they are subject to prevailing market prices and cannot determine a market price.

Energy producers concerned about falling prices can offset their risk by selling futures against the oil or natural gas they extract. Locking prices at specific levels is especially vital for producers that rely on the per barrel price of oil or MMBtu (1 million BTUs) of natural gas to yield a profit due to the costs associated with extracting it.

Conversely, companies that rely on crude oil and natural gas as an input, such as oil refiners or natural gas processors, concerned about rising costs can buy futures to offset their risk to maximize profits potentially.

Since energy futures contracts are physically delivered contracts that mandate delivery at a future date, individual investors worldwide can speculate on crude oil and natural gas prices by establishing long or short futures contract positions. At tastytrade, investors can trade the active standard crude oil or natural gas contract until the first notice date. However, e-mini and micro contracts financially settle instead and can be held to expiration.

Notable Characteristics

When viewing an expiration date, it's general knowledge that the listed date, whether on a loaf of bread or an equity option, is the day it expires. However, that logic differs for the standard-sized crude oil futures contracts (/CL).

Unlike other futures contracts that typically terminate trading within their listed month, crude oil futures expire before their listed contract month. For example, although a March 2023 crude oil contract lists its corresponding month code in its symbol (/CLH3), it terminates trading in late February.

How to Read Energy Futures Quotes

Energy futures are arguably one of the more straightforward quotes to interpret because most have large round numbers as their multiplier.

For example, a Henry Hub Natural Gas (/NG) futures contract, or "nat gas" for short, quoting a last price of 2.505 with a price change of -0.04 may appear somewhat "inexpensive" when only considering the price and change. However, since each nat gas future controls 10,000 MMBtu, the contract has a notional value of $25,050 (2.505 x 10,000). As a result, a -0.040 price change equates to a -$400 loss when long a contract or a +$400 gain when short (±0.04 x 10,000 million BTUs).

Price Impact Factors

Apart from agricultural prices that can affect the cost of food, the price of energy plays an integral part in everyone's life, even if you do not personally own a vehicle or use heat. As a result, a lot can affect the price of energy and their futures contracts counterpart. Some factors include, but are not limited to:

- Weather

- Geopolitics

- Currency value

- Cartel (OPEC)

- Economic expansion or contraction

Metal Futures

Gold, silver, and bronze (copper) are more than just Olympic medals. Not only can precious metals store wealth, but they also play a big part in our industrial economy, other than jewelry. Like any other futures asset class, the price of metals can fluctuate, and investors at tastytrade have access to five separate metal futures contracts, including micro-sized contracts.

Available metal futures at tastytrade:

- /GC – Gold

- /MGC – Micro Gold

- /HG – Copper

- /MHG – Micro Copper

- /SI – Silver

- /SIL – Micro Silver

Metal futures with available options:

- /GC – Gold

- /HG – Copper

- /SI – Silver

Learn more about how these futures are priced

What Are Metal Futures Used For?

Like other commodities, the price of metals fluctuates and can affect a company's or industry's bottom line. Mining companies are price takers, meaning that the market determines the price they receive for the metals they mine. Miners are generally concerned about falling prices and can offset their risk potentially by selling futures against the gold, silver, or copper they extract to lock in a sale price per troy ounce for gold and silver, or per pound for copper.

Conversely, companies and industries that depend on a specific metal as an input to their business are concerned about rising prices, as increased costs could erode profit margins or raise prices. Manufacturers concerned about the price of a specific metal can buy a futures contract to hedge themselves from rising prices potentially. Manufacturers that rely on metals span from jewelry makers, semiconductors, electric motors, air conditioners, and much more.

Since metal futures contracts are physically delivered contracts that mandate delivery at a future date, individual investors worldwide can speculate on metal prices by establishing long or short futures contract positions. At tastytrade, investors can trade the active standard and micro-sized metal contract until the first notice date.

Notable Characteristics

Unlike other micro contracts that may settle financially (cash-settled), the micro-sized metals futures contracts physically settle instead at expiration. As a result, investors at tastytrade can hold micro-sized metal contracts up until the first notice date. Investors at tastytrade must roll to a further series or close their positions to avoid physical delivery, which tastytrade does not permit. Please visit the tastytrade Help Center to learn more about rolling an outright futures contract.

How to Read a Metal Futures Quote

The largest metals contract by contract unit/multiplier is copper futures (/HG). With each futures contract controlling 25,000 pounds of copper, each point (1.000) equals $25,000. Due to its large size, it has a minimum tick increment of 0.0005, which means it can tick in sub-penny increment, with each tick equaling $12.50.

In the copper future example below, the last quoted price of 3.8425 equals a notional value of $96,062.50 ($3.8425 x 25,000 pounds of copper). A change of -0.0905 equals a loss of -$2,262.50 when long a single contract or a gain of +$2,262.50 when short (±0.0905 change x 25,000 pounds of copper).

Price Impact Factors

Metals are a big part of the world's economy since they are multi-faceted. Jewelry is the first thing that comes to mind when people think of gold and silver, but it can also be a store of wealth. However, due to their thermal and conductivity properties, gold and silver also play a big part in semiconductors. On the other hand, copper demand can be a proxy for whether the world economy is healthy since copper is a widely used industrial metal. If it's electric, then it probably has copper inside of it. Products with copper range from air conditioners, electric motors, car starters, refrigeration, plumbing, and more. Some other factors that can impact the price of metals include, but are not limited to:

- Increase or decrease in industrial output

- Energy prices

- Currency strengthening or weakening

- Geopolitics

Livestock Futures

Like your local grocery store's meat section that readily stocks beef and pork products, did you know each has a respective futures contract? Traders can speculate on the price fluctuation of beef and pork at tastytrade with live cattle and lean hog futures products.

Available livestock futures at tastytrade:

- /HE – Lean Hogs

- /LE – Live Cattle

Both have available options.

Learn more about how these futures are priced

What Are Livestock Futures Used For?

Livestock ranchers, like any commodity producer, want the ability to sell their product for top dollar. Livestock ranchers can offset their risk by selling futures against their herd to lock a per-pound sale price and protect themselves from falling prices. On the other hand, businesses that rely on beef or pork as an input to their business, like a wholesale butcher or hot dog maker, can use futures to help offset rising input costs by buying futures to lock in a per-pound purchase price. By establishing a futures position and holding it to expiration, each party will deliver or take delivery of the commodity at their set price on a future date.

Traders at tastytrade can speculate on the potential price fluctuations of deliverable livestock futures contracts up until the first notice date.

Notable Characteristics

Like agriculture futures, livestock futures have unique trading hours that do not align with other asset classes and only trade from 8:30 AM to 1:05 PM (Central Time).

Another notable characteristic of livestock futures is how the quote displays. Livestock futures quote in U.S. cents per pound, like agricultural futures. However, the quote shows a whole number instead of traditionally displaying cents as $0.01. For example, a penny is displayed as 1.00. As a result of quoting in whole numbers, each pound can quote in sub-penny increments up to two decimal points.

How to Read a Livestock Futures Quote

A lean hogs futures (/HE) contract with a last price of 95.350 indicates that each pound of lean hogs costs $0.9535. This results in a total notional value of $38,140 for one contract [(95.350 x 40,000 pounds per contract) / 100].

Furthermore, a price change of -2.225 signifies a decrease of $0.02225 per pound. When in a long position, this would result in a loss of -$890, while when in a short position, it would result in a gain of +$890 (0.02225 x 40,000 lbs= 890). Although a change of just a penny or two may seem insignificant, considering the substantial control exerted by a single contract, even small price changes can have significant implications.

Price Impact Factors

A lot goes into the per-pound price your grocery store sets for beef and pork, and futures can play a part in determining that price. Some factors that could affect livestock futures prices and possibly your next grocery store haul include but are not limited to:

- Adverse weather

- Geopolitical risks, such as sanctions

- Currency

- Energy costs

- Disease

Futures account approval is subject to tastytrade suitability requirements. Futures and futures options trading is speculative and not suitable for all investors. Please read all applicable futures risk disclosures.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.