What Is a Roth IRA and How to Open One?

Roth IRAs allow post-tax contributions, and the account value can grow tax-free. Withdrawals are usually not taxed after age 59½.

What Is a Roth Individual Retirement Account (IRA)?

A Roth IRA is a retirement account that allows eligible individuals to contribute post-tax dollars to trade and invest with. Since contributions are already taxed when funds are deposited into the account, this account type allows funds to grow tax-free and after age 59½, penalty-free and tax-free withdrawals can be executed. In some circumstances, a Roth IRA allows for early withdrawals without penalty. Please consult with a qualified tax professional prior to taking any action in your IRA. The main draw to a Roth IRA is the tax-free nature of growth and qualified withdrawals.

In 2025, Roth IRAs allow accountholders to contribute up to $7,000 per year if you’re under 50 years old, or up to $8,000 per year if you’re over 50 years old. It is important to keep in mind that there are income limits at which contributions will be reduced or eliminated, so it is important to do your research to see if opening a Roth IRA makes sense in your circumstances.

tastytrade's IRAs offer strategic flexibility by allowing users to place trades in stock, options, and futures for those who qualify. Learn more about trading permissions.

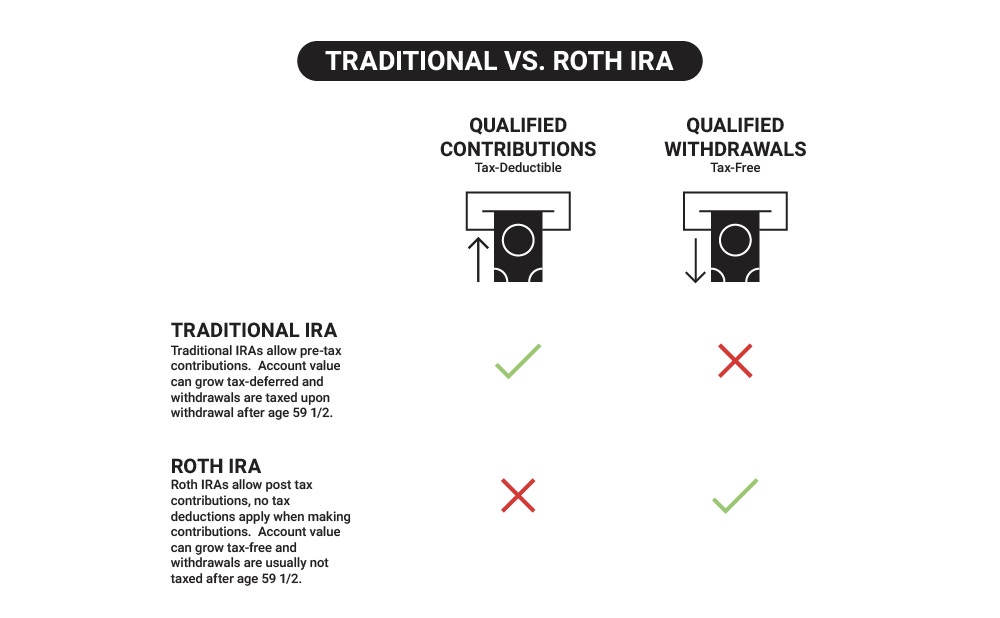

Roth vs. Traditional IRA

A Roth IRA differs from a traditional IRA in a few different ways. Contributions are made with post-tax money, which means there are no potential tax deductions on annual contributions like what could apply to a traditional IRA account. With that said, any potential growth in a Roth IRA grows tax-free, and qualified retirement withdrawals can be made tax-free.

What Can I Trade and Invest in with a Roth IRA?

You have a variety of options when it comes to what you can trade in your tastytrade Roth IRA. Stocks, options, and futures are all available to trade with IRA The Works. Learn more about what you can trade in a tastytrade Roth IRA.

| IRA The Works (limited margin) | Basic IRA (limited margin) | Limited / Cash* | |

|---|---|---|---|

Buy stock | |||

Short sell stock | - | - | - |

Buy options | |||

Sell covered calls | |||

Sell cash-secured puts | |||

Defined-risk options spreads | - | ||

Sell naked puts | - | - | - |

Sell naked calls** | - | - | |

Futures^ | - | - | |

Cryptocurrencies | - | - | - |

| IRA The Works (limited margin) | |

|---|---|

Buy stock | |

Short sell stock | - |

Buy options | |

Sell covered calls | |

Sell cash-secured puts | |

Defined-risk options spreads | |

Sell naked puts | - |

Sell naked calls** | |

Futures^ | |

Cryptocurrencies | - |

| Basic IRA (limited margin) | |

|---|---|

Buy stock | |

Short sell stock | - |

Buy options | |

Sell covered calls | |

Sell cash-secured puts | |

Defined-risk options spreads | |

Sell naked puts | - |

Sell naked calls** | - |

Futures^ | - |

Cryptocurrencies | - |

| Limited / Cash* | |

|---|---|

Buy stock | |

Short sell stock | - |

Buy options | |

Sell covered calls | |

Sell cash-secured puts | |

Defined-risk options spreads | - |

Sell naked puts | - |

Sell naked calls** | - |

Futures^ | - |

Cryptocurrencies | - |

* By default, IRAs are provisioned to have margin relief, which allows for defined risk spread trading. However, if you wish to provision your IRA as a cash account instead, please write to accounts@tastytrade.com.

** To trade an uncovered call in an IRA, The Works trading level is required. Additionally, the IRA must have a start of the day net liquidation value of $25,000, and the higher margin requirement is held when compared to a non-retirement account with the Works. Please see here for more detail.

^ Your account must qualify for IRA The Works to apply for futures trading. Learn more about CME futures products.

How Can I Open a Roth IRA?

There are a few basic requirements to open a Roth IRA. You must have earned income or other qualifying compensation for the tax year that you plan to make the post-tax contributions. You must reside in the United States and have a social security number. If those requirements are met, you’ll likely be eligible to open a Roth IRA.

FAQs

A Roth IRA is a type of investment account that provides potential tax advantages to individuals during retirement. It allows qualified individuals to contribute a certain amount of post-tax money each year. These contributions can be invested in a variety of assets such as stocks, bonds, futures, and even options for users who are approved for The Works.

Potential investment gains within a Roth IRA are often tax-free because contributions are made with post-tax money. During retirement, qualified withdrawals can be made tax-free.

In a Roth IRA, contributions are made with post-tax money, and withdrawals after age 59½ are tax-free.

Potential gains in Roth IRAs are not taxed year-to-year, similar to a traditional IRA.

Everyone’s circumstances are different, and your specific situation may impact your ability to make contributions to or take distributions from a Roth IRA. We aren’t tax advisors at tastytrade, so it is important that you consult with a qualified tax advisor to determine your tax status prior to opening a Roth IRA account.

There is no minimum deposit requirement to open a Roth IRA at tastytrade.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.