What are Oil Futures & How to Trade Them

What Are Oil Futures?

West Texas Intermediate (WTI) Light Sweet Crude Oil futures are derivative products that give traders access to the world’s most liquid commodity. These contracts trade on the New York Mercantile Exchange, which is a part of the CME Group, under the ticker symbol /CL and trades in U.S. dollars.

WTI crude oil futures trade six days a week starting on Sunday at 5 p.m. to Friday at 4 p.m. Central Time (CT). There is a daily one-hour break at 4 p.m. CT. Each contract controls 1,000 barrels and has a tick value of $10 and a minimum tick size of one cent. WTI contracts expire monthly, and the contracts are physically delivered. This means that the nearest contract turns into real oil upon expiration.

Cushing, Oklahoma is the delivery point for the underlying crude oil futures. Cushing has a storage capacity of 90 million barrels and is connected to multiple pipelines and storage facilities. Over 1 million contracts are traded every day, making it the leader in price discovery for the crude oil market.

WTI crude oil is made from a blend of U.S. domestic light sweet crude oil, meaning it has a low sulfur content and low density. It is often used to produce gasoline and diesel fuel. While the delivery point is Cushing, WTI also serves as an international benchmark due to a highly integrated global network.

Understand What Oil Trading is and How it Works

Crude oil is one of the most traded commodities in the world and is traded across a variety of financial instruments. In addition to the futures market, crude oil trades in the spot market and on exchanges through exchange-traded funds (ETFs).

Crude oil futures are used by traders to speculate on price movements. For example, a trader who believes that crude oil prices will fall as the economy weakens might go short a crude oil futures contract to express their bearish view.

Oil companies, oil producers, and companies that consume oil use these futures contracts to hedge against adverse price risk. For example, a refiner who produces fuel products from crude oil buys futures contracts to lock in the current price to hedge against rising prices. Hedging increases efficiency in the futures market by adding liquidity to the market.

A large trading firm can use crude oil futures to arbitrage the market and exploit price differences along the futures price curve, or between markets. A firm might sell futures contracts on crude oil for six months out and buy in the spot market if the price difference exceeds storage costs. We’ll talk more about arbitrage and how it affects futures prices later.

The spot market for crude oil involves transactions that are settled and delivered immediately or within a few days and are traded in cash. It is also called the physical market or the cash market. Companies throughout the entire oil complex use the spot market for various purposes, including meeting short-term production needs. Governments use this market to manage strategic reserves, and trading firms use it in arbitrage strategies.

In addition to the futures market, there are exchange-traded funds (ETFs) and stocks of oil companies, like ExxonMobil (XOM), Chevron (CVX), etc.

Oil Futures Trading

Crude oil futures allow traders to speculate and hedge on and against one of the world’s most traded commodities. These contracts allow traders to use leverage to speculate on the price of oil, which can be traded almost 24 hours a day, six days a week.

A diverse set of options are offered for WTI crude oil futures. In addition to monthly options there are weekly options expiring on Monday, Wednesday, and Friday for the four nearest weeks. This allows traders to use risk-defined futures strategies and provides additional leverage to speculate on prices.

If you believe that oil prices will rise, then you can buy a crude oil futures contract. Conversely, if you think crude oil will fall, then you can sell a crude oil futures contract. There are also an E-mini and micro contract, smaller products with lower capital requirements based on the same underlying.

Learn What Moves the Price of Oil

Being a physical commodity, the price of crude oil is primarily influenced by supply and demand. However, crude oil markets are complex, with many factors from production and inventory levels to economic activity and interest rates weighing on the supply and demand dynamics. Trading in the spot market also influences futures prices. We’ll look at some of the more prominent influences below.

- Arbitrage

- Hedging

- OPEC

- Global macroeconomic events

- Inventory and production

- Alternative energy

Carrying Costs, Arbitrage, Hedging: Convergence and Parallelism Between Spot and Futures Prices

Crude oil prices are partly driven by the relationship between spot prices and futures prices—both of which are used for hedging and arbitrage purposes.

Because crude oil is a physical commodity, holders face carrying charges. This is because there are the costs to store, transport, insure, and finance the initial purchase. Since futures contracts don’t have a carrying charge, they are typically priced higher the further out you go in expiration—a phenomenon known as contango.

When the crude oil market is in backwardation—the spot price or nearest-term futures price is higher than prices further out in time—it typically means that buyers are willing to pay a higher price for oil now, suggesting a supply shortage in the physical market.

Because crude oil futures represent a specific amount of physical crude oil, prices in those futures tend to track the spot market price. This is known as parallelism. As a crude oil futures contract approaches expiration, its price tends to get closer to the spot price. This is known as convergence. Arbitrage and hedging in the oil market relies heavily on the relationship between parallelism, convergence and carrying costs.

Arbitrage

Arbitrage is a strategy where crude oil is bought at a low price and sold at a higher price. This occurs when the basis exceeds the cost to carry. The basis is the futures price minus the spot price.

It’s easiest to understand by walking through an example:

Assume that an oil trading firm faces carrying costs of $5 per barrel of oil and the market is in contango—futures prices are higher than the spot price. If crude oil is trading in the spot market at $80 per barrel and the futures contract for delivery in six months is $90 per barrel, then the basis is $10 per barrel.

Since the basis exceeds the firm’s cost to carry of $5 per barrel, the firm would buy in the spot market at $80 per barrel and simultaneously sell that futures contract at $90 per barrel, locking in a profit of $5 per barrel. Upon expiration of the futures contract, they would deliver the crude oil, or they could buy it back before expiration.

When oil futures are in backwardation, market arbitrage opportunities are reduced since anyone with oil is incentivized to sell it as soon as possible. This is why global inventories of oil typically fall in backwardation.

In contango, the arbitrage process leads to convergence by increasing the spot price toward the futures price. If the costs to hold crude oil are less than the basis price, oil will be bought in the physical market and stored until arbitrageurs fulfill their short contracts by delivering their oil.

The increased buying in the spot market pushes prices higher, while the selling in the higher-priced futures contracts pushes prices lower. This occurs until the basis is equal to the carrying costs and arbitrage opportunities disappear. The process adds liquidity to the market, which increases efficiency and price discovery, creating a healthy market for traders.

Hedging

Hedging also influences prices and adds to market efficiency. Hedging is done by anyone who faces price risk in the market. Because hedgers are also seen by market participants as being good price forecasters, their activity in the futures market influences sentiment.

Let’s go through an example of a perfect hedge:

An oil producer would sell futures contracts for crude oil to create a market for the oil they produce. This gives the company a counterparty that provides a fixed price for its product, helping to reduce the risk of falling prices and making it easier to forecast profitability.

Assume it is June and the oil producer wants to hedge against price risk. The spot market for oil is $70 per barrel and the December futures contract is trading at $75 per barrel. The producer sells the December futures contract. The producer is natural long the spot price because they produce oil. Fast forward to November and the contract is trading at $65 per barrel and the spot market is $60 per barrel. The producer would close the December contract and lock in a profit of $10 per barrel ($75 - $65). Since the contract represents 1,000 barrels, they would gain $10,000 on their futures position. Meanwhile the spot price fell by $10 per barrel, representing a $10,000 loss in the spot market. Because of the hedge, the producer was able to hedge the price risk.

However, it’s important to remember that the correlation between the spot and futures price is not perfect. Realistically, hedging doesn’t eliminate all price risk but instead mitigates it to a degree.

OPEC

The Organization of the Petroleum Exporting Countries (OPEC) is a group of 12 of the world’s top oil exporting countries. Founded in 1960, OPEC was formed to help control oil prices through economic and political cooperation between its member states, primarily by controlling the supply of oil.

In 2016 OPEC broadened its membership in response to the United States challenging its influence over global oil prices. The larger group, known as OPEC+, includes Russia—a top three global oil producer. It controls nearly half of the world’s crude oil production. The group holds regular meetings, often monthly, to decide how much oil to collectively produce. When the price of oil falls, OPEC usually cuts production to keep prices at profitable levels for its members’ economies—most of which are highly dependent on the commodity. Because of this, crude oil traders closely follow any announcements put out by the group, especially production levels.

Global Macroeconomic Events

Crude oil demand is closely tied to economic output. That means that prices usually rise when the global economy grows and fall when it slows. The United States, Europe, and China make up the bulk of global oil demand. Consequently, oil prices closely track the performances of those economies.

Gross domestic product (GDP), trade activity, transportation, and construction barometers are considered potentially high-impact data points for the price of oil. For example, if U.S. GDP is stronger than expected, it would likely increase the price of crude oil.

Inventory and Production

Inventory and production reflect the supply side of prices for crude oil. Along with OPEC’s production levels, traders closely follow inventory and production levels for the United States, China, and Europe.

Weekly inventory reports from the U.S. Information Administration (EIA) offer insights into how much crude oil the U.S. stores, produces, and uses. The EIA also releases reports that forecast U.S. and global production and use.

China isn’t as transparent with its data and doesn’t report directly on commercial inventory levels. Still, traders attempt to estimate inventory in the country by looking at domestic production and trade data.

Alternative Energy Sources

The renewable energy transition poses a long-term risk to crude oil prices, as fossil fuels are replaced with renewable sources, such as solar, wind, and hydropower.

Electric vehicle sales grew from 4% of total market share in 2020 to 18% in 2023, according to the International Energy Agency (IEA). The growth highlights the pace of transition away from fossil fuels, which include oil, and toward renewables.

Still, investment in the broader renewables industry has lagged forecasts. BP, a major oil and gas producer, raised its long-term forecast for oil demand in 2024. The company expects oil demand to be 97.8 million barrels per day in 2035. That is only about 4 million barrels per day less than crude oil consumption through the first half of 2024.

That said, crude oil will eventually be replaced by renewable sources but for now, it’s more of a long-term consideration rather than an immediate concern.

Choose Which Oil Futures Contract You Want to Trade

In addition to the WTI crude oil contracts discussed above, tastytrade also offers E-mini Crude Oil futures (ticker symbol /QM) and Micro WTI Crude Oil futures (ticker symbol /MCL).

E-mini Crude Oil futures are half the size of the /CL contract, controlling 500 barrels of crude oil with a minimum price fluctuation of 0.025 per barrel, or $12.50. The Micro WTI Crude Oil futures contract controls 100 barrels of crude oil and has a minimum price fluctuation of 0.01 per barrel, or $1. Both smaller contracts are financially settled but trade during the same hours as the benchmark contract.

Crude oil futures and the micro contracts offer options on futures, while E-mini contracts do not. Options on crude oil futures offer traders more versatility and leverage in their trading strategy. Options also allow traders to define or limit their risk to the premium paid when using credit strategies such as selling a put spread.

WTI Crude Oil offers Monday, Wednesday, and Friday weekly options in addition to monthly expirations, allowing traders to speculate on weekly risk factors such as inventory reports and weather forecasts.

Learn more about the futures month codes listed after the product ticker symbol in the tastytrade help center.

WTI Crude Oil Futures

- Symbol: /CL

- Contract Unit: 1,000 barrels

- Tick Size: 0.01

- Tick Value: $10

- Settlement: Physical

- Options Available: Yes

- Exchange Fee: $1.50

- NFA Fee: 0.02

E-Mini Crude Oil Futures

- Symbol: /QM

- Contract Unit: 500 barrels

- Tick Size: 0.025

- Tick Value: $12.50

- Settlement: Financial

- Options Available: No

- Exchange Fee: $1.20

- NFA Fee: $0.02

Micro Crude Oil Futures

- Symbol: /MCL

- Contract Unit: 100 barrels

- Tick Size: 0.01

- Tick Value: $1

- Settlement: Financial

- Options Available: No

- Exchange Fee: $0.65

- NFA Fee: $0.02

Exchange and NFA fees are subject to change.

Open a Futures Trading Account

You can apply to open your trading account in minutes with tastytrade by following these simple steps:

1. Choose an Account Type

Consider the benefits along with your specific requirements and financial goals to find an account that's suitable for you. Cash accounts are not eligible for futures trading. Be sure to see how to enable other account types for futures trading here.

2. Fund Your Account

Deposit funds to your trading account to begin trading.

3. Take Your First Position

Trade or invest by choosing from a wide range of markets and products such as stocks, ETFs, options, and futures.

Open Your First Oil Trade

Now that you have a grasp of the crude oil futures market, you may be equipped to place your first trade. You’ll want to assess the market by looking at prices and the fundamentals discussed above. Once you decide on a direction, you can buy or sell a contract to express your directional bias.

You’ll have to pick a product based on your account size and individual risk appetite. The E-mini (/QM) and micro contract (/MCL) require less margin than the standard crude oil futures contract (/CL) and reduce your price exposure.

However, the crude oil futures contract (/CL) offers options, which you can use to create a more dynamic risk profile.

Monitor and Close Your Oil Position

Monitor your position once it’s open. You can do this by going to the platform and clicking the “Positions” tab. If you have multiple positions, you can filter by clicking on the “futures” button in the horizontal tab to the right of positions. Here you’ll see your crude oil futures position, with the Symbol, Last, P/L Day, Bid (Sell), Ask (Buy), IV Rank, Cap Req, and Days To Expiration. You can configure these settings to display more or fewer metrics by clicking on the gear icon at the top right of the screen.

You can also close your position from the positions tab. Simply click on the position, right-click, and then select “Close position.” A closing order ticket will open.

Your crude oil position can also be closed using the “Activity” tab, located a couple tabs below the “Positions” tab. Click on it and then find your order. Right-click the order and then select “opposite order” to generate a closing order ticket.

Crude Oil (/CL) Futures Trading Example

Sign into the tastytrade platform.

Type /CL into the symbol field on the top left side of the platform and press enter.

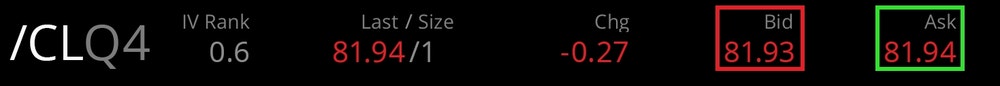

The nearest-term active contract for crude oil will populate. In this example the August contract (/CLQ4) populates, showing the contract’s last price, change, bid, ask, size, volume, and the contract name at the top of the platform. Learn more about futures trading hours.

If you click on the bid price, the order ticket at the bottom will appear and populate to show a short order defaulting to a single contract, denoted by a -1 in the quantity field. It also displays the limit price at the bid and the order type defaults to a limit order. Time in force, denoted by “TIF,” will also appear, defaulting to “Day.”

.jpg?format=pjpg&auto=webp&quality=90&width=1000&disable=upscale)

The same happens if you click the ask price, except it will show a buy order for 1 contract with a limit price at the ask. To adjust the quantity, you would click the up or down arrow. You can adjust your limit price by using the arrows on the limit price tab.

.jpg?format=pjpg&auto=webp&quality=90&width=1000&disable=upscale)

If you’re comfortable with buying or selling at the price, quantity, order type and TIF, you can click the orange “Review & Send” tab on the bottom right to review the order.

If everything looks good, you can place the order by clicking the orange “Send Order” tab, also on the bottom right. Be sure to review commission and fees on this page, along with the rest of the order details. To go back to the trade page, you can click on “Edit Order” to adjust or clear the order ticket.

FAQs

Crude oil futures are accessible and highly liquid, allowing traders to easily enter and exit trades nearly 24 hours a day, six days a week.

Trading futures contracts requires you to have a margin account, and while there is no minimum account balance required to trade a crude oil futures contract, you must meet the overnight margin requirement. If you have a smaller account, the micro WTI crude oil futures contract has the lowest overnight margin requirement.

Crude oil futures—like all futures—are standardized financial contracts that obligate the buyer to purchase, and the seller to sell, crude oil per the contract’s specifications.

Crude oil futures trade nearly 24 hours a day, six days a week. Trading starts on Sunday at 5:00 p.m. Central Time (CT) and stops daily for 60 minutes at 4:00 p.m. before reopening at 5:00 p.m. The trading week ends on Friday at 4:00 p.m.

“/CL” is the ticker symbol for the standard Light Sweet Crude Oil futures contract. “/QM” is the symbol for the E-mini Crude Oil futures contract, and “/MCL” is the symbol for the Micro WTI Crude Oil futures contract.

Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read all applicable Futures Risk Disclosures prior to trading futures products.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.