Options Backtesting

Open a tastytrade account and get access to the backtesting tool. Test your trades by simulating with past data, for free.

Take the Guess Out of Guesswork

Our options backtesting tool lets you use historical data to see how a trade would’ve performed over time. Backtest whatever options strategy you can think of—from single options to multi-leg strategies—using the most popular symbols with 10+ years of data.

Learn From the Past

View the past performance of trades and if they would’ve been profitable or incurred a loss. Edit custom parameters to see how different variables would’ve affected your position.

What is Options Backtesting and How Does it Work?

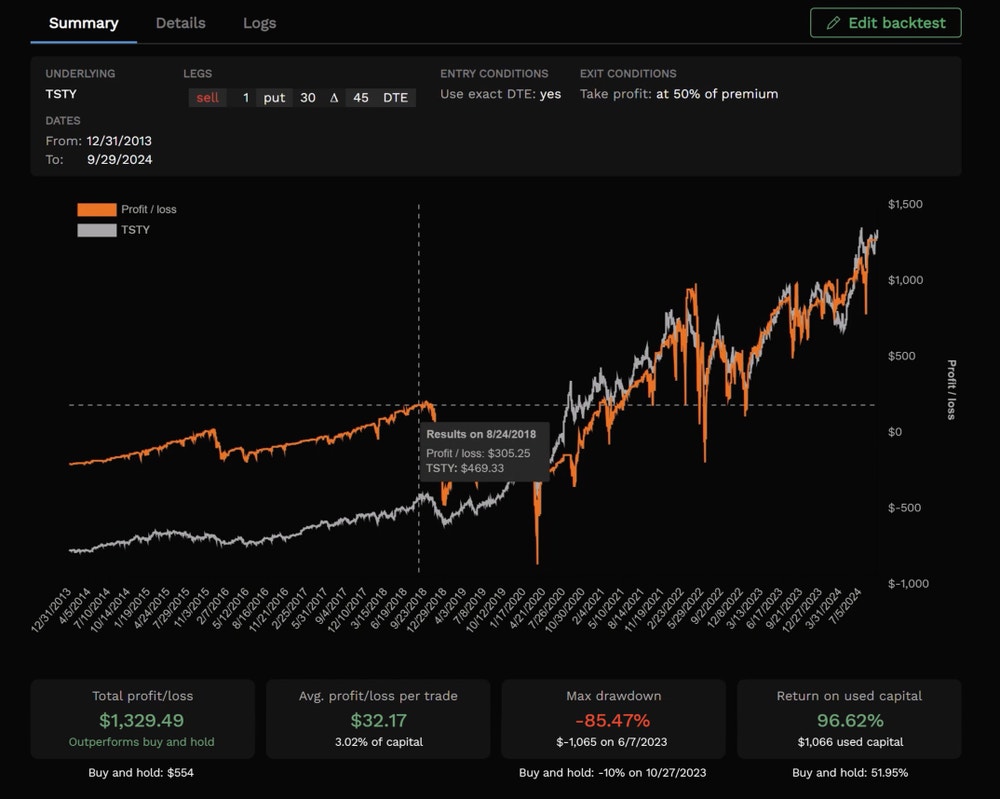

Options backtesting measures a strategy’s performance over a past time period by looking at total profit or loss, average profit or loss, and overall return on capital. With the tastytrade backtesting tool, you can input long or short options strategies as well as spreads and specify the timeframe you’re analyzing.

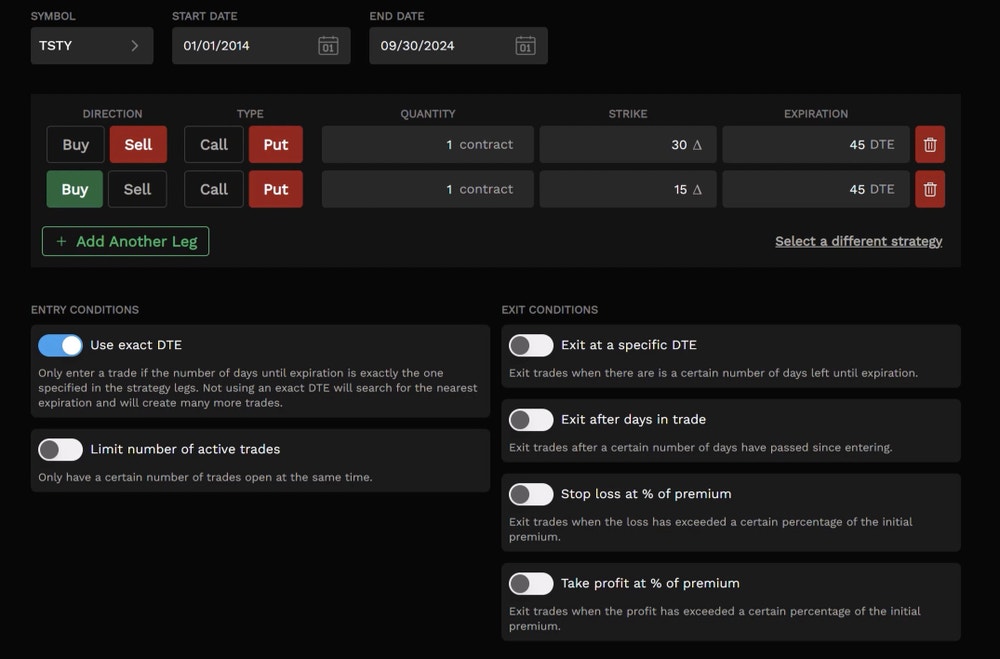

Options contract quantity, strike delta, and expiration are just a few of the inputs available to you for backtesting options strategies.

You can also enter trade exit conditions, with variables like exiting at a specific DTE, or after you realize a certain percentage of loss or profit.

When you run the backtest, it presents a graphical representation of P/L, with profit and loss metrics for your selected timeframe. You can also see the total number of trades entered and exited, how many trades produced profits vs losses, and more in-depth statistics for your backtest.

How to Use Our Backtesting Tool

- Sign in to my.tastytrade.com: Navigate to the Trading tab. Then, on the left navigation bar, select Backtesting.

- Enter a ticker symbol: To use the tastytrade backtesting tool, you need to first select a ticker symbol to analyze. Many popular symbols are available, with several years of historical data to reference.

- Select a start and end date for your backtest: Specify your start and end date for trade analysis. We have many years of data available.

- Select your options strategy to analyze: You can select a single put or call, or a multi-leg options strategy to analyze from either the long or short side. You can also change your contract quantity, strike delta, and options expiration date here.

- Specify trade entry conditions: To further customize your backtest, you can decide whether to use exact DTE, or the closest expiration that fits your specification. You can also limit the number of active trades, so that only a certain number of trades can be active at one time. This feature ensures that your trade size is considered.

- Specify trade exit conditions: After you submit your trade entry parameters, you can customize certain variables that will trigger the closing trade. You can exit the trade at a specific DTE or choose to exit after being in the trade for a certain number of days. You can also exit the trade at a stop loss percentage, or after gaining a specific percentage of profit.

- Analyze your options trade backtest results: After you run your backtest, you can see overall results graphically on the summary tab. This page overlays your trade P/L relative to buying and holding the underlying asset. You’ll also see overall profit, loss, and return on capital figures here.

In the details tab, you’ll see each trade’s profit and loss in isolation over time. You can also see the number of trades executed, percentage of profit and loss rates, highest profit and worst loss, and much more.

On the logs tab, you can see all trade transactions and pertinent information related to each transaction. You can also download a spreadsheet of all transactions from this tab for further analysis.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

Backtesting tool is provided for informational and educational purposes only. Past performance is not indicative of future results.