What Is a Traditional IRA and How Do I Open One?

Traditional IRAs offer tax-deductible contributions up to the IRS yearly contribution limit for qualified account holders, and the account is generally subject to income tax at the time of withdrawal.

What Is a Traditional Individual Retirement Account (IRA)?

A traditional IRA allows you to invest and trade in financial assets, but there can also be tax benefits that apply to those who qualify. Traditional IRAs offer tax-deductible contributions up to a certain amount for qualified account holders, and the account is generally subject to income tax at the time of withdrawal, as opposed to a traditional brokerage account where taxable events can occur as transactions happen.

For 2025, traditional IRAs allow accountholders to contribute up to $7,000 per year if you’re under 50 years old or up to $8,000 per year if you’re over the age of 50.

In a traditional IRA, you are required to take minimum distributions of funds every year at a certain age. At that time, withdrawals are taxed as income.

tastytrade’s IRAs offer strategic flexibility by allowing users to place trades in stock, options, and futures for those who qualify. Learn more about trading permissions.

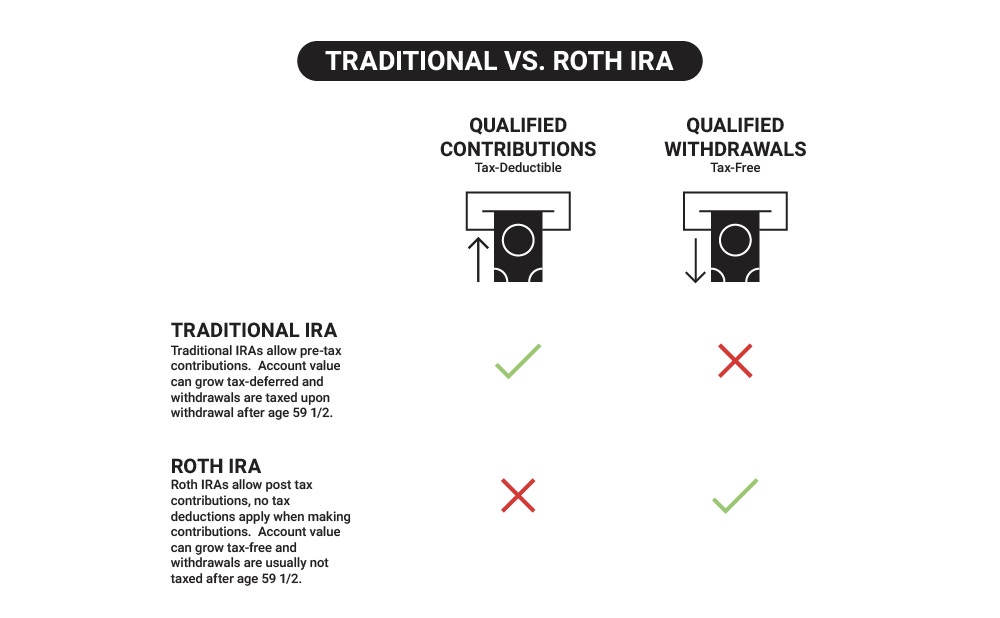

Traditional vs. Roth IRA

When it comes to choosing between a traditional IRA and a Roth IRA, the main differences revolve around how your contributions and withdrawals are generally taxed. With a traditional IRA, a portion of your taxable income can often be used as a contribution, which is made on a pre-tax basis. However, when you start withdrawing those funds after age 59½, you’ll have to pay taxes on the withdrawals. Withdrawals from a traditional IRA before the age of 59½ may be subject to a 10% tax penalty plus any tax associated with your income level.

Alternatively, a Roth IRA won’t give you a tax break upfront. Instead, you’ll contribute income that has already been taxed. The benefit is that you usually won’t pay taxes on the funds, including any profits made in the account, when they are withdrawn after age 59½.

What Can I Trade and Invest in with a Traditional IRA?

You have a variety of options when it comes to what you can trade in your tastytrade Roth IRA. Besides stocks, you can trade bond and futures products, as well as various options strategies on stocks, indices, and futures with IRA The Works. Learn more about what you can trade in a tastytrade traditional IRA.

| IRA The Works (limited margin) | Basic IRA (limited margin) | Limited / Cash* | |

|---|---|---|---|

Buy stock | |||

Short sell stock | - | - | - |

Buy options | |||

Sell covered calls | |||

Sell cash-secured puts | |||

Defined-risk options spreads | - | ||

Sell naked puts | - | - | - |

Sell naked calls** | - | - | |

Futures^ | - | - | |

Cryptocurrencies | - | - | - |

| IRA The Works (limited margin) | |

|---|---|

Buy stock | |

Short sell stock | - |

Buy options | |

Sell covered calls | |

Sell cash-secured puts | |

Defined-risk options spreads | |

Sell naked puts | - |

Sell naked calls** | |

Futures^ | |

Cryptocurrencies | - |

| Basic IRA (limited margin) | |

|---|---|

Buy stock | |

Short sell stock | - |

Buy options | |

Sell covered calls | |

Sell cash-secured puts | |

Defined-risk options spreads | |

Sell naked puts | - |

Sell naked calls** | - |

Futures^ | - |

Cryptocurrencies | - |

| Limited / Cash* | |

|---|---|

Buy stock | |

Short sell stock | - |

Buy options | |

Sell covered calls | |

Sell cash-secured puts | |

Defined-risk options spreads | - |

Sell naked puts | - |

Sell naked calls** | - |

Futures^ | - |

Cryptocurrencies | - |

* By default, IRAs are provisioned to have margin relief, which allows for defined risk spread trading. However, if you wish to provision your IRA as a cash account instead, please write to accounts@tastytrade.com.

** To trade an uncovered call in an IRA, The Works trading level is required. Additionally, the IRA must have a start of the day net liquidation value of $25,000, and the higher margin requirement is held when compared to a non-retirement account with the Works. Please see here for more detail.

^ Your account must qualify for IRA The Works to apply for futures trading. Learn more about CME futures products.

How Can I Open a Traditional IRA?

There are a few basic requirements to open a Roth IRA. You must have earned income or other qualifying compensation for the tax year that you plan to make the contributions. You must reside in the United States and have a social security number. If those requirements are met, you’ll likely be eligible to open a traditional IRA.

FAQs

A traditional IRA is a type of investment account that provides potential tax advantages to individuals saving for retirement. It allows individuals to contribute a certain amount of money each year, which can be invested in a variety of assets such as stocks, bonds, futures, and even options.

Potential investment gains within a traditional IRA are tax-deferred until withdrawals are made after age 59½, at which point they are subject to ordinary income tax.

In a traditional IRA, contributions may be tax deductible, but withdrawals after age 59 ½ are taxed as regular income. Withdrawals made prior to age 59 ½ may be subject to taxation and early withdrawal penalties.

Potential gains in traditional IRAs are not taxed year-to-year, as taxable events only take place upon withdrawal.

Everyone’s circumstances are different, and your specific situation may impact your ability to make contributions to or take distributions from a traditional IRA. We aren’t tax advisors at tastytrade, so it is important to consult with a qualified tax advisor to determine your tax status prior to opening an IRA.

There is no minimum deposit requirement to open a traditional IRA at tastytrade.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.