After Hours Trading: Trade Pre- and Post-Market

What is After-Hours Trading?

Investors and traders can access the stock market not only during the regular daytime trading hours but also during the pre-market and post-market.

However, market participants who elect to trade during these extended sessions should know that the pre- and post-market dynamics can differ significantly from the regular daytime session.

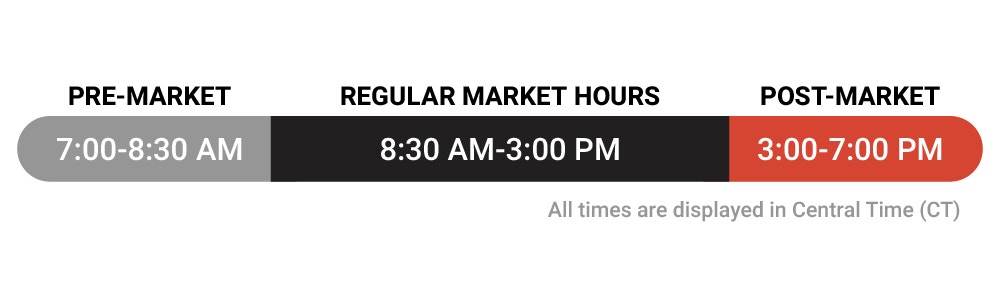

Most are aware that the normal daytime trading session for stocks is conducted on weekdays from 8:30am to 3:00pm Central Standard Time (CST). This period is officially bracketed by the "opening bell" in the morning and the "closing bell" in the afternoon.

Currently, the tastytrade pre-market session opens at 7:00am CST and runs until 8:30am CST, while the post-market session (aka “after-hours session”) runs from 3:00pm CST to 7:00pm CST.

There are some benefits to trading after hours. It allows you to:

- Keep an Eye on Earnings: React to and trade company earnings announcements each quarter

- Discover Diverse Opportunities: Speculate on the markets and access more potential opportunities

- React to Breaking News: Place trades and manage positions based on breaking news outside of regular trading sessions

What is 24/5 Trading?

24/5 stock & ETF trading is available on tastytrade. Trade any stock in the S&P 500, Nasdaq 100, and select exchange-traded funds (ETFs) 24 hours a day from Sunday night to Friday night. Trading beyond normal market hours enables traders to respond to developments that occur before or after the closing bell, providing more flexibility to respond to news and manage your risk.

24/5 trading enables round-the-clock access to stocks & select ETFs on a continuous basis from Sunday 7:00 pm to Friday 7:00 pm Central Time.

What & When Can You Trade After Hours?

With tastytrade, you can trade 24/5 or during specific pre- and post-market trading sessions. Extend your reach with a selection of stocks, ETFs, and options beyond regular trading sessions in the intervals below.

Stocks & ETFs

- 24-hour trading: 7:00 pm Sunday to 7:00 pm Friday CT (continuous)

- Pre-market trading session: 7:00am to 8:30am CT1

- Post-market trading session: 3:00 pm to 7:00pm CT

ETF Options

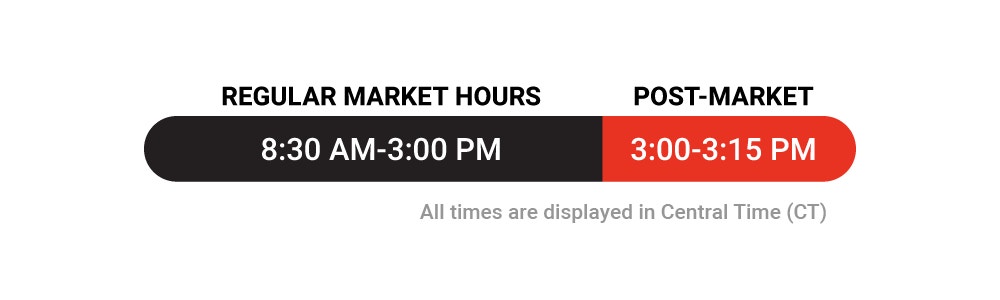

- A selection of ETF options trade until 3:15 pm CT, or 15 minutes after the close of the market

Some orders may be subject to a no cancel period.

Risks of After-Hours Trading

Importantly, the dynamics of the pre-market and post-market trading sessions can differ greatly from the regular daytime session, and one of the most important considerations is liquidity—or lack thereof.

Liquidity in the financial markets is defined as the ability to easily convert an asset into cash without significantly affecting the associated market price of that asset. A high degree of liquidity helps ensure that pricing in a given market is as efficient as possible.

Unfortunately, the pre-market and post-market trading sessions frequently offer sub-optimal liquidity. That means, in short, that executing trades during these sessions can significantly affect prices resulting in unfavorable pricing. Slippage is the term to describe a situation when an investor faces difficulty or unfavorable pricing when entering or exiting a trade due to lack of liquidity.

In general, that means an investor or trader attempting to execute an order outside the regular daytime session may not be able to complete their entire order at the posted bid/offer prices, and will therefore be forced to accept a sub-optimal price (sometimes significantly) to complete the order. Investors can also wait until the regular daytime session begins, but there is no guarantee where the market would open.

In addition to suboptimal liquidity, the pre-market and post-market sessions may also be characterized by the following:

- Inexplicable gap moves

- Elevated volatility

- Wider bid-ask spreads

Order Types

Investors and traders should note that outside of regular trading hours, the order types accepted by the system are also limited. That means "market orders" and "stop orders" can't be entered. Instead, market participants must use limit orders only, which is an order type that guarantees the price you entered or better but doesn’t guarantee a fill. Using limit orders during the extended hours trading session applies to equities, equity options, futures, and options on futures. Traders can select extended hours as their time-in-force (aka "EXT limit") to trade during the pre-market and post-market.

In terms of other securities, options on single stocks are not open for trading outside of the regular daytime trading session, which means options-related transactions in single stocks cannot be executed during the pre-market and post-market sessions. However, some ETF options do continue to trade after the regular daytime session, from 3:00pm to 3:15pm, or 15-minutes after the regular trading session closes.

How Do I Start Trading Extended Hours?

You can start trading out of regular trading sessions by following these steps:

- Learn about extended hours trading

- Create an account or log in

- Decide which market and asset you want to trade

- Open, monitor, and close your position

1These hours also pertain to orders by phone, e-mail, or chat to our trade desk. Any unfilled extended hours orders entered during the pre-market or normal trading session (8:30 am CT to 3:00 pm CT) will continue to work and expire at 7:00 pm CT the day it was entered. Also, please be aware that stop orders do not carry over into extended hours.

Trading during extended hours involves additional risks, including but not limited to reduced liquidity, increased volatility, wider bid-ask spreads, and the potential impact of news released outside of regular market hours.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.