Covered Call Options Strategy Explained

Contents

Covered Call

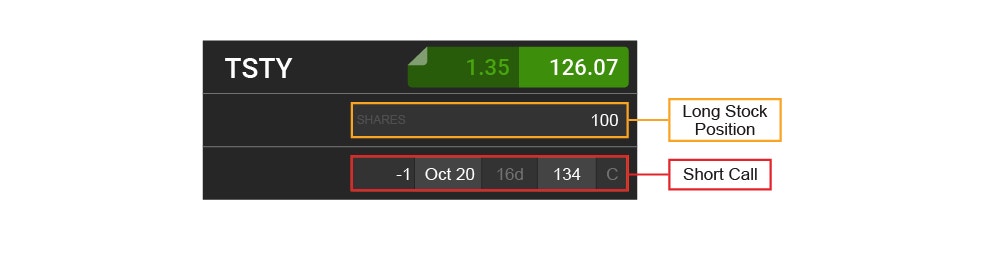

The covered call strategy consists of selling an out-of-the-money (OTM) call against every 100 long shares or ETF shares an investor has in their portfolio, as illustrated below. While this strategy allows investors to generate potential interim income on long shares and caps profits when assigned, investors are still subject to the downside risk of long stock.

For example, an investor holding 500 shares of XYZ @ $50 can sell 5 $55 strike call options against it. Selling calls against shares you own enables investors to generate income on their stock holdings, but investors are obligated to sell their shares if their short call options are assigned early or if it expires ITM. Selling call(s) against round lots of stock to form a covered call position is allowed in all account types at tastytrade regardless of being a margin or cash account.

Since each long call gives the buyer a right to buy 100 shares of stock at the option's strike price, a call option seller must sell the stock at the option's strike price if the long holder exercises early or if it expires in the money (ITM) by $0.01 or more at expiration. In short, options buyers buy a right, and sellers are obligated to sell a hundred shares per contract at the option's strike when the long holder exercises or if it expires ITM.

Assuming the call option sold against the stock position remains OTM during the life of the trade, the value of the call option sold may erode each day due to time decay and potentially be closed (purchased back) below the selling price to yield a profit. A call option that expires OTM at expiration will be worthless and generate a max profit. The profit from the covered call positions helps generate interim income for investors holding a long stock position.

A covered call gets its name since the long stock collateralizes the short call. A covered call is collateralized since an investor with only a short call in their portfolio would have 100 short shares if the option were assigned. The long shares collateralize the short call resulting in the account being flat (no shares) and preventing it from being short 100 shares. Whereas a naked short call (uncovered) would have potentially unlimited risk since a stock can theoretically rise without limit.

There is always the risk of the stock falling and losing value, which could help yield a profit on the covered call, but the gain made on the covered call may not cover the value lost on the shares.

Additionally, covered calls sold at a strike below the share's cost basis (average cost per share) could result in locked-in losses if the shares get called away (or sold) early by assignment. For example, if you purchased 100 XYZ @ $50, but it is currently trading at $30, then selling a $40-strike call against the shares could lock in a $10 loss per share (-$1,000 total loss excluding the income from the call options) if the shares were called away early or if XYZ closed above $40 at expiration.

Lastly, for dividend-paying stocks, covered calls also risk dividend forfeiture if the shares get called away before the ex-dividend date.

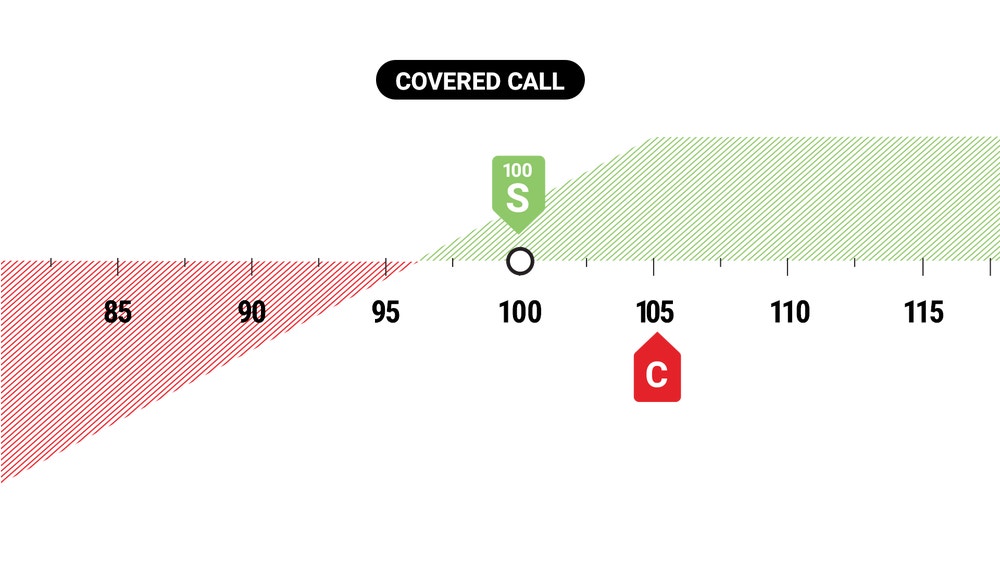

Profit & Loss Diagram of a Covered Call

The profit and loss diagram below assumes a covered call sold above the stock's cost basis. Since investors with a covered call position are selling their upside, an investor's max profit will cap if the underlying surpasses the covered call's strike price, as illustrated where the green profit zone flattens. Investors with a covered call position also face the risk of the value of their stock position falling. Although a falling stock price will favor a covered call position by depreciating the short call, the potential profit on the call may not cover the value lost on the shares.

The profit and loss diagram above assumes a covered call sold above the stock's cost basis.

Covered Calls vs. Buy-Write

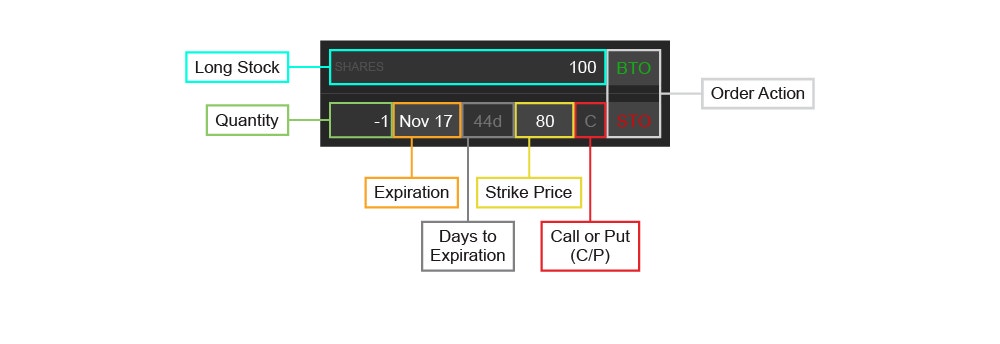

A buy-write is essentially the same strategy as the covered call strategy. The main difference between the two strategies is how each order executes. A buy-write is established by buying +100 shares (a round lot) and selling an out-of-the-money call against the shares simultaneously in a single order. It’s worth noting that the buying power requirement will be higher when establishing a buy-write position since you are also opening a long stock position. The cost basis of buying the 100 shares is multiplied by the stock price at which those shares are purchased. For example, setting up a buy-write involves buying 100 shares at $70 per share and selling to open a 80 strike call for $1.50 against it would cost $6,850 ($7,000 cost of shares - $150 credit received) in one order ticket, as illustrated below.

A covered call, on the other hand, usually refers to selling a call against each round lot of stock that was previously in your portfolio. When an investor sells a call against existing shares, the order ticket only comprises a short call. The risk profile of a covered call will resemble a buy-write, assuming the call sold is above the stock's cost basis.

Investors that establish a buy-write position or a covered call sell their upside by selling an OTM call against the long shares.

All in all, covered calls and buy-writes have the same strategy concept. In short, it boils down to the timing of when the call is sold, when establishing the long stock position or against an existing stock position in your portfolio.

Covered Call: What’s Required?

A covered call position requires a round lot of stock and a short call.

- +100 long shares, also known as a round lot (per hundred shares)

- One short call per round lot

Example of a Covered Call

Portfolio already holds +100 shares of XYZ @ $45, which is the stock’s cost basis. The current price of XYZ is $50.

- Sell to Open -1 XYZ $55-strike call for $1.00 credit ($100 total credit received)

Example of a Buy-Write

Setting up a buy-write consists of buying shares and selling a call against it in one order. Assume the current price of XYZ is $50.

- Buy to Open +100 shares of XYZ @ $50

- Sell to Open -1 XYZ $55-strike call for $1.00 credit ($100 total credit received)

| Covered Call | Buy-Write | |

|---|---|---|

Time Decay Affect | Works for the seller as time can decay the value of the call sold. | Works for the seller as time can decay the value of the call sold. |

Max Profit | Stock + Covered Call ((Short call strike − stock cost basis) x 100) + Total credit received ((55−45) x 100) + $100 = $1,100 Only the Short Call Total credit received $100 | Stock + Short Call ((Short call strike − stock cost basis) x 100) + total credit received ((55 − 50) x 100) + $100 = $500 Only the Short Call Total credit received $100 |

Max Loss | Total credit received − (stock cost basis x 100) $100 − (45 x 100) = -$4,400 if the stock goes to $0 | Total credit received − (stock cost basis x 100) $100 − (50 x 100) = -$4,900 if the stock goes to $0 |

Breakeven Price | Stock cost basis − short options credit received from the short call $45 − $1 = $44 | Stock cost basis − short options credit received $50 − $1 = $49 |

Buying Power Requirement | No additional buying power required to the existing shares. | Cash account: total cost of stock – total credit received. Margin account: varies based on stock price − total credit received. |

Account Type Required | Cash, Margin, and IRA | Cash, Margin, and IRA |

How to sell a covered call

Please visit the tastytrade Help Center for video instructions on how to sell a covered call on the tastytrade desktop platform.

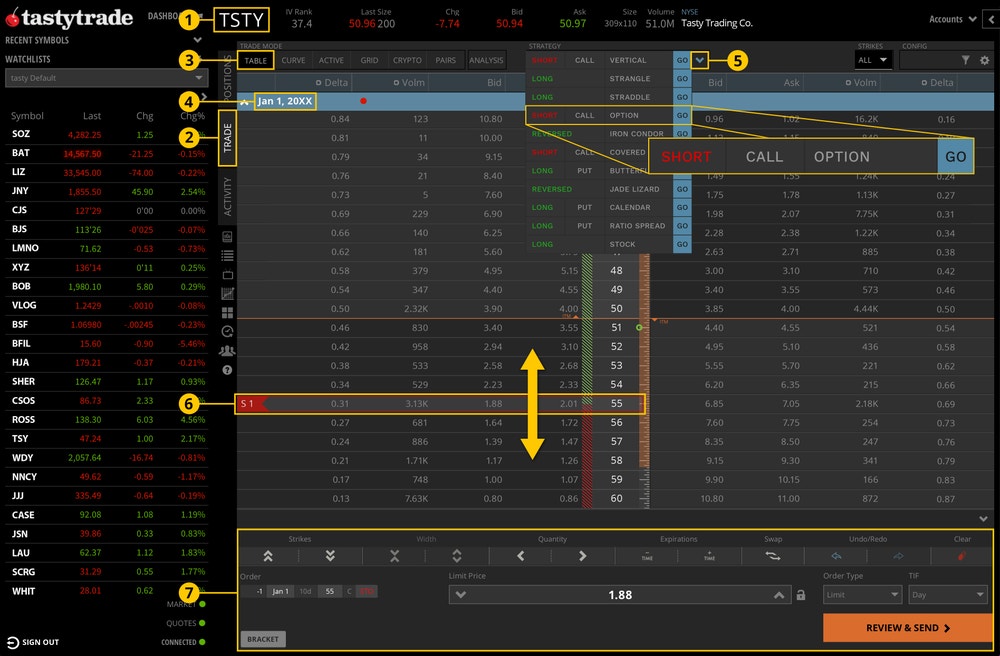

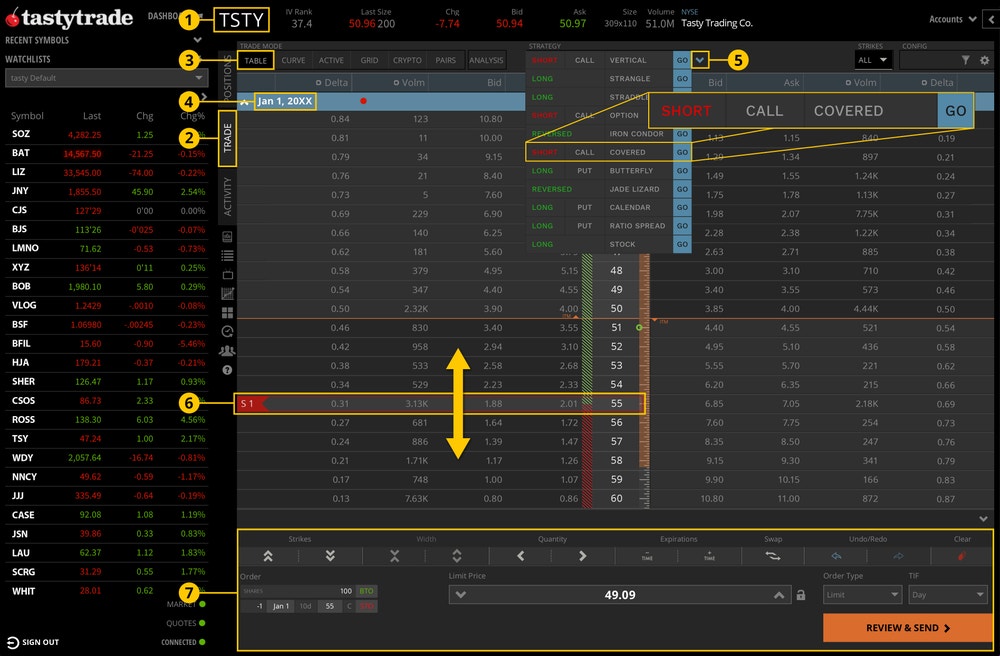

Using the Strategy Menu

- Enter a symbol.

- Navigate to the Trade tab.

- Go to Table mode.

- Click on an Expiration Date to expand.

- Click the Strategy Menu and locate the Option strategy, and (from left to right) click each column to display Short, Call, and Go.

- The short call will populate in the expanded expiration. Click and drag the call to the desired strike price.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

Building it Manually

- Enter a symbol.

- Navigate to the Trade tab.

- Go to Table Mode.

- Click on an expiration Date to expand (on the Table mode).

- Click on the Bid price of the call you want to sell.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

How to set up a Buy-Write

Please visit the tastytrade Help Center for video instructions on how to set up a buy-write on the tastytrade desktop platform.

Using the Strategy Menu

- Enter a symbol.

- Navigate to the Trade tab.

- Go to Table mode.

- Click on an Expiration Date to expand.

- Click the Strategy Menu and locate the Covered strategy, and (from left to right) click each column to display Short, Call, and Go.

- The short call will populate in the expanded expiration. Click and drag the call to the desired strike price.

- The order ticket will list the shares and corresponding short call in it to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

Building it Manually

- Enter a symbol.

- Click the Ask price of the stock quote to prepare a stock order.

- You will reach the Trade tab and an order ticket will appear below. Go to Table Mode.

- Click on an expiration date to expand (on the Table mode).

- Click on the Bid price of the call you want to sell, and the short call will also appear on the order ticket.

- Go to the order ticket to determine the quantity, price, time-in-force (TIF), etc., before clicking "Review & Send" to send the order.

Covered Call Summary

- Selling a call against every 100 shares you own enables investors to generate potential income on their stock holdings.

- A call option seller must sell the stock at the option's strike price if the long holder exercises early or if it expires in the money (ITM) by $0.01 or more at expiration.

- A short call sold at a strike below the shares’ cost basis could result in locked-in losses if the shares get called away early by assignment.

- Selling covered calls is available in all account types and trading levels at tastytrade.

All investments involve risk of loss. Please carefully consider the risks associated with your investments and if such trading is suitable for you before deciding to trade certain products or strategies. You are solely responsible for making your investment and trading decisions and for evaluating the risks associated with your investments.

Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.