How to Trade Futures

Trading futures gives you the unique opportunity of securing your right to take a position at a later date, but at a predetermined price. Get the details on how to trade futures in this guide.

How to Trade Futures in 7 Simple Steps

Easy-to-understand steps for trading futures:

1. Learn the Basics of Futures Trading

It is vital that you build solid foundational knowledge of futures trading and how it works before getting started. This way, you can manage your risk better and boost your overall market awareness.

So, what are futures anyway? Futures are standardized derivative contracts that enable you to buy or sell an asset at a predetermined price and date.

Futures Contracts Standardization

One of the important aspects of futures contracts is that they are standardized – this ensures liquidity. Standardization of futures contracts means there are specific benchmarks on a range of aspects relevant to any given asset. These factors include:

- Underlying asset: asset being traded, e.g., commodities or foreign currency

- Quality: grade of the underlying asset Settlement type: whether it will be settled in cash or through physical delivery

- Contract unit: quantity of the underlying asset outlined in one contract

- Currency: the unit of money that the futures contract’s price quotation is in

- Date of delivery: time at which the final cash settlement, or the delivery, will be made

- Last trading date: the day before the contract expiration

- Tick size and value: the minimum increments by which prices can change and how much it is worth, e.g., the tick size for gold is 0.10 and the tick value is $10

- Maximum price fluctuation permitted: highest change in price that is allowed within a trading session

Mark-to-Market in Futures

Futures and options on futures are marked-to-market at the end of each trading day, making them Section 1256 products. With fair value measured daily, this is reflected in the futures contract price.

Marking-to-market refers to the valuing of assets – a process where profits and losses between long and short positions are settled at the end of each trading day. This means that the underlying asset’s settlement price becomes the new futures baseline price.

Notional Value and Leverage in Futures Trading

Notional value is how much the underlying asset’s units that is controlled by a derivatives trade is worth in total—the full amount that is at risk. Additional fees such as commission and margin relief are not factored into this amount. Position and market volatility affect buying power. For this reason, you need your initial margin to open your position and maintenance margin, the minimum amount required in your account. If there is less than this amount, a margin call occurs.

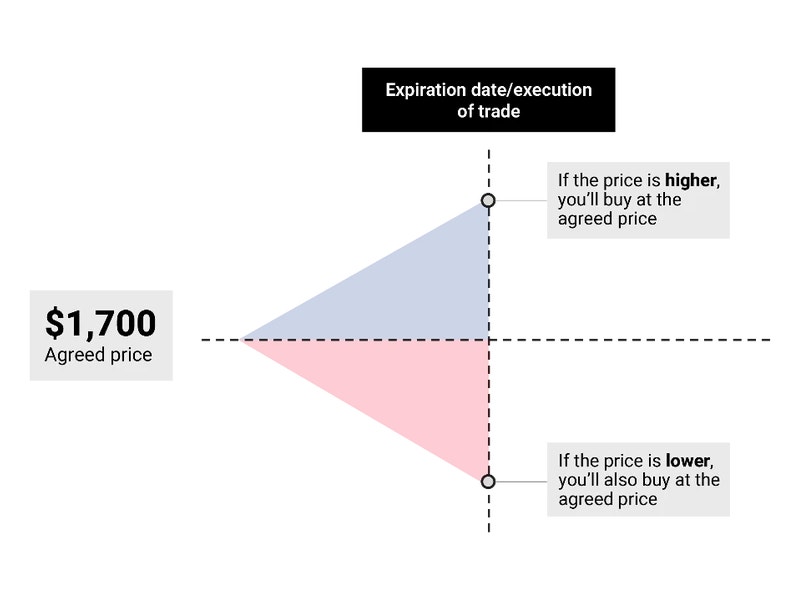

To calculate notional value, multiply the spot price per unit with the futures contract size. For example, if the price of gold is $1,700 and the contract size is 100 troy ounces (one contract unit), the notional value would be $170,000. Had the contract size been 200 troy ounces (two contract units), the notional value would be $340,000. Notional value is different from market value.

The market value is the same as the futures contract price, i.e., the spot price of the underlying asset (one unit). Based on our example, the market value of gold would be $1,700. The affordability of your trade is also affected by leverage, which lets you open your position at just a percentage of the full value of the trade. Regardless of this, your risk will still be equal to the notional value (excluding any additional fees).

Futures Contract Tick Size

Contract tick size is one of the fundamentals to understand in derivatives trading. Contract tick size refers to the minimum increment possible by which the underlying asset’s price can change. The tick size of an instrument is set by an exchange, e.g., the Chicago Mercantile Exchange (CME) put the tick size of gold at 0.10 and the tick value at $10 since a gold futures contract controls 100 troy ounces.

While ticks are indicated on the right side of the decimal point in the asset’s price, points are on the left of it. After acquainting yourself with the basics of futures, take a deep dive to make sure you have a good understanding of all the moving parts.

2. Pick a Futures Market to Trade

When it comes to choosing a futures market, you might have certain preferences, e.g., broad exposure, debt instruments or natural resources. Additionally, the number of potentially beneficial opportunities within markets fluctuates—at any given time, one might have particularly better prospects. Our extensive range of products across markets gives you the freedom to find what is right for you.

tastytrade provides a variety of products within these markets:

- Equity index futures Interest rate futures

- Foreign currency futures

- Commodities

- Energy futures

- Metal futures

- Agricultural futures

- Livestock futures

- Volatility Futures

- Cryptocurrency futures

3. Open a Futures Trading Account

Apply for a futures trading account and get a taste of something fresh.

- Try new features that are intuitive and engaging

- Use our in-app content to boost your market awareness

- Increase your potential returns and take your capital further with leverage

Ready to Trade?

4. Develop a Trading Plan

Developing a trading plan helps you lay out exactly what it is you hope to achieve. Remember to not walk in blindly—think carefully about what your long-term objectives are and how you are planning to reach them. Here are some essential questions you need to ask yourself when drawing up your trading plan:

- How will I choose my assets?

- What type of trading style am I going for and what strategies will I employ?

- How much capital is in my account and how much do I want to allocate per trade?

- What types of price extremes are there in various futures products?

- What is my risk appetite and how will I manage my risk?

- Are there any binary events coming up to be aware of and possibly take advantage of?

- How volatile is the futures product? Is its price movement slow-moving or rapid?

- Do I have any correlated positions? If so, how will I hedge these?

- What is my ideal entry/exit point for this trade?

- How often and for how long do I need to monitor a trade (or my portfolio)?

Even though it is impossible that it will be entirely foolproof, it is always a good idea to stick to your trading plan. Switching things up might be tempting sometimes. So, it is vital to prepare for the hasty responses you could have along the way. Understanding what influences your decision-making, e.g., the psychological impacts of trading, is important. Is it your personality, emotions, or moods? Perhaps it’s behavioral biases such as loss aversion, or maybe it's social pressures. It could even be a combination of factors.

5. Identify an Attractive Trading Opportunity

With tools such as tastytrade’s Follow Feed and in-platform video feed, you can choose from a wide range of opportunities across markets. You can also use features such as the market watchlists to access curated lists of futures, as well as trade metrics to analyze trading performance, and more.

But before you choose your preferred futures market and asset, it’s important that you give thorough consideration to your risk tolerance level and the relevant disclosures.

Outright Futures Trading Strategies

Investors can speculate on the direction of a futures contract by going long (buy to open) or short (sell to open) a futures contract. Moreover, investors noticing price convergences or divergences between different contract months of the same future, or between two separate futures contracts, can speculate by establishing an outright futures calendar spread trade or pairs trade, respectively. Futures are not subject to Pattern Day Trading rules, unlike trading stocks or options. Investors seeking to speculate by day trading futures actively are not limited by how many day trades they perform within a trading session.

Buying/Long Individual Outright Futures

Investors speculating that the price of a futures contract will go up can establish a long position by buying to open the contract. An investor can profit from a long futures contract as the price rises. Losses occur when the futures contract price falls below the contract's purchase price or cost basis.

Selling/Short Outright Futures

Investors speculating that the price of a futures contract will go down can establish a short position by selling to open the contract. An investor can profit from a short futures contract as the price falls. Unlike long positions, losses occur from a short futures contract position when the price rises above the sale price.

Futures Trading Examples

Suppose you are bullish on gold. You take a long position on the precious metal at $1,700 and one contract (100 troy ounces). You close the position before it expires, at which point the price of gold is at $1,750. You would pay $1,700 instead of $1,750, $50 less than the new market price. You would benefit and the seller would lose out. But there is more to calculating a futures contract profit or loss (P/L). First, you would divide the profit per contract (or the difference between the futures price and the price at expiration/execution of trade)—$50 in this case, by the tick size (0.10 for gold futures). That gives you the total tick movement (500 ticks). Then you would multiply this with the tick value ($10 for gold futures), which gives you your total P/L. In this case, your profit is $5,000.

For a contract size bigger than 1, you would multiply this figure with the number of contracts to determine your P/L. Now imagine that you let the futures contract expire, at which point the price of gold is at $1,600. You would pay $1,700 instead of $1,600. That means you would have missed an opportunity to pay $100 less than the new market price. You would calculate the P/L as per the previous example. In this case, it would be $10,000. As per this example, you would lose out and the seller would benefit.

Outright Futures Calendar Spreads and Pairs Trades

Investors who notice price deviations between different contract months of a specific futures contract or notice that prices between two separate futures contracts are inverse can speculate by placing an outright futures calendar spread trade or pairs trade.

An outright futures calendar spread, or intramarket spread, describes a strategy where an investor buys or sells the active month futures contract and performs the opposite order action on the same future in a back-month contract. It is important to note that investors can speculate between any two contract months of a specific futures contract. It is worth noting that available contract months vary for each outright futures contract.

Similar to intramarket futures spreads, a futures pairs trade describes a strategy where an investor buys or sells a futures contract and performs the opposite order action to a different contract. Investors can speculate between the inverse price action of two futures contracts by placing a pairs trade. Whether an investor speculates by establishing an outright futures spread trade or a pairs trade, both have the same goal of price convergence or divergence.

Before we discuss an example, it is essential to understand what convergence and divergence mean in a futures calendar spread or pairs trade. Convergence assumes the two products or contracts are at price extremes far away from each other. A convergence would profit when the prices of the two products moved towards each other over time.

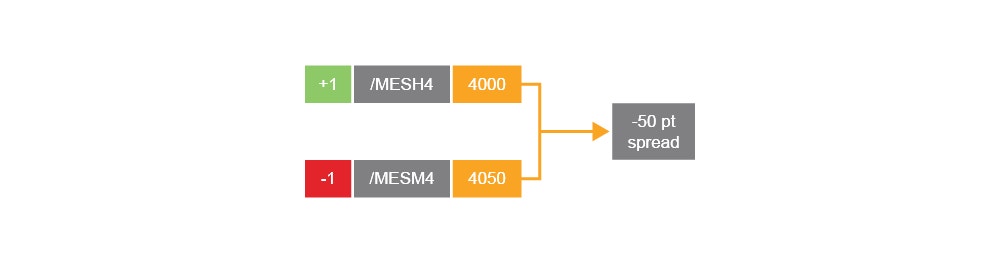

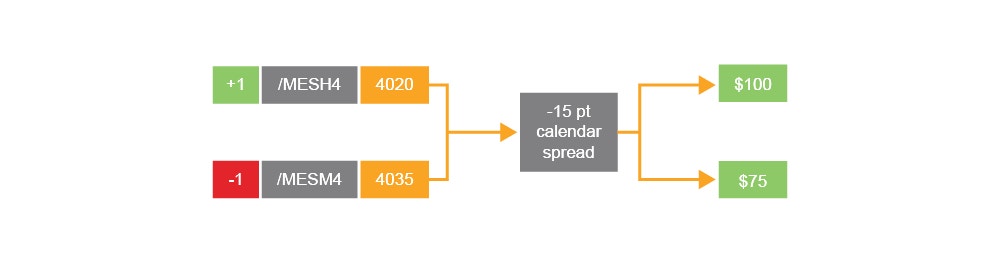

For example, if we are long the front-month /MESH4 futures contract at 4,000 and short the back-month /MESM4 futures contract at 4,050, we would see profitability if the price of the front-month contract rose, and the back-month contract fell. Of course, when the inverse occurs in the example above, we would see losses on both contracts.

The example above shows the spread narrowing from -50 points to -15 points due to the long front month /MES contract increasing 20 points for a $100 gain (20 pts x $5) and the short back-month /MES contract dropping by 15 points for a $75 gain (15 pts x $5). This equates to a $175 total profit between the two contracts ($100 + $75).

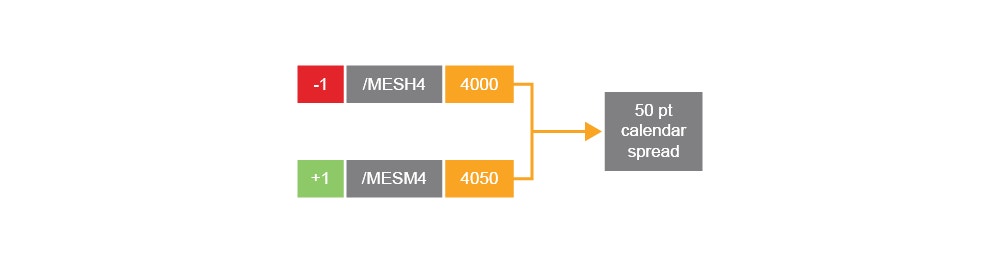

Conversely, traders can speculate on a divergence. Traders speculating on a divergence assume the price of each futures contract in an outright futures calendar spread will move away from each other over time.

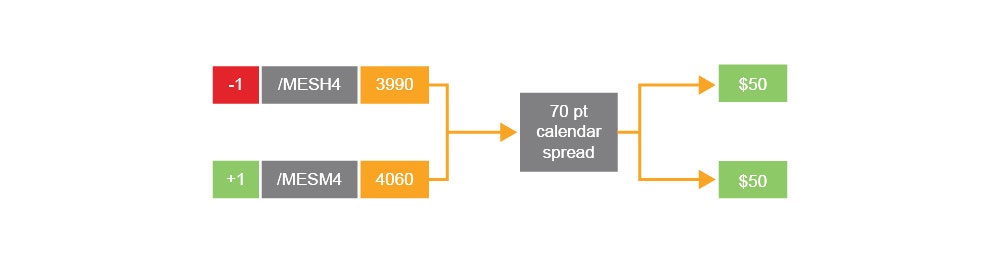

For example, let’s say we are short the front-month /MESH4 futures contract at 4,000 and long the back-month /MESM4 futures contract at 4,050. We would see profitability if the price of the front-month contract fell, and the back-month contract rose. Both contracts are moving away from each other or diverging. If the price of both contracts started moving toward each other, in this example, a loss would be incurred.

The example above shows the spread widening by 10 points due to the short front-month /MESH4 contract dropping by 10 points (from 4,000 to 3,990) for a $50 gain (10 pts x $5) and the long back-month /MESM4 contract rising by 10 points. This equates to a $100 profit between the two contracts.

Before establishing, it is essential to fully understand the risks of futures calendar spreads and pairs trades. The tastytrade desktop trading platform has the Pairs Trading mode for investors seeking to establish futures spread or futures pairs trade. Please visit the tastytrade Help Center to learn more about the Pairs Trading mode.

6. Open Your First Futures Trade

Once you have been approved to trade futures, follow these steps to open your first futures trade:

- Log in to your tastytrade account

- Find the futures market and the asset you want to trade

- Decide whether you will go long or short

- Manage your risk by adjusting the quantity, price, and order type

- Open your position and monitor the market

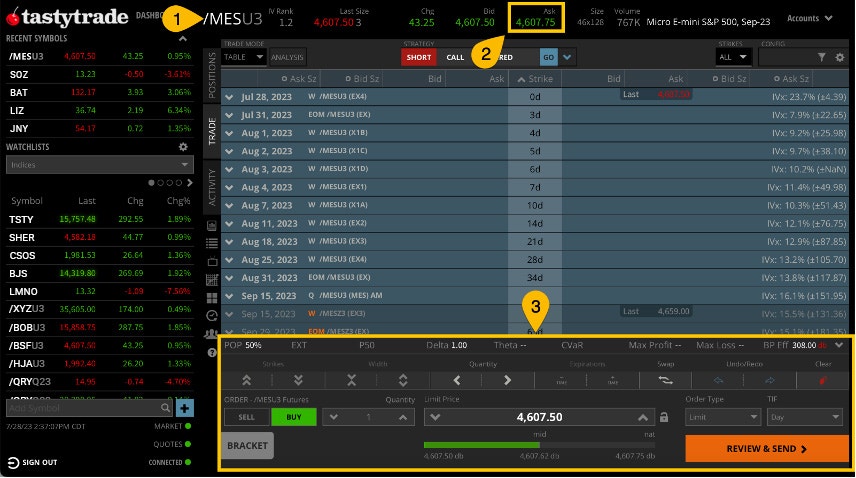

More specific guidelines depend on the futures market you want to trade and the interface you are using (desktop, mobile ,or web browser). Like the start of any trade, it all starts with entering the futures root symbol into the active symbol field at the top of the tastytrade desktop trading platform. The tastytrade Help Center also has video instructions on how to set up a futures trade on the platforms.

How to Set up a Long Futures Trade

Enter the futures root symbol.

Click on the Ask price.

Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking Review and Send. Verify your order including commissions and fees before clicking Send to place the order.

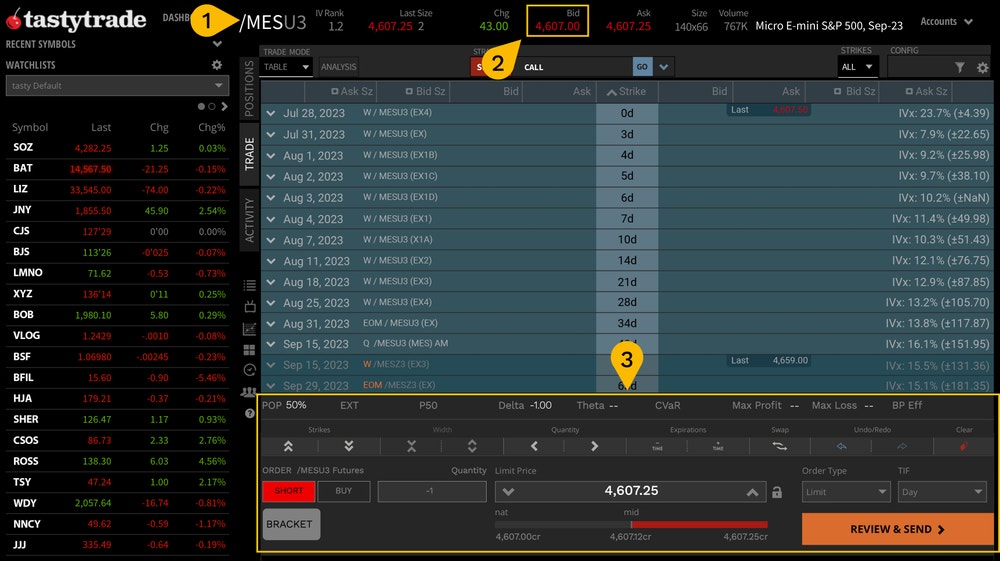

- How to Set up a Short Futures Trade

- Enter the root symbol.

- Click bid price.

- Go order ticket determine quantity, price, time-in-force (tif), etc., before clicking review and send. Verify your including commissions fees send place order.

Features like the Active Trader Interface on the tastytrade desktop platform are purpose-built for active futures traders. At tastytrade, margin accounts with our highest trading level, "The Works," can trade futures after enabling it. While there is no minimum to enable futures trading, investors must have enough account equity to satisfy the overnight or SPAN requirement when establishing a futures position.

Futures trading is also available in IRAs with our highest trading level, "IRA The Works," after satisfying account minimums. Please visit the tastytrade Help Center to learn more about our trading levels, including how to enable futures trading after your account is open and minimums for IRAs.

7. Monitor and Close Your Futures Positions

Once you have executed your futures trade, it is important to manage it accordingly. You can either let the contract expire if it is financially (cash) settled or close it before the expiration if you believe you will lock in profits or cut losses this way. The tastytrade platform has capabilities that empower you to manage your open positions effectively. These include the Active Trader Interface as well as risk management tools such as stop orders, quote alerts, and charting features like technical indicators.

Futures Stop Orders

Instead of constantly monitoring your futures position manually, you can opt for in-platform features such as stop limit and stop market orders that can do a lot of the heavy lifting for you. Predefining your trading conditions this way lets you enter and exit your position at price levels that you are comfortable with.

Learn how to set up a stop order

Technical Indicators

Technical indicators, such as moving average convergence divergence (MACD) and relative strength index (RSI), are chart analysis tools. They can alert you of ongoing trends and give you a look at how a market has performed historically. Both analysis tools can be useful in your decision-making as they are designed to predict future price action. Relying solely on chart indicators can lead to bumps in the road, making it important to use them alongside your trading plan.

Futures Trading Capital Requirements

The idea of paying when buying and collecting cash when selling is widely understood when considering buying or selling any asset. However, when trading outright futures contracts, that changes a bit. Since an outright futures contract is a binding agreement between two parties, an agreement is established between two parties when opening a futures position.

Unlike other asset classes where you pay to go long or collect proceeds when going short, with outright futures contracts, investors do not "pay" or "collect" anything when establishing a futures position. Instead, they assume the risk of the contract being long or short from that point. This section covers what is required when opening an outright futures position and how it differs from other asset classes. This section can help investors seeking to expand from equity or equity options trading to futures by understanding the unique nature of the capital required to open an outright futures position.

Overnight Futures Trading Capital Requirements

After enabling futures trading, investors looking to trade outright futures contracts must satisfy the overnight requirement to establish a long or short futures position. The overnight requirement is the dollar amount investors must have in available options buying power (non-marginable equity) to open an outright long or short futures contract position. Moreover, it is important to note that the futures exchange determines the overnight requirements for each contract.

Even if you do not plan to hold a futures contract overnight, investors looking to trade them must satisfy the entire overnight requirement to establish a position. The overnight requirement amount will also vary by contract, with Micro E-mini contracts requiring a fraction of their E-Mini counterpart. It is important to note that the overnight requirement of a futures contract could increase or decrease throughout each trading session, especially during periods of heightened volatility, and require additional capital to maintain the position. Lastly, it is essential to note that the overnight requirement investors must post when establishing long or short futures positions is not exactly a "cost." After closing an outright futures position or holding any financially settled futures to expiration, the held overnight requirement will be released back to your buying power, net any final gain or loss, commissions, and closing fees.

Please visit the tastytrade Help Center to view a complete list of available futures contracts, including the real-time overnight requirement for each contract. Futures trading in an IRA is subject to account minimums and additional suitability requirements. Please visit the tastytrade Help Center to learn about IRA minimums for futures trading, including instructions on potentially upgrading to "IRA The Works."

Intraday Futures Margin

Investors seeking to trade futures intraday from 8:30 AM to 3:00 PM CT and not carry them overnight or establish options on futures positions against their outright futures position can utilize intraday futures margin for additional leverage. Intraday futures margin is only available for non-IRA margin accounts.

Investors eligible for intraday futures margin only need to post 1/4 of a future's overnight requirement, effectively providing investors with 4X futures leverage. For example, an investor with intraday futures margin enabled looking to establish a futures contract with an overnight requirement of $10,000 will only have to post $2,500 per contract to establish a long or short outright futures position instead.

It is important to note that outright futures contracts, by their nature, are already leveraged products. By enabling intraday futures margins, investors can yield accelerated profits if the position works in their favor. However, it can expose investors to accelerated losses too.

Lastly, any outright futures contracts held after the stock market close (3:00 PM CT) on days when markets are open will revert to the standard overnight requirement. Investors with insufficient account equity to maintain those positions established may incur a negative buying power and be required to liquidate positions to free up account equity or become subject to a Futures Maintenance (FM) Margin Call.

Please visit the tastytrade Help Center to learn more about account minimums to enable intraday futures margins and much more. Intraday futures margin relief hours differ for Agricultural and Livestock futures due to their unique trading hours.

FAQs

There is no minimum account balance for tastytrade account holders to start trading futures in a margin account.

Using an IRA account, however, means that start-of-day net liquidation for CME micro e-mini futures and CME options on micro e-mini futures must be $5,000; and $25,000 for standard CME futures contracts and options on futures.

IRAs also have increased buying power requirements:

- Long options on futures: Debit paid

- Short options on futures: 2X CME SPAN Margin Requirement

- Long/short options on futures spreads: 2X CME SPAN Margin Requirement

- Outright CME futures contract + any options futures position in the same root symbol: 2X CME SPAN Margin Requirement

- Outright CME future and CME micro futures: 125% of the overnight requirement

Whether you are looking to trade futures in a margin account or an IRA account, you are good to go if you meet the overnight requirements, in addition to the buying power requirements.

Yes, you can trade futures day and night. However, some contracts have specific trading hours. With a tastytrade account, futures trading is available to you 23 hours a day for most products.

The best futures trading platform is the one that works for you, as it depends on whether your needs as a trader are met.

Join the tastytrade customers that are already dabbling in futures and see whether we have the best futures trading platform for you.

In comparing platforms, you might want to consider factors such as:

- Educational resources

- Pricing and fees

- Safety, reliability, and speed

- Optimization for desktop, browser, and mobile

- Trading hours

- Trade desk support

- Customer communications

- Customizable trading preferences

- Regular updates and feature releases

- Wide range of product offerings

- Support with tax documentation

You can buy and sell futures on the tastytrade trading platform by following our steps on how to trade futures. The tastytrade trading platform also offers the active trader interface, purpose-built for active futures traders.

Due to the speculative nature inherent in futures products, the risk of loss in trading futures products can be substantial. You should consider whether trading futures are suitable for you due to investing circumstances, risk tolerance, and financial resources. Please read all applicable futures risk disclosures prior to trading futures products.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.

Futures and futures options trading is speculative and is not suitable for all investors. Please read the Futures & Exchange-Traded Options Risk Disclosure Statement prior to trading futures products.