What is Portfolio Margin & How Does it Work?

What is Portfolio Margin?

Portfolio margin (PM) is a dynamic risk-based margining system commonly used by trading firms to compute the margin requirements for eligible positions. In short, PM can often allow traders to have more flexibility with positions by requiring less capital to maintain positions. The result is more leverage.

PM accounts base their end-of-day margin requirements on the Theoretical Intermarket Margining System (TIMS) as instructed by the Options Clearing Corporation (OCC).

tastytrade uses an industry-standard theoretical option pricing model to determine potential real-time losses at various price points and levels of volatility.

The maximum theoretical single-day loss from the percentage-based price points is aggregated to determine the portfolio's overall margin requirement.

Enabling PM will often result in a lower margin requirement than standard Regulation-T margin account requirements, specifically for non-concentrated, hedged positions. This can provide users with additional buying power to diversify further and/or hedge their portfolios. Additionally, this improves the alignment between margin requirements and the overall risk in the portfolio. See below for additional information on PM at tastytrade and the instructions on how to estimate what your margin requirements would be if your account was approved for PM.

Funding Requirements for Portfolio Margin Accounts

tastytrade margin accounts must satisfy an initial funding requirement of $175,000 to activate portfolio margin (PM). Afterward, customers must maintain $150,000 in their securities account to keep PM active.

When a PM account falls below $150,000 at the close of business (EOD)1, it will trigger a downgrading process. Accounts in the process of downgrading that fall below $100,000 before the downgrade process is completed will shift to a more restrictive downgrade process.

How to Apply for a Portfolio Margin Account

Apply for portfolio margin by logging in to your account at my.tastytrade.com. Individual, joint, international, and entity margin accounts with The Works may apply. After logging in, navigate to My Accounts, and select Trading Preferences. Full instructions can be found here.

Regulation-T vs. Portfolio Margin: What Are the Differences?

Standard margin accounts are governed by Federal Reserve Board’s Regulation-T (Reg-T) margining methodology. Reg-T requirements are based on a fixed percentage, position-based system. Conversely, portfolio margin (PM) account requirements are determined by the theoretical risk of the portfolio as a whole. This can result in lower requirements and greater flexibility for the trader.

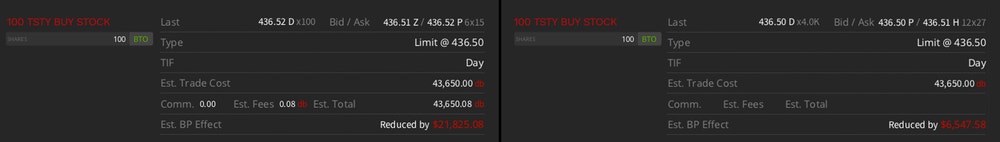

Reg-T margin accounts hold a fixed percentage margin requirement as collateral which allows you to borrow cash to hold securities positions. When establishing a stock position, Reg-T requires investors to have 50% of the trade's value as the initial margin requirement and 25% (long stock) or 30% (short stock) of the position's value after that. For uncovered options strategies in a Reg-T account, the margin requirement to establish a position is based on a fixed, rules-based percentage. Maintenance margin requirements can vary under certain market conditions such as large implied volatility increases, hard-to-borrow stocks, and more.

PM is a risk-based methodology that allows an investor to have improved transparency and alignment between margin requirements and the overall theoretical risk of the portfolio. PM calculates margin requirements by looking at the aggregate exposure of a trader’s portfolio. If an investor has a well-hedged portfolio, their margin requirement can be much lower than it would be with a Reg-T margin account.

Due to the Theoretical Intermarket Margining System, PM accounts can get up to 6.7:1 leverage. Reg-T on the other hand is capped at a leverage ratio of 2:1.

Advantages of a Portfolio Margin Account:

- Can offer more flexibility than Reg-T accounts

- Initial and maintenance margin requirements are the same when establishing positions

- Allows for position correlations to determine margin requirement offsets

- Long in-the-money options are marginable

- Includes implied volatility when calculating the theoretical value of calls and puts to determine an account's margin requirement—a major component of an option pricing model to calculate risk

Flexibility in a PM account comes from lower buying power requirements, which means traders can have greater risk even when the notional risk is the same as any other account. This also means their buying power requirements can fluctuate much more than a Reg-T margin account. It's important that you understand all risks when trading in a PM account to avoid undesired exposure to the markets.

How Does Portfolio Margin Work?

In a portfolio margin (PM) account, eligible positions are stress tested by hypothetical price moves in the underlying. These hypothetical price moves are used as inputs into our options pricing model to produce risk arrays* across a set price range, generally ranging from –20% to +20%. The price range is split into ten equidistant points. At each price point there is a theoretical change in the profit or loss for the position and portfolio. PM will aggregate the largest theoretical single-day loss for each position across the price range and subtract it from the account's net liquidation value to determine the remaining buying power.

*Risk Arrays: Each position's risk array scenario comprises a different market simulation. Simulations include moving the underlying price and implied volatility up or down. The largest loss on the risk array results in the position's margin requirement. These simulations are commonly referred to as a stress test.

How is Portfolio Margin Calculated?

Portfolio margin (PM) calculates various price point movements up and down from the current underlying spot price to produce risk arrays, used to determine a real-time theoretical single-day gain/loss. Positions may have different stress test ranges depending on the characteristics of the underlying, market volatility, concentration, and more. The largest theoretical loss determines the buying power requirement for each position.

- Individual stock and options positions stress with ± 20% price changes

- Concentrated positions are evaluated using a greater percentage price move based on EPR (Expected Price Range) and PNR (Point of No Return)

Portfolio Margin Example

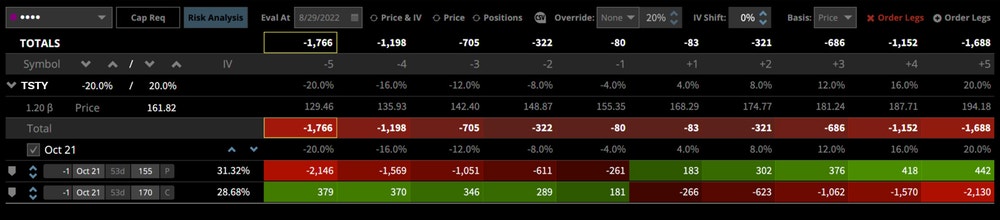

Let’s look at the risk analysis window to understand how stress tests create risk arrays to determine margin requirements. For example, if an account holds a short strangle (1 short OTM call and 1 short OTM put), the position will start to trade at a loss as the underlying moves against the position. Below is a risk array that makes this easier to visualize.

The default stress test (price volatility range) will be ± 20%. This indicates we are testing for the possible loss if the underlying price increased by +20% or decreased by -20%. The Total row above each position will list the theoretical one-day change in profit/loss for that position at varying stress levels.

Underneath the Total row, you can see the 20% up and down max stress test levels and their accompanying risk array below. If the underlying price drops 20% from a price of $161.82 to a price of $129.46, then based on the risk array, the strangle will theoretically have a loss of -$1,766.

On the other hand, if the underlying price increases by 20% from $161.82 to $194.18, the strangle would theoretically have a loss of -$1,688. The portfolio margining system will take the higher potential loss at all stress test scenarios, which results in a buying power requirement of $1,766 to hold that strangle. In comparison, a Regulation-T margin account would likely have a buying power requirement closer to $3,000 in a normal market environment.

Portfolio Margin Risk Analysis Tool

The portfolio risk analysis tool allows you to view real-time portfolio margin (PM) stress testing on your open positions or queued trades. It can be used to see how your positions and portfolio would react to theoretical price moves and implied volatility shocks.

- Use the Risk Array to view margin requirements and theoretical gains/losses on individual symbols based on market scenarios, price moves, and changes to implied volatility

- View PM or Regulation-T margin requirements based on margin account type

- Simulate "what if" scenarios in the Risk Array by viewing the potential effects on positions after an implied volatility shock, price move, etc

- Determine option expiration exposure by omitting any expiring hedges or evaluating at a future date

- Add simulated trades to view the impact on buying power and any changes in the risk arrays

Portfolio Margin House Rules and Requirements

In addition to the standard portfolio margin (PM) requirement calculations (TIMS margin methodology), tastytrade also has its own house rules and requirements. House rules and requirements may change at any time. The most impactful is the tastytrade concentration requirement.

Portfolio Margin Concentration Logic (EPR and PNR)

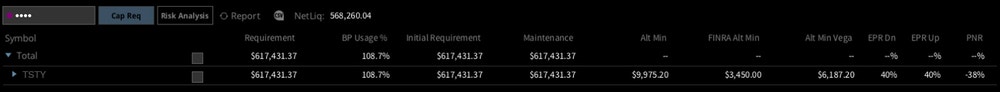

If you trade a small handful of symbols, and your exposure is concentrated in one underlying, your PM requirements may increase due to a position concentration. There are two important figures to understand when it comes to portfolio margin concentration: a position's Expected Price Range (EPR) and Point of No Return (PNR).

EPR represents tastytrade's estimate of a given security's price change over one day, based on current implied volatility. It is expressed as a percentage of the current security price and comprises a lower and upper bound (i.e., percentage up and percentage down).

PNR represents the percentage move in a security's price when an account would theoretically lose 100% of its net liquidating value. Said another way, this is when an account's Net Liquidating Value (NLV) reaches $0. Risk concentration occurs when a security's EPR exceeds its PNR. The price scenario move will expand in real time to incorporate the increased margin requirement.

When a position's PNR is outside or greater than its EPR, the risk array stress test will default to tastytrade’s house percentages. Generally, this is a base minimum of +/-20% for individual equities and a minimum of -15% and +10% stress levels for equity-based indices.

Conversely, when a position's PNR is inside or less than the EPR, tastytrade will apply a higher concentration (EPR) percentage when stress testing positions.

You can view positions' EPR and PNR in the Cap Req window.

Learn more about tastytrade’s additional house requirements and stress test parameters.

Portfolio Margin Eligible Products

- Stocks and ETFs

- Stock and ETF options

Portfolio Margin Non-eligible Products

Each of the following is subject to FINRA Rule 4210 Margin Requirements and calculated using a regular strategy-based margin:

- Fixed income products

- Exchange traded notes (ETN’s)

- Low liquidity products

- Cryptocurrencies

- OTC (bulletin board) and other non-marginable securities

- Futures positions are not permitted to be included in portfolio margin as margin requirements are determined by a different margining system.

- Securities deemed ineligible by tastytrade and APEX Risk Management

FAQs

Portfolio margin is a type of margin account that allows eligible customers access to greater leverage as a result of its risk-based margining methodology.

Standard margin accounts (Regulation-T) base requirements on fixed percentages whereas portfolio margin uses the Theoretical Intermarket Margining System margin methodology. This risk-based approach allows up to 6.7:1 leverage.

Portfolio margin accounts allow for up to 6.7:1 leverage as opposed to 2:1 in a Regulation-T account.

1 Does not include futures and/or cryptocurrency requirements.

Trading in a Portfolio Margin account is not suitable for all investors as the increased leverage can result in significant losses in the event of adverse market movements, up to or greater than the amount of your original investment. You are solely responsible for carefully considering the risks involved and determining whether trading in a Portfolio Margin account is appropriate for you based on your personal circumstances as the information presented does not take into account your particular investment experience or objective, financial condition, risk tolerance, or other considerations. Please read the Portfolio Margining Risk Disclosure Statement before determining if trading in a Portfolio Margin account is appropriate for you.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.